In late December 2019 and into January 2020, you could not access the news without hearing of the horrific bushfires which were terrorising Australia.

Typically, bushfire season in south-eastern Australia runs from December to March, however, 2019-20 is marking the most catastrophic bushfire event in recent memory. Fires were seen as early as September 2019 and have continued to wreak havoc since. The current season has seen 10.7 million hectares of bush destroyed, 1,700 homes in ruins and the tragic loss of 25 human lives and millions of native animal lives (as at 10 January 2020[1]).

Several lines of research indicate that climate change and contributory activities are playing a large part in exacerbating this disaster[2].

Days of extreme heat, coupled with drought-like conditions, have intensified the bushfires[3]. The pressure is now mounting on organisations of all sizes to operate more sustainably and incorporate mitigation strategies to reduce future climate impacts. The public is calling for climate justice and stakeholders are demanding increased information regarding climate change mitigation and adaptation practices[4].

It is now imperative that going forward, organisations:

- Understand the impacts (both risks and opportunities) of climate change on their business;

- Develop resilient strategies for future adaptation; and

- Disclose risks to meet stakeholder demands for business accountability.

Although not yet mandatory, by disclosing climate change risks, organisations have an added benefit of enticing behavioural change[5]. As organisations obtain a better understanding of future risks and opportunities, strategic planning can be strengthened to increase internal resilience. This is achieved through the internal process required to develop carbon reduction and other strategies, which can also lead to increased innovation and societal awareness.

Globally - The Task Force on Climate-related Financial Disclosure (TCFD)

The TCFD was established by the Financial Stability Board on 4 December 2015 following a speech given by the Governor of the Bank of England, Mark Carney, discussing climate change and financial stability. The TCFD, Chaired by Michael Bloomberg, was formed to develop voluntary, consistent climate-related financial risk disclosures for use by companies.

With the aim to provide transparent information to investors, lenders, insurers, and other stakeholders, TCFD published Recommendations of the Task Force on Climate-related Financial Disclosures in June 2017. This report included recommendations to improve the ability to assess and cost climate-related risks and opportunities.

The report further defines Climate Risk as encompassing two areas:

- Physical (asset) risk: resulting from climate change can be event-driven (acute) or longer-term shifts (chronic) in climate patterns. Physical risks may have financial implications for organisations, such as direct damage to assets and indirect impacts from supply chain disruption.

- Transition risk: to a lower-carbon economy may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change.

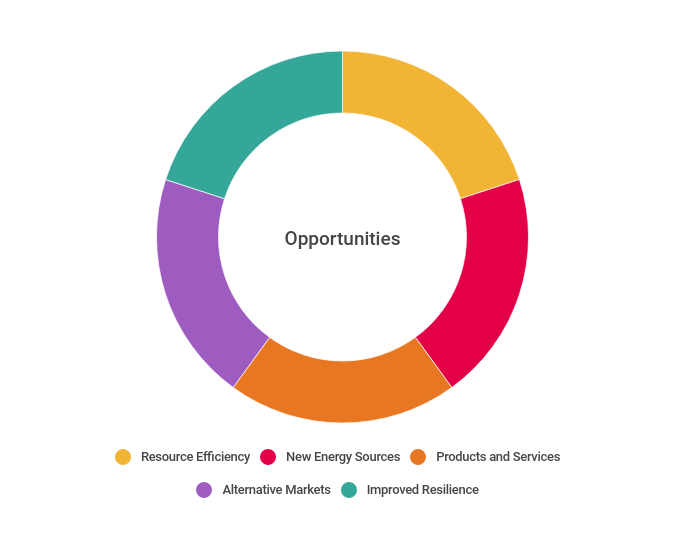

The task force further believes that despite climate risks, there are significant opportunities for organisations in the mitigation and adaptation of climate change. This is detailed in the diagram below:

A key goal of the TFCD is to encourage sustainable investments and create a resilient economy. Given the unpredictability of climate change, risks can be volatile and severely impact financial stability. Therefore, businesses must work to evaluate climate risks and can use the TFCD framework to guide reporting. This can create a competitive advantage by demonstrating an active transition to a low-carbon economy, while simultaneously reducing impacts from future climate impacts.

Climate change risk disclosure and related financial reporting in Australia

In September 2018, the Australian Securities & Investment Commission (ASIC) published their report Climate risk disclosure by Australian listed companies[6]. This report states that:

“Listed companies should provide meaningful and useful risk disclosure to enable investors to make fully informed decisions. In some cases, the Corporations Act requires listed companies to disclose material business risks.”

This report contains four key recommendations for listed companies which include:

ASIC is encouraging organisations to include climate change risks as part of financial reporting and to factor the cost of climate change into impairment calculations. Without investigating climate change risks, an organisation may not be able to demonstrate appropriate strategic risk management and could experience adverse future impacts on strategic objectives.

In 2018, the Australian Accounting Standards Board (AASB) also released a report on Climate-related and other emerging risks disclosure, which has a particular focus on how climate risks can impact materiality within financial statements. AASB has developed the following decision tree to assist organisations in whether climate risk disclosures should be reported within an organisation’s financial statements[7].

The AASB has identified the following financial implications from emerging climate-related risks:

- Asset impairment;

- Changes in the useful life of assets;

- Changes in the fair valuation of assets due to climate-related and emerging risks;

- Increased costs and/or reduced demand for products and services affecting impairment calculations and/or requiring recognition of provisions for onerous contracts;

- Potential provisions and contingent liabilities arising from fines and penalties; and

- Changes in expected credit losses for loans and other financial assets.

With both ASIC and AASB encouraging the evaluation of climate change risk exposure, organisations will need to understand how these risks will impact future financial statements.

How RSM can assist

RSM has the skills, knowledge and experience to support organisations in identifying and measuring the impact of climate risks, both in terms of financial reporting and on operational activities. Combined with our expertise in risk management, our dedicated Climate Change and Sustainability team are well versed in providing support to clients on mitigation, adaptation, and resilience building.

This is the first in our “Climate Change Risk” series of articles. In the coming months, look out for the following four articles, which will delve further into climate change disclosure for organisations and how we can help:

- Article 2: COP25 and landscape going forward

- Article 3: Resilience and mitigating climate risk

- Article 4: Resource Efficiency and New Energy Sources

- Article 5: Products, Services and Alternative Markets

Each article will review the areas of focus from a customer, business and stakeholder perspective, while also providing updates from the sector.

For more information speak to Tim Pittaway, Aleena Dewji or Ken De Negri.

[1] The Guardian | Economic impact of Australia's bushfires set to exceed $4.4bn cost of Black Saturday - Wednesday 8 Jan 2020

[3] Time | Australia's Wildfires and Climate Change are making one another worse in a vicious, devastating circles - January 7 2020

[4] Eleftheriadis, I., & Anagnostopoulou, E. (2015). Relationship between Corporate Climate Change Disclosures and Firm Factors. Business Strategy and the Environment, 24(8), 780-789.

[5] Topping, Nigel. "How Does Sustainability Disclosure Drive Behavior Change?." Journal of Applied Corporate Finance 24.2 (2012).

[6] ASIC | Climate risk disclosure by Australia's listed companies - September 2018

[7] AASB | Climate-related and other emerging risks disclosures - April 2019