RSM World of IFRS summarises key matters arising from recent IASB discussions and decisions, highlights RSM thought leadership from around the world, and addresses an IFRS application question each month.

Latest matters from the international accounting standards board (IASB)

The following is a summarised update of key matters arising from the discussions and decisions taken by the IASB at its meetings on the following dates:

24, 25 and 26 September 2019

The full update, as published by the IASB, can be found here.

Business Combinations under Common Control

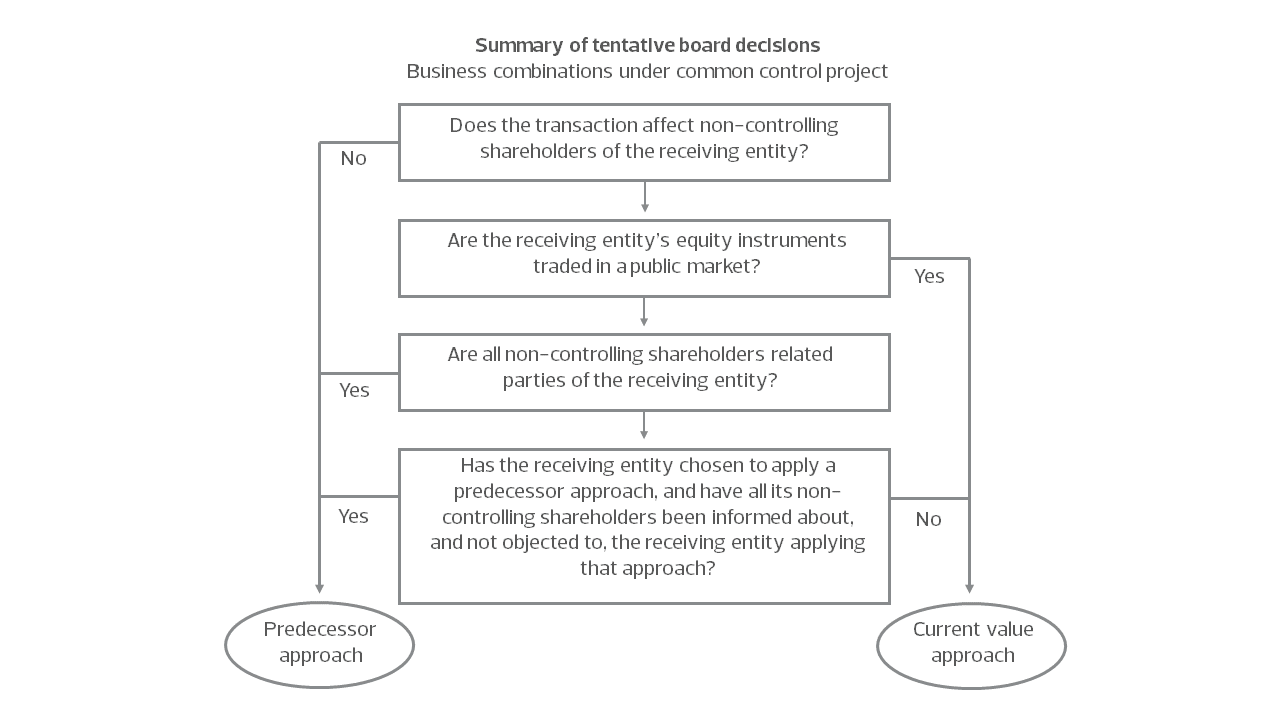

The Board tentatively decided that the forthcoming discussion paper on Business Combinations under Common Control (discussion paper) should not propose a single measurement approach for all transactions within the scope of the project. Its tentative decisions are summarised in a decision tree that helps determine whether predecessor approach or the current value approach should apply.

Future discussions will deal with how each approach should be applied and disclosures.

Disclosure Initiative—Targeted Standards-level Review of Disclosures

The Board discussed amendments to the disclosure objectives in IFRS 13 Fair Value Measurement and tentatively decided to include high-level, catch-all and specific disclosure objectives:

| High-level, catch-all disclosure objectives | Specific disclosure objectives |

| Disclose information that enables users to understand the:

|

The Board tentatively decided not to develop specific disclosure objectives to address the information needs of users of financial statements relating to forecasting of future fair value movements.

FINANCIAL INSTRUMENTS WITH THE CHARACTERISTICS OF equity

The Board tentatively decided on an approach to the project that addresses practice issues by clarifying some principles in IAS 32.

IFRS INTERPRETATIONS COMMITTEE (IC) LATEST DECISIONS SUMMARY

The following is a summarised update of key matters arising from the discussions held by the IC at its meeting on 17 September 2019. The full update, as published by the IASB, can be found here.

Tentative agenda decisions

The Committee tentatively decided not to add the following matters to its standard-setting agenda because the principles and requirements in IFRS already provide an adequate basis.

Training Costs to Fulfil a Contract (IFRS 15 Revenue from Contracts with Customers)

The Committee received a request about the recognition of training costs incurred to fulfil a contract with a customer (as an asset or an expense) considering the following fact pattern:

- an entity enters into a contract with a customer for the supply of outsourced services, that is within the scope of IFRS 15.

- to be able to provide the services to the customer, the entity incurs costs to train its employees regarding the customer’s equipment and processes. Applying IFRS 15, the entity does not identify the training activities as a performance obligation.

- the contract permits the entity to charge to the customer the costs of training (i) the entity’s employees at the beginning of the contract, and (ii) new employees that the entity hires as a result of any expansion of the customer’s operations.

Before assessing whether costs to fulfil a contract shall be recognised as an asset according to paragraph 95 of IFRS 15, it is necessary to determine whether they are within the scope of other standards., Training costs are within the scope of IAS 38 Intangible assets, as stated in IAS 38.5 . IAS 38 requires that training costs are expensed when incurred. Paragraph 15 of IAS 38 explains “an entity usually has insufficient control over the expected future economic benefits arising from a team of skilled staff and from training for these items to meet the definition of an intangible asset”.. Accordingly, the entity recognises an expense when it incurs the training costs to fulfil the contract with the customer.

Definition of a Lease—Shipping Contract (IFRS 16 Leases)

The Committee received a request about whether the customer has the right to direct the use of a ship throughout the five-year term of a particular contract with the following characteristics:

- there is an identified asset (the ship).

- the customer has the right to obtain substantially all the economic benefits from use of the ship, because it benefits from an exclusive use of the ship throughout the five-year period.

- many, but not all, of the relevant decisions about how and for what purpose the ship is used are predetermined in the contract:

- The ship can only be used to convey coal from three geographical areas (X, Y and Z) to a unique destination (S). There are three possible trips: from X to S, Y to S or Z to S.

- The ship transports 100 tons of coal on each voyage.

- The voyages must be scheduled to run continuously.

- as for non-predetermined decisions, the customer has the right to make the remaining relevant decisions about how and for what purpose the ship is used throughout the period of use. Those decision-making rights are relevant because they affect the economic benefits to be derived from use of the ship.

- During the period of use, the customer determines annual and quarterly shipment plans

- The customer has the right to determine the order of voyages — i.e. it has the right to decide upon the starting point for the ship for each voyage.

- the supplier operates and maintains the ship throughout the period of use and is responsible for the conveyance of the products.

- the customer may not change the operator.

- the customer did not design the ship nor some of its characteristics.

The Committee concluded that the customer has the right to direct how and for what purpose the ship is used throughout the five-year period of use. . The predetermination in the contract of many of the relevant decisions about how and for what purpose the ship is used defines the scope of the customer’s right of use. Within that scope, the customer has the right to make all the relevant decisions about how and for what purpose the ship is used that can be made. Consequently, the contract contains a lease.

The Committee also observed that, although the operation and maintenance of the ship are essential to its efficient use, the supplier’s decisions in this regard do not give it the right to direct how and for what purpose the ship is used.

Agenda decisions

The Committee decided not to add the following matters to its standard-setting agenda because the principles and requirements in IFRS already provide an adequate basis.

Compensation for Delays or Cancellations (IFRS 15 Revenue from Contracts with Customers)

The Committee confirmed its previous tentative decision relating to an airline’s obligation to compensate customers for delayed or cancelled flights because of legislative requirements.

The Committee observed that, in the fact pattern described in the request, the entity promises to transport the customer from one specified location to another within a specified time period after the scheduled flight time. If the entity fails to do so, the customer is entitled to compensation. Accordingly, any compensation for delays or cancellations forms part of the consideration to which the entity expects to be entitled in exchange for transferring the promised service to the customer; it does not represent compensation for harm or damage caused by the entity’s products as described in paragraph B33. The fact that legislation, rather than the contract, stipulates the compensation payable does not affect the entity’s determination of the transaction price.

Consequently, the Committee concluded that compensation for delays or cancellations, as described in the request, is variable consideration in the contract.

The Committee did not consider the question of whether the amount of compensation recognised as a reduction of revenue is limited to reducing the transaction price to nil.

Lessee’s Incremental Borrowing Rate (IFRS 16 Leases)

The request received by the Committee asked whether a lessee’s incremental borrowing rate is required to reflect the interest rate in a loan with both a similar maturity to the lease and a similar payment profile to the lease payments.

The definition of a lessee’s incremental borrowing rate in IFRS 16 does not explicitly require a lessee to determine its incremental borrowing rate to reflect the interest rate in a loan with a similar payment profile to the lease payments. Nonetheless, the Committee observed that, in applying judgement in determining its incremental borrowing rate as defined in IFRS 16, it would be consistent with the Board’s objective when developing the definition of incremental borrowing rate for a lessee to refer as a starting point to a readily observable rate for a loan with a similar payment profile to that of the lease. Here again, the IC confirmed its previous tentative decision.

Presentation of Liabilities or Assets Related to Uncertain Tax Treatments (IAS 1 Presentation of Financial Statements)

The Committee maintained its previous decision on the presentation of liabilities or assets related to uncertain tax treatments recognised applying IFRIC 23 Uncertainty over Income Tax Treatments (uncertain tax liabilities or assets). It observed that neither IAS 12 nor IFRIC 23 contain requirements on the presentation of uncertain tax liabilities or assets. Therefore, the presentation requirements in IAS 1 apply. Applying IAS 1, an entity is required to present uncertain tax liabilities as current tax liabilities (paragraph 54(n)) or deferred tax liabilities (paragraph 54(o)); and uncertain tax assets as current tax assets (paragraph 54(n)) or deferred tax assets (paragraph 54(o)).

RSM INSIGHTS from around the world

Recent articles from RSM firms around the world addressing complexities within accounting standards can be found on our website.

IFRS QUERY OF THE MONTH

Each month, we will share an IFRS query from matters raised with RSM member firms around the world. The advice contained in the response is general in nature and should not be relied on for an entity’s specific circumstances.

QUESTION

What factors should be considered when determining a lessee’s incremental borrowing rate (IBR) under IFRS 16?

ANSWER

The incremental borrowing rate is not the same as the entity’s cost of capital or weighted average cost of debt.

An IBR should take into account the terms and conditions of the lease i.e. it is a lease specific rate, and therefore an entity may not be able to use the same IBR for every lease it holds. The IBR should consider the features specific to the lease including the length of the lease, security (the underlying asset), amount of borrowing (assumed to be 100%), currency of lease payments, the economic environment and the lessee’s credit status. Observable rates such as weighted average cost of capital (WACC) or property yields (for property leases) may provide a starting point but will require adjustments. WACC includes the cost of equity as well as the cost of debt and is not specific to the lease. Property yields are a market-based measure of the annual return expected on a property but will not reflect features specific to the lease and the lessee. Determining the appropriate adjustments can be challenging in practice and may require expert valuation input. There may be variations between different asset classes. For example, property leases may typically have a lower IBR than specialised plant and machinery.