The automotive industry is a diverse and complex sector and may well be one of the most hard-hit industries during the COVID-19 crisis. Nissan shares are falling after a record loss warning, the output of UK cars has reached its lowest level since 1954 and more than two-thousand car industry jobs are facing cuts. Conversely, Tesla shares have been on the rise and a consumer-driven shift towards electric vehicles has driven the market into a different direction with more and more manufacturers developing electric vehicles.

What is driving change in the automotive industry?

The consumer narrative for purchasing a car has changed dramatically over the past twenty years. What originally was a purchasing decision driven by practical function is now one lead by emotional and technological aspects. The process of a consumer buying a vehicle is accompanied by entirely different preferences; does the car have Bluetooth? Is it a hybrid and energy efficient? What sort of technology comes pre-loaded? All these questions speak to a consumer desire for an easier, automated experience when driving.

New demand. New technologies. New complexity.

This new demand has had a drastic impact on the automotive industry global supply chain. These consumer requirements mean that more investment needs to be applied to the supply level - from its most basic level, all the way through to its most complex.

Research and development into new technologies is inherently expensive and can only become cost efficient with increased sales volumes. In addition, continued capital investment in research and development in technologies is generally a long-term investment resulting in short-term increased costs and lower operating margins and return on investments to shareholders and investors. This is one reason why we see massive reductions in the cost of technologies a few years after they have been released into the mass market. A similar example are OLED televisions, which were prohibitively expensive during the initial release but have gradually become more cost efficient due to early adopters supporting the sales structure. This in turn allows for cheaper development. The same applies to the automotive supply chain.

This was the case pre-COVID19.

Shifting behaviour, supply chain shock and transformation

As with many industries, the entire business landscape has now shifted and as countries around the world come out of lockdown, we are seeing the business impact. The automotive supply chain that has relied heavily on continued consumer spending now struggles with being able to invest enough to stay ahead of the curve to meet the changing consumer preferences given the technological advancements in mobility and autonomous technologies. Simply put, there is not enough liquidity. As a result, it is increasingly likely that we will begin to see major transactional transformation in the post-Covid supply chain. One possible outcome is continued consolidation with suppliers. This approach shows similarities to what many other industries are doing in the face of adversity - transforming. For example, we are seeing companies, which were working towards a five-year plan with R&D pushing towards this new customer demand for electric vehicles, pivot and pause to rethink.

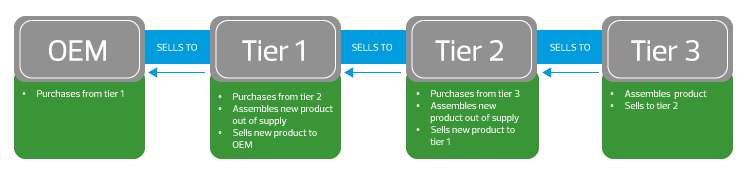

Given the importance of tier one suppliers in the overall supply chain, the forward-thinking step is for tiers two and three to provide support. No one element of the supply chain can function without this. The tier one requirements to sell product to tier two, and tier two to in turn sell product to the tier 3 automotive suppliers has been disrupted due to the slowed OEM production levels and ultimate global sales to the consumer.

Transformation and change are on the horizon

Therefore, the transformative approach begins to make sense. The importance of the middle market is demonstrative here, as within the automotive industry this is where the bulk of consumers look for their buying decisions. The entire supply chain is built on a complex network of systems, needs and requirements of each section. As each tier informs the next, any profitability issues that tier one is facing will be in some way felt by the following two, so through consolidation of the supply chain, risks may be mitigated.

Automation is a growing requirement in consumers’ lives, look at the successes of AI assistants, smart devices and the plethora of technology centric products that aim to streamline day-to-day life. Could this same approach be applied to supply chain management, in a manner than ensures absolute efficiency between the tiers?

In this period of uncertainty, it is not entirely clear what the future will hold for the automotive industry. What is clear though is that great change is on the horizon and the steps being taken now are being taken to ensure swift recovery.