The Gaming Licence Fees Regulations (L.N. 409.17) were introduced through Legal Notice 409 of 2017 on the 22nd December 2017, effective as of 1st January 2018.

Licence Fees

Licensees shall pay to the Authority a licence fee which shall be constituted of:

A) The Compliance Contribution, payable for each licence period; and

B) The non-refundable Fixed Annual Licence Fee, payable in advance for the twelve running months following the issue of the licence and every anniversary thereof, throughout the duration of the licence.

It is important to note that Compliance Contributions are only payable in terms of a B2C licence. B2B licence holders are only required to pay the Fixed Annual Licence Fee.

Compliance Contributions

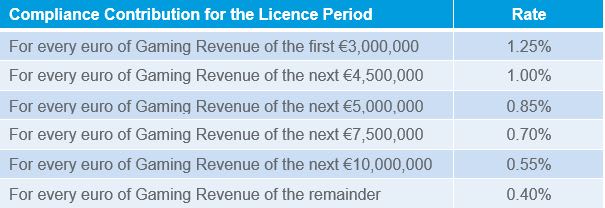

The compliance contribution payable for Type 1 gaming services shall not be less than €15,000 and shall not exceed €375,000.

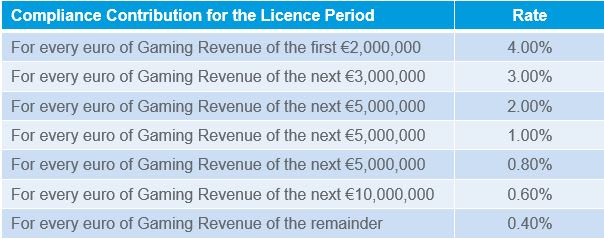

The compliance contribution payable for Type 2 gaming services shall not be less than €25,000 and shall not exceed €600,000.

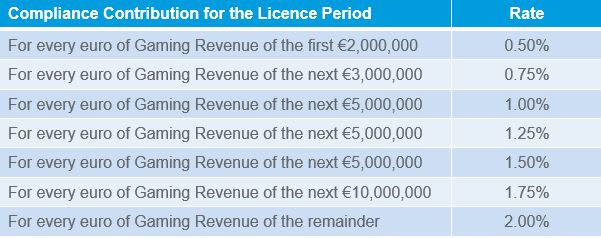

The compliance contribution payable for Type 3 gaming services shall not be less than €25,000 and shall not exceed €500,000.

The compliance contribution payable for Type 4 gaming services shall not be less than €5,000 and shall not exceed €500,000.

ANNUAL Licence Fees

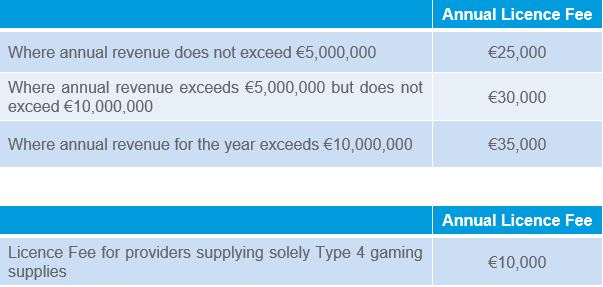

The annual licence fees payable for a B2C licence holder are as follows:

The annual licence fees payable for a B2B licence holder offering the supply and management of material elements of a game are as follows:

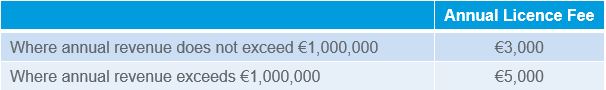

The annual licence fees payable for a B2B licence holder offering the supply and management of software to process any essential regulatory record; and/or supply and management of the control system, namely the system on which the software referred to above resides; are as follows:

Gaming Tax

Gaming Tax has been re-defined. Any person offering any gaming service to any player who is physically present in Malta at the time when the gaming service is actually provided, shall pay to the authority, for each Tax Period (month), gaming tax to be computed at the rate of 5% of the Gaming Revenue generated from the said gaming service during the relevant Tax Period.