Why Corporate Tax Compliance Matters?

Under the self-assessment system, the Inland Revenue Board of Malaysia (IRBM) has placed the responsibility of computing taxes to taxpayers. Accordingly, businesses are required to ensure that taxes are accurately computed and paid on time. Non-compliance will result in imposition of additional taxes, hefty penalties and unnecessary financial exposure. All companies and businesses deriving Malaysian-source income are required to submit an annual tax return. Frequent changes in the tax legislation have increased the pressure on taxpayers to ensure that their tax returns are accurately prepared. The possibility of tax audit conducted by the IRBM further elevates the risk of incurring additional taxes and penalties. Tax compliance is more than just submitting returns — it is a critical responsibility for all businesses operating in Malaysia. Effective compliance helps in optimising tax efficiency, avoiding penalties, audit risks and legal exposure while maintaining accurate financial records and supporting long-term financial stability and growth. |

|

Why RSM in Malaysia?

Our corporate tax specialists undergo continuous technical training and are fully committed towards service excellence.

We proactively identify potential tax risk areas and provide practical and effective solutions to mitigate exposure.

We understand diverse business sectors and their unique challenges, enabling us to deliver tailored, industries-specific advice and supports that aligns with your operational direction.

As part of RSM International’s global network, we offer strong local expertise supported by worldwide resources – giving you direct access to senior professionals who enhance the effectiveness of your tax compliance process.

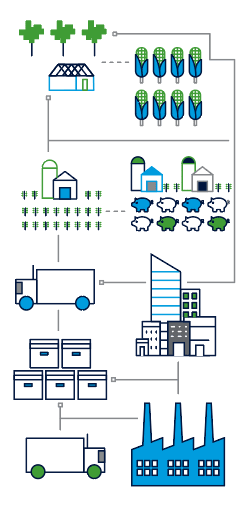

How We Can Assist?

Our tax specialists are well equipped with the technical expertise, resources and experience to address all aspects of a taxpayer’s tax compliance needs. We offer a comprehensive range of corporate tax compliance services designed to support companies through the tax return process.

|

|

For any assistance, please contact our team or email us at info@rsmmalaysia.my