With just a month until the end of 2020, many individual resident investors in Puerto Rico may feel unsure about their Puerto Rico bona fide resident status.

Since this year has been full of life-changing events due to the coronavirus pandemic, it is common to question whether investors would qualify this year as Puerto Rico bona fide residents. Restrictions set by both the Puerto Rico and the United States governments to prevent the spread of Covid-19 may have impacted many resident investor's ability to be physically present in Puerto Rico for the total of days required by Puerto Rico and United States laws and regulations.

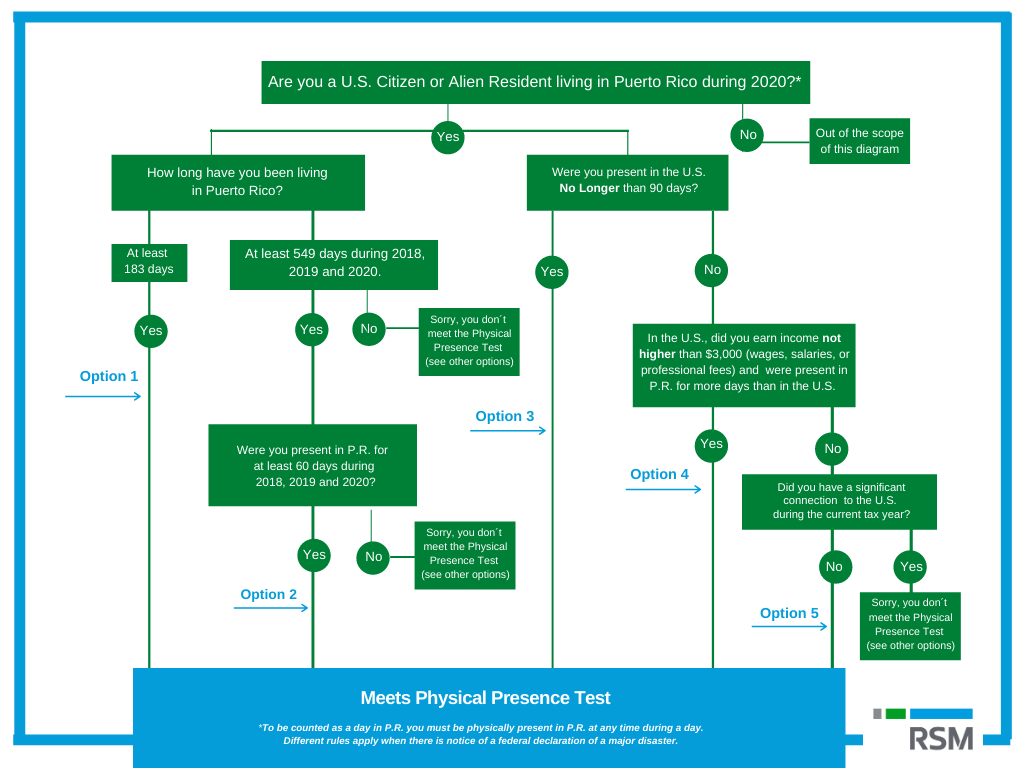

We encourage resident investors to take a closer look at this year’s calendar to determine their compliance with the physical presence test of the U.S. regulations for Puerto Rico bona fide resident status below, to understand their 2020 status. This exercise will allow a proper filing in 2021 under the Puerto Rico Internal Revenue Code, the United States Internal Revenue Code, their regulations, and Act 22 (now Act 60).

The following illustration will assist you in this process for tax year 2020. It is also useful for 2021 tax planning.

For your convenience, you may download the image for future reference.

Please note that this chart is not meant to be tax advice, but a conversation starter for you and your tax advisor. For additional information, contact our tax advisors at [email protected], or call (787) 751-6164.