A withholding tax (WHT) is a legal requirement for the payer of an item of income to withhold or deduct tax from the payment and pay that tax to the government. WHT is tax deducted at source on payments to both resident and non-resident persons for income arising from various sources.

Payments subject to withholding tax include employment income, international payments, payments to non-resident contractors or professionals, payments of dividends, payments for goods and services by government, government institutions, and designated withholding agents, payments of professional fees and payments on imports.

WHT – non-residents

Section 83 (1) of the Income Tax Act (ITA) states that “Tax is imposed on every non-resident person who derives any dividend, interest, royalty, rent, natural resource payment or management charge from sources in Uganda.” The tax is withheld by the payer at a rate of 15% of the gross amount before payment/remittance of the amount is made. However, this does not apply to amounts from activities of a Ugandan branch of the Non-Resident. Section 83(6).

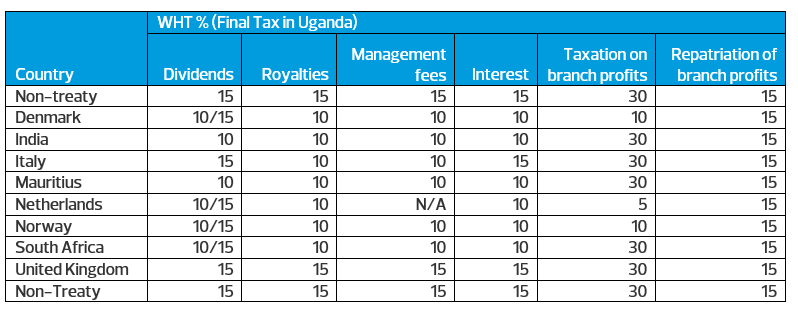

In the event that the payment is made to a resident of a country that has a double tax agreement (DTA) with Uganda, the rate specified in the DTA is applicable. The table below shows the applicable rates where a DTA is in place.

Non-residents - international transport payments

Payments for services embarked in Uganda

Section 86 (1) of the Income Tax Act (ITA): Taxation of non-residents providing shipping, air transport or telecommunications services in Uganda states that “Subject to this Act, a tax is imposed on every non-resident who derives income from the carriage of passengers who embark, or cargo or mail which is embarked in Uganda and on a road transport operator who derives from the carriage of cargo or mail which is embarked in Uganda. The tax payable by a non-resident is 2% to the gross amount derived by the person from the carriage and is treated for all purposes of the Act as a tax on chargeable income.

Payments for transport services embarked from outside Uganda

This matter has proved to be contentious over the years between the Uganda Revenue Authority and taxpayers. The URA has insisted that Section 85 (1) of the ITA which states that “ …..tax is imposed on every non-resident person deriving income under a Ugandan – source services contract” at a rate of 15%, applies to these transactions. The taxpayers argue that there are specific provisions under Section (86) of the Income Tax Act (“ITA”) that deal with the taxation of non-resident transporters in Uganda as discussed above. However, this section only covers WHT if it relates to the delivery of cargo that has embarked, boarded or originated from Uganda. The taxpayers have over the years insisted that the absence of a specific provision as part of Section 86 implies that the jurisdiction of this matter is outside the reaches of the laws of Uganda. Further, a player in the international transport arena is already being taxed by the country of origin and should therefore not be taxed twice.

In March 2021, Uganda’s Tax Appeals Tribunal (“Tribunal”) ruled in favor of the Uganda Revenue Authority (“URA”) collecting withholding tax (“WHT”) at the rate of 15% on freight payments to non-resident transporters for cargo deliveries into Uganda from abroad. Though this decision did not initially attract much public attention, there are now growing concerns especially as Uganda gears up for the development phase of its crude oil discoveries that the prevalent enforcement of this WHT imposition will make Uganda a less competitive destination for doing business.

It is highly unlikely that regional logistics players would find it attractive participating in international transportation terminating in Uganda when the same underlying income that they have earned from Uganda is also subjected to taxation in their home countries.

We therefore expect to see players in the industry demand that they are paid net of local taxes with the client in Uganda grossing up the tax charge hence pushing up their costs of doing business. It is therefore likely, that the final consumer will bear this cost which will fuel inflation across the greater part of the economy.

Recent developments

We have noted that the Uganda Revenue Authority (URA) is holding further discussions with stakeholders following their petition to the Ministry of Finance and Economic Development to intervene on the same. A decision and way forward is awaited in the coming months.

In the meantime, industry players and their customers are advised to consult their tax agents/consultants on the matter.