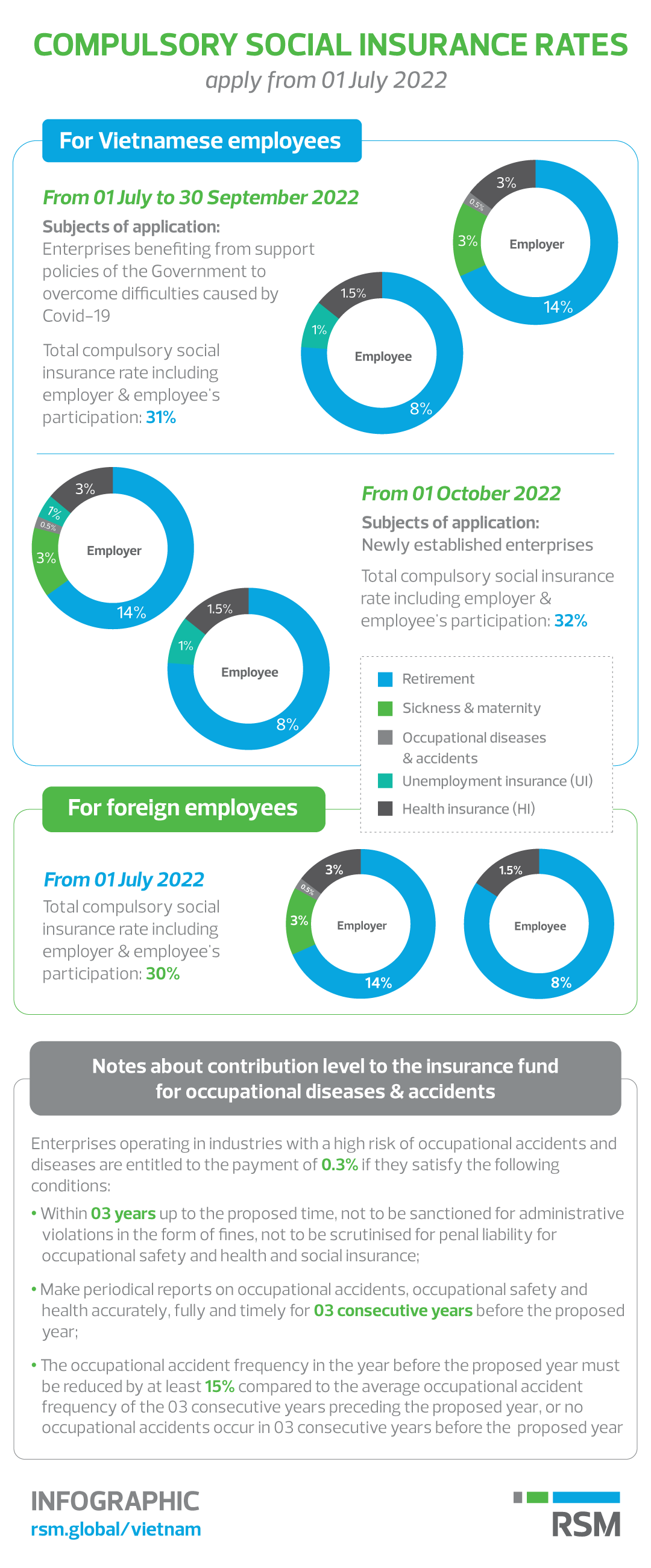

Decree No. 38/2022/ND-CP stipulates the new regional minimum wage from 01 July 2022. Accordingly, many businesses have to adjust the level of social insurance contributions for employees. However, there are different rates of social insurance contributions for Vietnamese employees and foreign employees working in Vietnam. This infographic shows specifically the payment of social insurance, health insurance, unemployment insurance, occupational accident and occupational disease insurance for each subject.