In this article I present a review of the annual reports of 97 publically traded entities on the Small- and Mid-Cap list of NASDAQ OMX Nordic Exchange in Stockholm for the financial year 2015. The focus of my review has been disclosures on operating segments, as I find this to be a topic of continuous debate. Key focus areas have been on the definition of the Chief Operating Decision Maker, aggregation of operating segments and a qualitative analysis of entities that report only one segment (‘one-segment entities’).

In my review I addressed the following questions:

- What argument do listed entities use when aggregating operating segments?

- Who is identified as the Chief Operating Decision Maker (‘CODM’)?

- What impact might the determination of CODM have on the definition of reportable segments?

Introduction

The core principle of the standard on segment reporting (IFRS 8) emphasises the importance of segment disclosures that enables users of the financial statements to evaluate the nature and financial effects of the operations, and the economic environment in which an entity operates. The method for determining what information to report is referred to as the ‘management approach’. The management approach is based on the way that management organises the segments within the entity for making operating decisions and assessing performance.

In spite of the number of years IFRS 8 has been in place, it continues to constitute a challenge for many preparers and is still a topic subject frequently discussed among preparers, auditors and users of financial information.

Aggregation of operating segments is one of the more judgmental areas of operating segments disclosures. The principle of aggregation is that separate reporting will not add significantly to the understanding of a segment, if the segments have characteristics that are so similar that they are expected to have the same future outcome. However, meeting all the aggregation criteria is a rather high hurdle.

In my experience I noticed that most entities will have more than one operating segment and fewer than ten, if the core principle is applied to the letter and when evaluating the financial information actually available – but possibly not always included in the CODM report, i.e. the reports on which the management monitors and makes decisions about the operations.

I have intentionally excluded the large cap list in this review and focused on the small- and mid-sized publically traded entities. Key data that I have reviewed are disclosures regarding identification and description of the CODM and the number of segments disclosed. I have given the ‘one-segment’ entities extra focus, to evaluate if it would have been helpful to read about the operations with less aggregated information. I also have tried to understand the rationales of the one-segment entities for aggregating operating segments into one.

Summary of the review

Based on my review I found a mix of good and lower quality examples of segment disclosures. A review of annual reports is limited in the sense that the management arguments for how to display segments are not fully disclosed.

Entities reviewed by industry and by listing:

| Small Cap | Mid cap | Total | |

| Consumer goods | 3 | 4 | 7 |

| Consumer services | 5 | 3 | 8 |

| Financials | 4 | 10 | 14 |

| Health care | 14 | 6 | 20 |

| Industrials | 18 | 9 | 27 |

| Materials | 3 | 0 | 3 |

| Oil and gas | 0 | 1 | 1 |

| Technology | 13 | 2 | 15 |

| Telecom | 2 | 0 | 2 |

| Total | 62 | 35 | 97 |

To my surprise I found a large number of entities displaying only one segment; in total, 37 companies of the 97 I looked at disclosed only one segment. Among the one-segment entities, there were several with international operations, and/or several product/service lines. Many companies also held subsidiaries in more than one country.

‘Global operations with major geographic differences’ is a quote I found in one of the entities as a headline in the beginning of the annual report. The entity reported its operations as one segment. This is a group with subsidiaries in 16 countries spread over four continents.

A common argument I have found for reporting only one segment is that the operations are monitored at group level. The generic arguments keep coming back, with slight variations. An example that is recurring, with more or less the same content, is:

‘The company has to identify the level at which the company’s most senior executive decision-maker makes regular reviews of sales and operating income. These levels are defined as segments. The company’s most senior executive decision-maker is the company’s CEO. The regular internal reporting of income to the CEO, which fulfils the criteria to constitute a segment, is done for the Group as a whole, and we therefore report the total Group as the company’s only segment.’

The quote above is collected from a company that operates in 14 countries, promoting at least two different sets of products. The question that might come to one’s mind is ‘Shouldn’t this company monitor and evaluate their operations in more detail than at group level?’.

Another interesting argument for disclosing only one segment is:

‘The Company’s top executive decision-makers govern and manage the operations based on legal corporations. The number of legal corporations within the Company is about 60, and so, according to the IFRS 8 standard, the Group has that number of segments. Because the presentation of 60 segments would entail excessively detailed information, the standard proposes aggregating these at a suitable level if there are similar economic characteristics and the segments resemble one another. We cannot see how such an aggregation, into no more than ten segments, could be done so that the information was comprehensible. Thus the Company has chosen to aggregate all segments into a main segment.’

In this case the rationale for displaying only one segment is that each operating segment is so different in character that aggregation is not possible. The CODM in this entity was not clearly identified, which might be a factor for not monitoring the operations on a more aggregated level. The argument is hardly acceptable in that surely some detail must be better than no detail at all.

Chief Operating Decision Maker (CODM) and operating segments

IFRS 8 defines an operating segment as a component of an entity:

- that engages in revenue-earning business activities,

- whose operating results are regularly reviewed by the chief operating decision maker. The term ‘chief operating decision maker’ is not defined in IFRS 8, but the Standard clearly refers to a function rather than a title (in some entities the function could be fulfilled by a group rather than an individual), and

- for which discrete financial information is available.

Deciding who the CODM is can be difficult and judgement is often needed to ensure that the right person or persons have been identified.

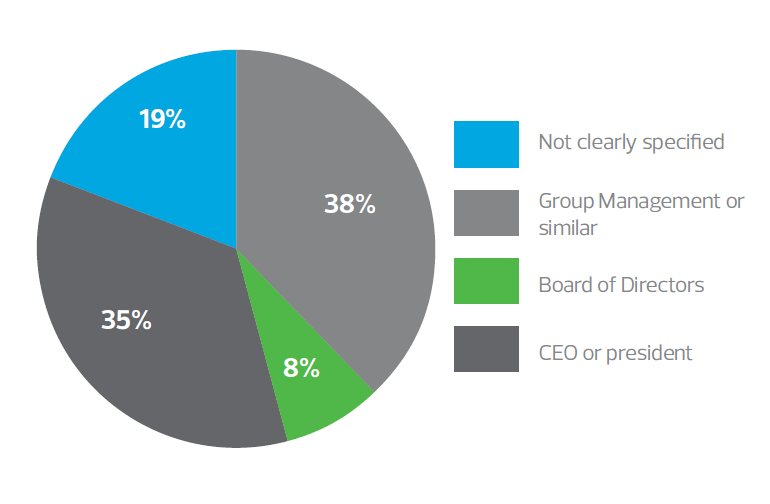

In the following chart (Chart 1) I have summarised the different categories disclosed in the annual reports. Different terms might have been used; for example, if the CODM has been described as Board of Directors and CEO I have included it in the category Group Management or similar.

Chart 1 – CODM by category

Depending on which level in the organisation the CODM is identified, the granularity of information reviewed by the CODM may vary. Understanding the organisational structure of an entity is important to understand how the identification of the CODM has been done by the reporting entity; however, approximately 19% of the entities did not clearly specify the function neither in the accounting policies nor in the note regarding segments. General information that should be disclosed in accordance with the Standard comprises factors used to identify the entity’s reportable segments, including the basis of organisation. In my view, a clear understanding of who the CODM is helps a reader of the report to understand how operations are managed and monitored. This can be easily achieved by disclosing an organisational structure, e.g. through a chart or detailed description of how the operations are managed.

The review indicates that 38% of the investigated companies have identified the CEO or President as the CODM. 35% of the entities reported that Group Management or similar was the CODM. As the sample encompasses only small- and mid-cap entities, I anticipated that the Board of Directors would have been represented by the most senior positions.

Regardless of how the CODM is determined, it is important that they are involved in the process of monitoring, evaluating and allocating resources. A Board of Directors or Group Management that simply approves management’s decisions would not, in my opinion, constitute a CODM, even though I would agree that the Board of Directors normally would not be the CODM, but rather working at a more strategic level.

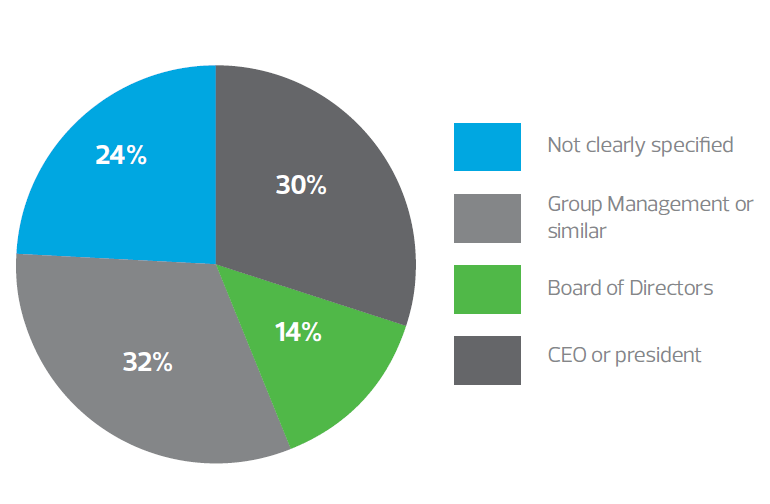

In the one-segment entities (Chart 2), the proportion of entities which did not clearly specify their CODMs was even higher.

Chart 2 – CODM in one-segment entities

Looking at the sub-sample of one-segment entities only, the CODM is defined as a group of managers, more often than in the entire sample. This might explain why only one segment has been identified, i.e. the internal reports support decision-making at the higher level.

In addition to the arguments proposed by the entities in their annual reports, management might find segment disclosures sensitive by nature and show their reluctance to disclose the segments by providing generic explanations;

As an advisor to companies, I seek ‘evidence’ on how the CODM monitors the operations, e.g. through a reporting package. However, with the advancement of technology I often find that information could be found outside the reporting package and that additional information is actually being reviewed by individuals forming part of the management team. So, at what level are the operations actually monitored? If the CODM reporting package is the key factor for determining operating segments, information reviewed outside the reporting package might be important as well – if reviewed on a recurring basis by the CODM and used in the decision-making process.

Reportable segments

Once an operating segment has been identified, the entity needs to report segment information if the segment meets any of the following quantitative thresholds:

- Its reported revenue (external and inter-segment) is 10% or more of the combined revenue, internal and external, of all operating segments.

- Its reported profit or loss is 10% or more of the greater, in absolute amount, of (i) the combined profit of all operating segments that did not report a loss and (ii) the combined loss of all operating segments that reported a loss.

- Its assets are 10% or more of the combined assets of all operating segments.

IFRS 8 states that if the total external turnover reported by the operating segments identified by the size criteria is less than 75% of total entity revenue, then additional segments need to be reported on until the 75% level is reached.

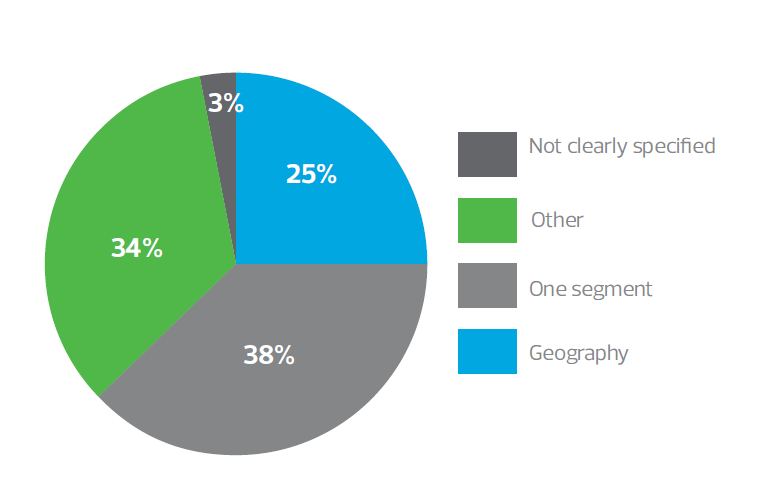

I found several entities disclosing information about operating segments but then arguing that the reportable segments are something else, due to the aggregation criteria. Besides the one-segment entities, geography was often stated as the segmentation. My data demonstrates that this is more common among smaller entities, rather than the large cap entities. The Standard states that an operating segment generally has a segment manager who is directly accountable to and maintains regular contact with the CODM to discuss operating activities, financial results, forecasts, or plans for the segment. If an entity has operations in several countries, discrete financial information often is available and a country manager is appointed. Financial information regarding products, services or business lines might require more from an ERP11 system – something that all the smaller entities might not have invested in. This might be a reason for the high%age of entities displaying geography as their segments.

The category ‘other’ includes business lines, products, services, sub-groups, distribution channels, category of customer and sometimes a mix of these categories. See Chart 3.

Chart 3 – Segment by category

Aggregation of operating segments

The main principle of aggregation is that separate reporting will not add significantly to the understanding of a segment if the segments have characteristics that are so similar that they are expected to have the same future outcome. However, meeting all the aggregation criteria is in my opinion a rather high hurdle.

If operating segments have similar economic characteristics, then they can be aggregated into a single reportable segment and viewed together for the purposes of the size criteria.

If management reporting is prepared on a geographical basis, the same criteria for aggregation apply. In order to be aggregated, each of the geographical areas must have the same economic characteristics, which might constitute a problem. Besides assessing the products and services, an entity needs to consider economic conditions, exchange control regulations and currency risks associated with the geographic areas when determining if each geographic area can be aggregated or not. In addition, even though some geographic areas can be aggregated there are entity-wide disclosure requirements meaning that revenues and assets of each material country must be disclosed.

I found several of the entities aggregating the ‘Nordics’, defined as the region that includes Sweden, Denmark, Finland and Norway, into one segment, on the basis that these countries have similar characteristics. The first observation that arises is that the four countries have four different currencies (SEK, DKK, EUR and NOK). The exposure to currency risk is one factor implying that these four countries should not be aggregated if each of these countries is identified as an operating segment. However, if they are monitored as one geographic area it would be correct to disclose them as one reportable segment.

With reference to the example above with 60 operating segments, the group has employees in more than 40 countries and five continents. Entity-wide disclosures are reported for 15 geographical areas. When having the criteria for aggregation in mind, I could agree with management’s conclusion, i.e. the geographic areas might not display similar economic characteristics. However, I would anticipate such an international business to have some kind of monitoring of regions as well as discrete financial information on a more grouped level. In addition, having the core principle of IFRS 8 in mind, I would say information on a more detailed level would have facilitated the users’ understanding of the operations - even though it would have meant aggregating characteristically different operating segments.

The main explanations disclosed by the one-segment entities for having only one segment were:

- Monitoring and analysis of the operations are performed for the group as a whole.

- All operating segments are similar so we aggregate them into one.

None of the above 29 entities of the 37 reporting only one segment argued that they monitor the group as a whole. In total there were 22 entities reporting only one segment that, however, have operations in at least two countries.

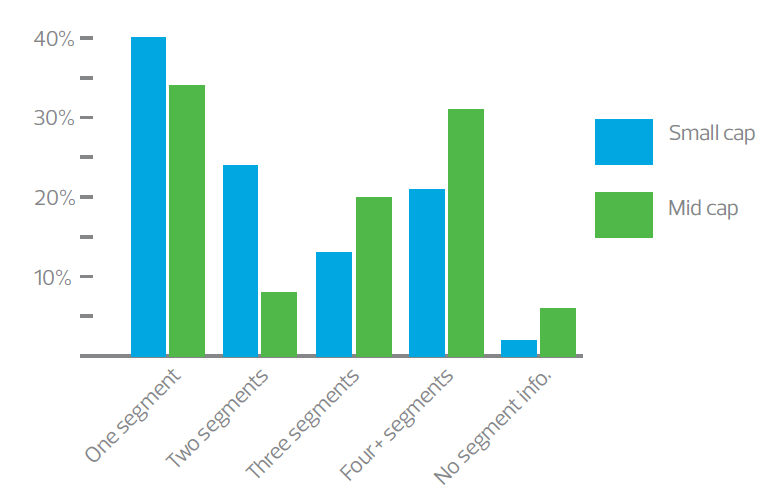

The frequency of one segment only in small cap and mid cap in my sample was 40% and 34% respectively, which, considering the information given in the management disclosures regarding the companies’ operations, is a higher frequency than I expected. In particular, the entities that use the argument number two above may come across as having weak internal controls. If operations exist in several countries and/or there are several business lines, one might expect more detailed monitoring and available discrete financial information. 72 companies reported three or fewer segments.

The number of segments reported is illustrated in Chart 4:

Chart 4 – entities by number of reported segments

Final remarks

I do acknowledge the difficulties of disclosing comprehensive information regarding operating segments and defining the CODM and the level of detail of the information reviewed on a regular basis.

However, financial reports must contain disclosures that enable the user to understand the significance of each service line, geographical area or category of products; seeing evidence that operations are actually monitored and evaluated in a structured manner makes the user more comfortable with the quality of the financial reporting.

Some recommendations based on this analysis and my professional experience on segment disclosure:

- Remember the core principle of the Standard: disclose information regarding segments so that users can actually evaluate the nature and financial effects of the operations.

- As a rule of thumb, businesses, even among small- and mid-cap entities, tend to have more than one and fewer than ten operating segments.

- Do not refer only to the reporting package provided to the CODM. Evaluate the information that is actually being reviewed and analysed on a regular basis by management, even though it might not be included in the CODM package.

- Evaluate the sensitivity of not disclosing segment information, as well as the sensitivity of disclosing this information.