Again, Paris is full of Chinese shoppers for the new shopping season. If you happen to join the checkout lane at Printemps or Lafayette, you would wonder if you were in China. Not too long ago before the recession started in Brazil, Miami was the same. Tons of Brazilians flooded into Miami for every shopping season.

How household consumption has evolved?

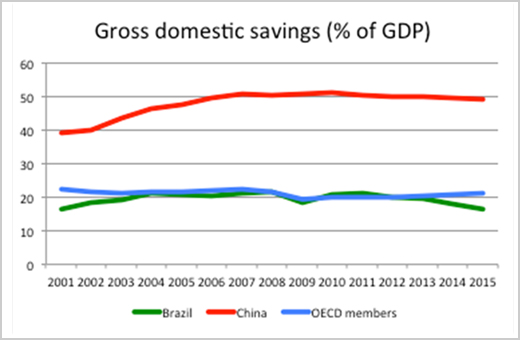

Historically, Chinese are not big spenders on average. Gross domestic saving has increased to around 50% for the last decade. The deepening economic reforms bring more opportunity and uncertainty at the same time. The young generation has to face skyrocketed housing prices and increasing cost of child rearing. Since the state transformed to a market-based economy, the older generation can no longer enjoy state-provided health care or pension. They now have to save for their own pensions and medical bills. The motivation of precautionary saving has been very strong across age groups in China.

In contrast, the average Brazilian does not save much. The gross domestic saving stayed around 20% for the past fifty years despite economic fluctuations. One may easily associate this with the hyperinflation experience during 1980s. People are unlikely to save after observing three-digits inflations. Even in the recent years, inflation stayed above 5 percent and occasionally climbed to more than 10 percent. The insufficient presence of financial institutions and prevalent illiteracy in rural areas might also account for the lack of saving. Brazilian household has a high propensity to consume, similar to OECD members.

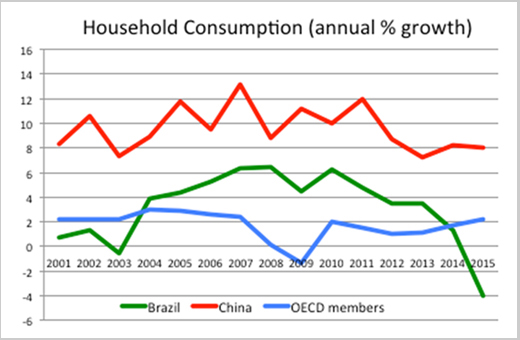

However, the household consumption trends are taking different directions in two countries. Personal consumption has been growing rapidly in China. Consumption is playing an increasingly important role in terms of driving growth. With rising household income, the growth in past twenty years started to form a small elite group and a relative large middle class. The nouveau riche demands luxury goods and high-end services. More importantly, the emerging young professional class is placing more emphasis on improving standard of living. They are willing to pay for higher quality products with fare prices. The situation is quite different in Brazil. There was moderate consumption growth since 2003. However, the recession endangered the income of many Brazilians, both the well offs and the working class. Jobless rate almost doubled in the last two years, reaching 11.9% at the end of 2016. Workers cannot expect a raise in paycheck if they haven't lost their jobs. The consumption is shrinking in Brazil.

The dynamics of government spending

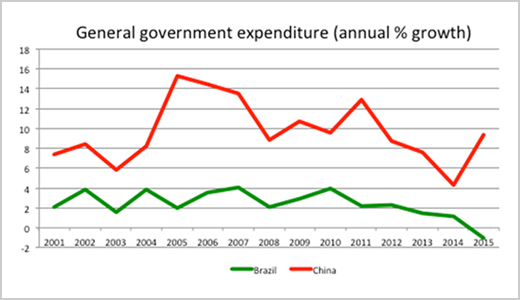

There is no surprise for the critical role played by the Chinese government in the development process. China's past economic growth has relied heavily on investment and exports, without a strong domestic consumption. High savings at the bank are transformed to investment in real economy. The National People's Congress publishes the GDP target every year around March, which puts political pressure for the administration to achieve the GDP goals. For example, the GDP target zone for 2016 is 6.5%-7%. Government acted as strong stabilizer for the economy. Particularly during the 2008 financial crisis, the government was able to implement fiscal stimulus plan, avoiding a huge drop in aggregate consumption. In recent years, the focuses of fiscal policy have shifted to building social safety net and incentives for innovation. The Government hopes to induce more structural changes, replacing the labor-intensive export sector with more domestic consumption and capital-intensive industries.

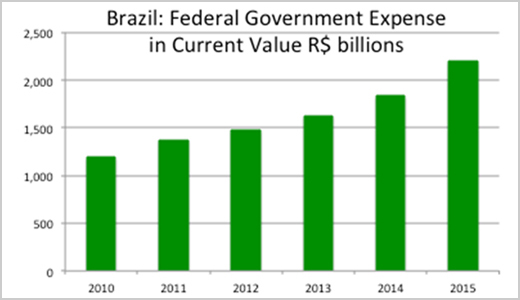

The Brazilian government expenditure has grown relatively fast during the central-left government of Lula Da Silva (2003 to 2010) and subsequently Dilma Rousseff (2011 to Aug. 2016). High commodity prices boosted exports and added additional revenue to the government's account. The Worker's Party (PT) expanded several social welfare programs, including the world-known conditional cash transfer program "Bolsa Familia". A large number of the poor were gradually included in formal sector of employment. The increases in minimal wages further strengthened the purchasing power of the workers. However, the large amount of fiscal spending dragged the government into deficits area after energy prices dropped. Together with corruption scandals, the PT government was replace by the leadership of Michel Temer. The new administration passed the constitutional amendment to freeze the real fiscal spending for twenty years, with the hope of reassuring foreign investors. This spending cap will definitely limit the functioning of public services, especially in public health and education. In the short run, household consumption will suffer from the austerity program, though the effect is more prominent on the poor. In the long run, it's hard to argue in what extent the fiscal discipline will help to reboot the economy and bounce it back to growth.

About the author: Niu Yuanhao is a Chinese Economist, who holds a bachelor's degree in Finance from the BLCU (Beijing Language and Culture University), a master's degree in Economic Policy with a focus on Economic Development from the University of Illinois in the USA, and is currently a Ph.D. in Economics from the University of Notre Dame in the USA . Niu had the opportunity to study a semester of Economy in Brazil at São Paulo’s University (Faculty of Economics and Administration FEA) in 2016.

For more information, contact us:

Janaína Guimarães - guimaraes.janaina@rsmbrasil.com.br

Executive China Desk - LATAM