Historically, the incremental development and high costs of renewable energy discouraged the rapid expansion of that industry. But recent shifts in the commercial and technological landscape signal a transformative moment for renewable energy, which now presents a credible challenge to fossil fuels in the competition for global investment.

Investments in renewable energy

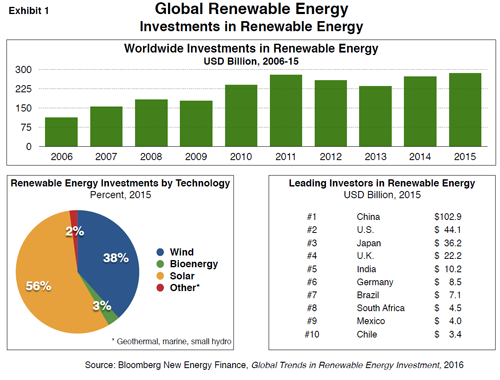

As shown in Exhibit 1, global investment in renewable energy reached a record $285.9 billion in 2015. Between 2006 and 2015, investment in renewable energy totaled $2.2 trillion. Industry analysts forecast continued growth of renewable energy investment in coming years. The International Energy Agency projects cumulative renewable energy investment of $7.4 trillion by 2040.

Solar and wind are the drivers of the renewable energy market, representing 56.0 and 38.0 percent respectively of global renewable investment in 2015. Solar power (photovoltaic and thermal) is the fastest growing renewable energy technology, with 2015 investment increasing by 12.0 percent over the previous year. Wind-related investment grew at a more modest rate, registering 4.0 percent year-on-year growth.

The growing attractiveness of solar and wind to global investors reflects the following factors:

- Technological advances that boost the performance and reliability of solar and wind power.

- Improvements in energy storage systems that heighten the utility of intermittent renewables.

- Realisation of economies of scale that lower the costs of solar and wind energy.

Bioenergy (subsuming biomass-based liquid fuel and gas) lags far behind solar and wind power. From a peak $28.3 billion in 2007, bioenergy investments fell to $9.1 billion in 2015 against a combined $270.6 billion for solar and wind. The declining attractiveness of bioenergy illustrates:

- Diminished governmental subsidisation of biofuels in the United States and other countries

- Persistent concerns over the diversion of farm products (corn, sugar, etc.) from food to energy

- Continued barriers to commercialisation of next-generation bioenergy technologies such as algae and cellulosic ethanol

Renewable energy capacity

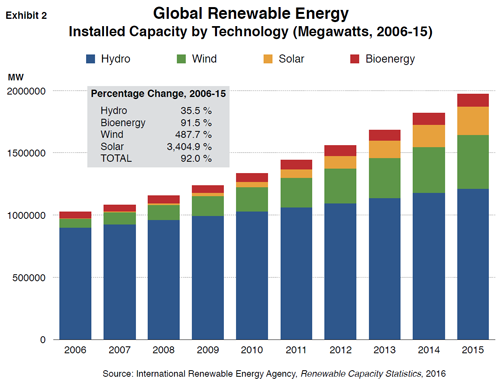

These investments are yielding large increases in renewable energy capacity worldwide. Installed renewable capacity approached 2,000,000 MW in 2015, nearly double the level of 2006 (see Exhibit 2).

Hydropower represents the largest share (61.3 percent) of renewable energy capacity, well surpassing the portions of wind (21.9 percent), solar (11.5 percent), and bioenergy (5.3 percent). But hydro is also the slowest growing of the renewable energy categories, posting a capacity increase of just 35.5 percent between 2006 and 2015.

Hydropower holds substantial untapped potential. Advances in turbine design and lightweight composite materials enable the deployment of small, high-efficiency hydroelectric systems. However, a range of factors inhibit realisation of hydro’s potential:

- Lengthy and expensive permitting of hydroelectric projects, which must navigate a maze of environmental regulations (e.g. the U.S. Environmental Protection Agency)

- Long distances between upstream hydro sources and major population centers that raise the costs of electricity transmission (e.g. Turkey)

- The location of much of the world’s non-utilised hydro resources in politically unstable countries (e.g., DR Congo)

Installed wind power grew by nearly 500 percent between 2006 and 2015. This development reflects steady gains in wind energy technology, particularly advances in turbine and blade design that permit continued windmill operations even in conditions of low wind velocity. The combination of increased scale and improved technology has enabled the achievement of grid parity in Germany and the United States, where onshore wind power now costs less than electricity generated by coal and CCGT (combined cycle gas turbine) stations. Offshore wind represents a small fraction (3 percent) of total wind capacity, illustrating high commercial, environmental, and regulatory barriers to the installation of offshore wind turbines.

Solar constitutes the fastest growing renewable energy sector. Installed solar power grew by over 3000 percent between 2006 and 2015. The surge of solar power results from rapid improvements in solar photovoltaic technology, notably advances in crystalline-silicon PV that have produced a dramatic decline in the cost of solar electricity. According to Dubai-based IRENA (International Renewable Energy Agency), the cost of solar PV electricity has fallen from $0.285/kWh in 2010 to $0.126/kWH in 2015. The pending commercialisation of next generation solar technologies (including the concentrated solar PV system being piloted at Masdar City near Abu Dhabi) promise further reductions in the cost of solar power and continued expansion of solar capacity.

Role of developing/emerging economies

The leading role of the United Arab Emirates in the development and commercialisation of advanced renewable energy technologies illustrates the rising visibility of emerging/developing economies in global renewable energy.

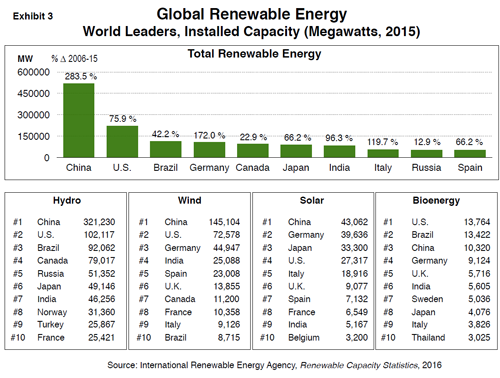

China was the top renewable energy investor in 2015, generating $102.9 billion or 36.0 percent of worldwide investments. That year installed renewable capacity in China reached 520 MW, over double the level of second-ranking U.S. China also enjoys the highest rate of growth of renewable energy capacity (283.5 percent increase in 2006-15 versus 172.0 percent in Germany and 75.9 percent in the U.S.). Measured by technology category, China is the world leader in installed hydro, wind, and solar power and third in bioenergy (see Exhibit 3).

Other emerging economies (Brazil, India, Thailand, Turkey, et al) rank among the global leaders in renewable energy. Even hydrocarbon-centric Russia ranks among the world’s top ten holders of renewable energy capacity, albeit almost entirely hydropower. The broader group of emerging/developing economies generated $156 billion in renewable energy investments in 2015, surpassing the advanced industrialised countries for the first time.

The ascent of emerging/developing economies in the renewable energy sphere reflects the following:

- Opportunities for emerging/developing countries to leapfrog the international technology curve, which permits the rapid adoption of renewable energy technologies that originated in developed market economies like Germany, Japan, and the United States.

- The rising cost competitiveness of renewable energy, which facilitates the deployment of solar and wind power for distributed generation in emerging/developing countries and mitigates the need for costly investments in electricity grid infrastructure.

- The more forgiving regulatory structures of emerging/developing countries, which enable the fast tracking of renewable energy projects to meet increasing demand for power.

Renewable energy vs. fossil fuels

The worldwide growth of renewable energy has coincided with the precipitous decline in hydrocarbon prices. Between June 2014 and January 2016, the price of oil (Brent crude spot) fell by 75 percent while the price of natural gas (U.S. Henry Hub) dropped by 58 percent.

In previous years, reductions in hydrocarbon prices have deterred investments in renewable energy. For example, in the mid- and late-2000s falling prices of oil and natural gas in North America (the consequence of advances in hydraulic fracturing and other extraction techniques) hindered investments renewable energy technologies. At that time, the relatively high costs of renewable energy made it difficult for private investors to justify major commitments to renewables amid cheap hydrocarbon prices.

But subsequent shifts in the technological and commercial landscape have altered the calculus of investors:

The dramatic fall in the cost of solar and wind power has made it possible for renewables to compete with fossil fuels, even with declining oil and natural gas prices and the curtailing of governmental support of renewable energy in Europe and North America.

Current technology allows the speedier construction of renewable energy plants than fossil fuel plants (3-6 months for solar and 9 months for wind compared with several years for coal and CCGT sites), accelerating time to market and easing project financing.

Mounting international pressure for greenhouse gas reductions (dramatised by the December 2015 United Nations’ COP 21 Climate Change Conference in Paris) has diminished the attractiveness of fossil fuels to the international investor community.

Conclusion

2015 marked an inflection point for renewable energy: For the first time, the share of renewables in new power generation power (53.6 percent) exceeded that of fossil fuel. During the same year, installed renewable energy capacity reached 16.2 percent of the global power capacity, over twice the level obtaining in 2006. This development is unambiguously good news for the renewable energy industry, auguring favourably for fulfillment of the COP 21 international agreement on greenhouse gas reductions.

But these figures underscore the fact that fossil fuels still represent over 80 percent of global power capacity (and nearly 90 percent of actual power generation, whose higher share reflects the intermittency problems that still plague solar and wind power). Notwithstanding the rapid growth of renewable energy, the world economy will remain heavily dependent on hydrocarbons for years to come.

This article was written by David Bartlett

Executive in Residence

Director of Global and Strategic Projects

Kogod School of Business

American University

Washington, D.C.

The publication is not intended to provide specific business or investment advice. No responsibility for any errors or omissions nor loss occasioned to any person or organisation acting or refraining from acting as a result of any material in this publication can, however, be accepted by the author(s) or RSM International. You should take specific independent advice before making any business or investment decision.RSM International is the brand used by a network of independent accounting and consulting firms. Each member of the network is a legally separate and independent firm. The brand is owned by RSM International Association. The network is managed by RSM International Limited. Neither RSM International Limited nor RSM International Association provide accounting or consulting services. The network using the brand RSM International is not itself a separate legal entity of any description in any jurisdiction. RSM International Limited is a company registered in England and Wales (company number 4040598) whose registered office is at 50 Cannon Street, London EC4N 6JJ. Intellectual property rights used by members of the network including the trademark RSM International are owned by RSM International Association, an association governed by articles 60 et seq of the Civil Code of Switzerland whose seat is in Zug. © RSM International Association, 2016