Are you aware of the restriction introduced by the Finance Act, 2020 on utilisation of brought forward tax losses from prior years?*

Section 19 of the Income Tax Act, 2004 (ITA) provides for utilisation of unrelieved losses (brought forward losses) emanating from prior years of income when computing the taxable profit/loss position in the current year of income.

The Finance Act of 2020 amended the provisions of S.19 of the ITA which restricts utilisation of tax losses brought forward from prior year(s) of income. We highlight below the practical impact of the amendment and the key points to be taken into account when computing the tax position of the current year.

Before the amendment of S.19 of the ITA, a taxpayer would be eligible to deduct the taxable losses carried forward from previous years with no time limit or restriction on the amount to be deducted.

However, where a taxpayer* has carried forward/unrelieved losses for 3 consecutive years of income, Alternative Minimum Tax (AMT) at 0.5% of Turnover would be payable in the third year of income.

*The amendment referred to and the AMT shall not apply to corporation undertaking agricultural business or providing health or education services.

Where AMT is payable, the ITA does not restrict on carrying forward the taxable losses for utilisation later.

Restriction introduced vide the Finance Act, 2020

Amendment introduced by the Finance Act, 2020 states that- “the income of a person for the year of income having chargeable income and unrelieved losses for the four previous consecutive years of income may be reduced by reason of use of the unrelieved losses. However, such income shall not be reduced below thirty per centum of that income before any reduction for losses.”

In other words, the restriction applies to taxpayers who have unrelieved/unutilised tax losses from four (4) previous consecutive years of income and generate a chargeable income in the current year of income (fifth year) before deduction of the brought forward tax losses.

Further to the above, it is clear that where a taxpayer generates a chargeable income in the current year of income (before offsetting the brought forward losses), the taxable income subject to income tax would not be lower than 30% of the chargeable income.

That is to say, a taxpayer would only be able to utilise the tax losses brought forward to the extent of 70% of the current year’s chargeable income. The remaining taxable loss would be carried forward for utilisation in the following year of income i.e. a matter of timing difference when the loss would qualify for utilisation.

Note that where the above restriction applies and the taxpayer is subject to Income Tax at 30%, AMT shall not apply.

We shall cover below the possible scenarios and the implications:

1. Applicability of Alternative Minimum Tax (AMT)

AMT at 0.5% of turnover shall apply where a taxpayer is in a taxable loss position for three (3) consecutive years of income from the third year of income.

AMT shall continue to apply if the taxpayer continues to be in a taxable loss position before offsetting the losses brought forward. However, where the taxpayer generates a chargeable income during the year, AMT shall not apply since the restriction of 70% would apply.

2. Where a taxpayer generates a chargeable income in the 5th year which is less than the tax loss brought forward

To demonstrate the practical impact of the amendment, an example is provided below:

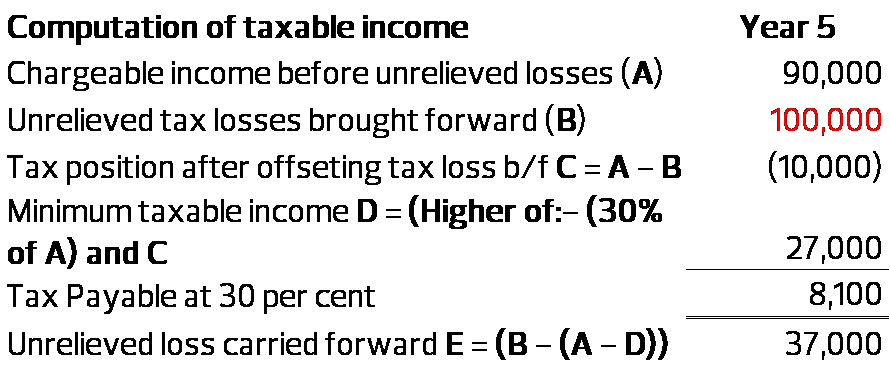

A taxpayer has unrelieved losses from 4 previous years of TZS 100,000 and generates a chargeable income of TZS 90,000 (income before offsetting the tax losses brought forward). Below table illustrates how the amendment of S.19 would come into play:

Therefore the unrelieved loss that is carried forward to the following year is TZS 37,000 and the tax payable for the YOI is TZS 8,100.

3. Where a taxpayer generates a chargeable income in the 5th year which is more than the tax loss brought forward

There are two possibilities under this scenario:

Scenario 1

- Where the chargeable income exceeds the loss brought forward and 30% of the chargeable income is higher compared to the tax position after utilising the loss i.e. (chargeable income less tax loss brought forward).

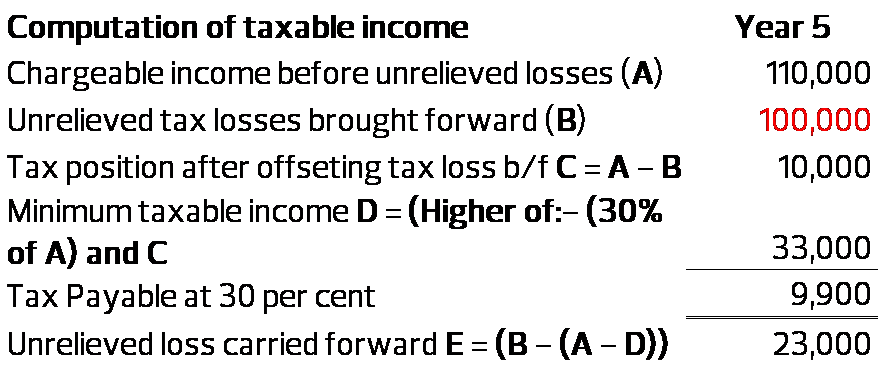

For example, computation for a taxpayer with unrelieved losses from 4 previous years of TZS 100,000 and chargeable income of TZS 110,000 in the current year of income shall be as follows:

One may consider TZS 10,000 (C) as the taxable income on the basis that the brought forward loss is fully utilised. However, it is imperative to take note that even where the chargeable income exceeds the tax losses brought forward, the minimum rule of 30% applies and one must compare the 30% of the chargeable income with the tax position after utilising the tax losses.

It can be observed that the tax losses brought forward is not fully utilised and the TZS 23,000 loss is carried forward. As a result, one may underpay tax if the correct formula is not applied. Note that this applies when filing the provisional estimates and establishing the final tax liability when filing the final tax returns.

Scenario 2

Where the chargeable income exceeds the loss brought forward and the tax position (after utilising the loss brought forward) is higher than 30% of the chargeable income.

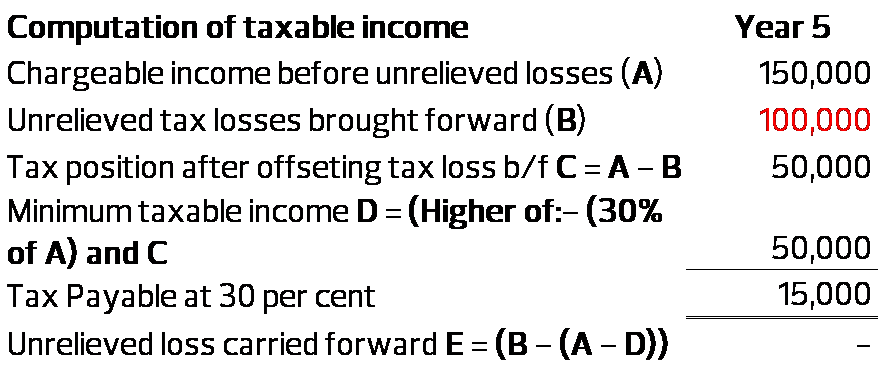

For example, computation for a taxpayer with unrelieved losses from 4 previous years of TZS 100,000 and chargeable income of TZS 150,000 in the current year of income shall be as follows:

Under this scenario, it can be seen that the tax position after offsetting the tax losses b/f is higher than the 30% of the chargeable income i.e. (TZS 50,000 VS TZS 45,000 (30% of TZS 150,000). Therefore, the taxable income shall be TZS 50,000, effectively utilising the full tax loss brought forward.

Conclusion

It is vital to ensure the restriction is understood and the impact of the same is factored when filing the respective income tax returns in order to mitigate any underpayment of taxes which could lead to imposition of interest and penalty.

Download Here: RESTRICTION ON UTILISATION OF TAX LOSSES B/f FROM PRIOR YEARS