AUTHORS

All articles on hybrid mismatches should come with a disclaimer. The disclaimer being that this is incredibly complex and far-reaching legislation that experts regularly find difficult to apply.

The rules are not intuitive and often result in unusual or unanticipated outcomes. Once you understand the intent of the rules you then have to wade through the law and all of its accompanying definitions, the OECD guidance, Explanatory Memorandums – plural, Taxation Determinations, Taxation Rulings, Law Companion Rulings and Practical Compliance Guidelines. In short, this is not simple stuff.

This should be helpful context before reading the ATO’s most recent Draft Taxation Determination (TD 2024/D1) on the hybrid mismatch rules - which primarily focuses on the definition of a ‘Liable entity’ for the purposes of Division 832 of the Income Tax Assessment Act 1997 (“Draft Determination”).

What is a ‘liable entity’

The liable entity definition contained in Division 832 is broad and was designed to be such. Under the law, an entity can be a liable entity in respect of its own income or profits even where no tax is required to be paid or where only part of its income is subject to tax. An example in an Australian context is an entity that is a company (and is not a subsidiary member of a consolidated group or MEC Group) which is a liable entity in respect of its own income or profits.

An entity can be liable in one or more countries. Furthermore, the law directs us to make certain assumptions when ascertaining whether an entity is a ‘liable entity’. It is this last point that is the subject of the ATO’s Draft Determination.

The ATO’s position in the Draft Determination is that the identification of a 'liable entity' or entities in a country in respect of (its own or another entity’s) income or profits for the purpose of Division 832 can be based wholly on hypothetical income or profits within the tax base of the country. As a general proposition, this is not controversial. For example, a non-trading corporate entity that has no income or expenses would still be a liable entity with respect to its own income of profits. This is because if you were to assume that it had hypothetical income or profits, then these income or profits would be subject to tax. The fact that no tax is paid because it does not derive income or profits does not mean that it fails the relevant eligibility requirements of a liable entity.

What assumptions are reasonable?

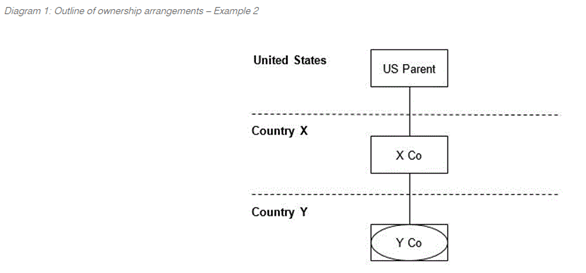

What is less clear is what assumptions you can or cannot make in determining the hypothetical income of profits within the tax base of a jurisdiction. In this regard, the ATO appears to have taken a broad reading. This can be best illustrated in Example 2 provided in the Draft Determination.

In the example, X Co is a controlled foreign corporation (CFC) for U.S. federal tax purposes. Country X does not impose a corporate income tax ergo, it is not subject to foreign tax in Country X – this does not, in of itself, cause hybridity. However, X Co is still a liable entity in Country X in respect of its own income and profits. Similarly, X Co it is not subject to foreign tax in the US either on its own income or profits or the income of profits of Company Y because neither company derive any income or profits within the tax base of the US.

It is the ATO’s view that for U.S. federal income tax purposes, sections 881 and 882 of the US Internal Revenue Code result in X Co being considered to be a liable entity in the U.S. as U.S. tax could be imposed on U.S. sourced income, were any to be derived (see paragraph 51 of the Draft Determination). It further states that under 832-325(4), we are required to assume that U.S. sourced income exists.

It would be missing the point of the Draft Determination to focus too heavily on the specifics of an example, as all outcomes are subject to the particular facts and circumstances. However, it is arguable as to whether either of these U.S. provisions would be relevant for determining whether an entity is a liable entity particularly on the hypothetical assumption that income or profits exist. Section 881 is essentially a “withholding type tax”, being a gross basis withholding applicable on U.S. sourced fixed, determinable, annual, or periodic income (FDAP). In this regard, withholding-type taxes are not relevant when determining whether an entity’s income is subject to foreign tax under section 832-130(7)(c).

Conversely, section 882 is a branch profits tax regime for foreign companies (of the U.S.) engaged in a U.S.-sourced trade or business. This extension requires an entity to assume that just because they could have a U.S. Branch they are a liable entity for U.S. federal tax purposes despite not actually having a branch. Whilst doing our best to avoid an apagogical argument, if we were to extend a potential consequence from the conclusion drawn in the example to other jurisdictions, it could mean that the merest possibility of a jurisdiction to tax the income or profits of an entity would result in that entity being a ‘liable entity’ in that jurisdiction.

Supporting material

The ATO’s basis for its view in this Draft Determination appears to be drawn, in large part, from paragraphs 1.206 – 1.207 of the revised 2018 EM which states:

1.206 Further, an entity may be a liable entity in respect of its own, or another entity’s, income of profits in a country even if any of the following situations exist:

- there are no actual income of profits;

- there are income of profits, but no part of that income or those profits is:

- for Australia — subject to Australian income tax; or

- for a foreign country — subject to foreign income tax in that foreign country; or

- the entity is not actually liable to pay an amount of Australian tax or foreign income tax. [Schedule 1, item 1, subsection 832-325(4)]

1.207 In this regard, in determining whether an entity is a liable entity in such a situation, it must be assumed that income or profits within the tax base of the country exist. [Schedule 1, item 1, subsection 832-325(4)].

1.209 Consequently, if, for example, a test entity is an entity of a type that is normally subject to tax but has a tax loss for a particular income year (and therefore has no tax liability in that particular income year), the test entity will be a liable entity.

Aside from the above, the EM does not provide much more detail on what assumptions are considered to be reasonable. The ATO view is that there is nothing in the guidance that would preclude this approach to the liable entity definition. The ATO state as much in paragraph 51 of the Draft Determination.

“Nothing in subsection 832-325(4) restricts the application of the assumption to only entities that normally derive income or profits within the tax base of the US. As stated at paragraph 28 of this Determination, subsection 832-325(1) and (2) serve the purpose of working out whether a particular entity is a taxable entity in a particular country (regardless of whether actual income or profits within the tax base of the relevant country have in fact been derived).”

Action (or non-action) for taxpayers

The extent to which analysis of the hybrid mismatch rules may be impacted by the positions espoused in this Draft Determination should be revisited once it is finalised – as there may well be changes to the analysis put forward.

That aside, this Draft Taxation Determination serves as a reminder that the Australian hybrid mismatch rules are complex and need to be read in view of the global group of entities and the payments it makes, having regard to a detailed understanding of foreign tax outcomes.

FOR MORE INFORMATION

If you would like to learn more about the topics discussed in this article, please contact your local RSM office.