IPO Support

RSM Seiwa has provided support to 29 companies as of February 2026.

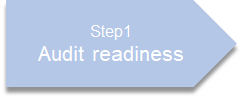

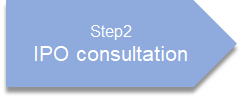

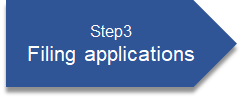

Overall there were three major steps a company goes through in order to become listed on a stock exchange.

RSM Seiwa offers support for each of these steps.

| |

|

|

|

|

List of Different Types of IP`O Support Services

(1) Short Reviews

When a company decides to go public (IPO), it is necessary to undergo a short review by an audit firm at an early stage to comprehensively identify matters that the company lacks or needs to improve in order to go public and to establish a strategic listing preparation schedule until the IPO.

In addition, the IPO screening will focus on the company's unique business model and business growth potential. Since the short review report by the audit firms are examined by the company management, the lead managing security companies, and the stock exchange in the process, our short review report will include the company's business model and business growth process in depth. As an accounting firm with abundant experience in IPO support and audit of listed companies, we provide services that foresees several steps ahead.

(2) IPO Support and Advisory

Preparation for an IPO requires more than two years of preparation work, including preparation of various rules and regulations, and development of internal controls and business management systems.

We have CPA who have experiences in IPOs of venture capital firms to provide any supports from preparing business plans, preparing IPO application documents, and setting up the internal control reporting system and capital policies etc. Even if the company is small and has a deficit at the moment, we will proactively support the IPO if the business is expected to expand in the future. We have multiple clients currently on IPO support services with us.

(3) Audits for IPO Preparation

Since IPO submission requires an audit report attached with the financial statements of the two fiscal years immediately preceding the application for IPO, it is important to have your company auditedt by CPA as early as possible.

Our audit team includes CPA who have been involved in IPO operations at venture capital firms, whom have abundant experience in auditing companies preparing for stock listing. Therefore, we will be able to provide services that will benefit you during IPO application and after your company has been listed.

Even if the company is small and has a deficit at the moment, as long as there is a prospect of business expansion in the future, it is a shortcut to a stock listing to undergo an audit to prepare for IPO application as early as possible to develop an internal control and financial reporting system.

We also provide audits to prepare for IPOs outside of Japan.