Professional Services Grounded in Local Insight and

Global Standards

RSM in Kuwait supports organisations with professional services informed by local market understanding and aligned to global standards.

Global Network

RSM in Kuwait is a member firm of RSM International, a global network spanning 120 countries, with 65,000 professionals across 900 offices worldwide.

Our People

RSM in Kuwait professional team comprises 198 personnel which includes 14 Partners, 5 Directors, 133 professionals and supported by 46 Administrative personnel.

Professional Heritage

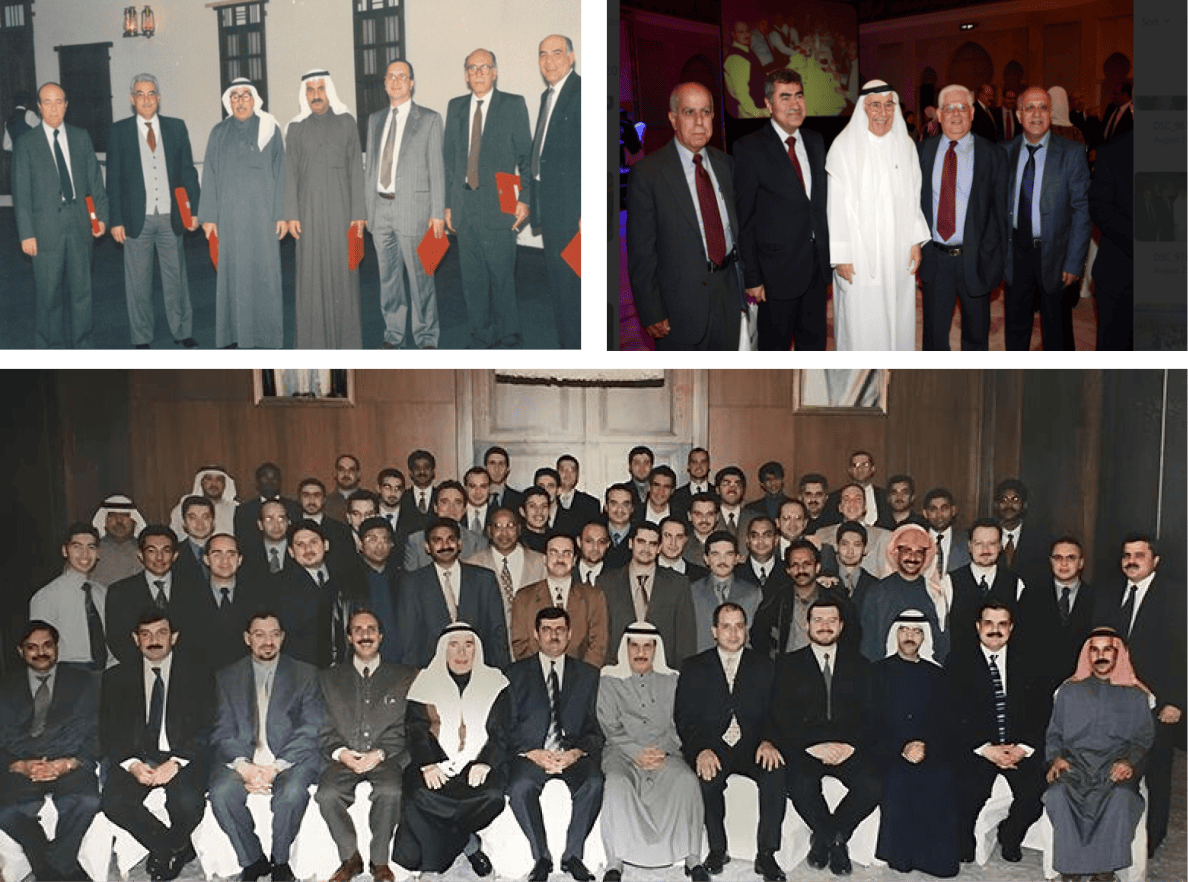

Operating in Kuwait since 1963, with over six decades of uninterrupted professional practice.

Trusted Advisors.

Six-Decade Legacy of Professional Services.

Founded in 1963 by Mr. Bader Al Bazie as Kuwait Auditing Office – Bader Al Bazie & Co., our Firm has served the business community in the State of Kuwait for more than six decades, with Mr. Bader Al Bazie allotted Auditor Registration Number (1A)—a legacy of trust and credibility.

The Firm provides Assurance, Tax and Consulting services grounded in deep local knowledge and aligned with global standards. As a member firm of the RSM network, present in more than 120 countries, with 65,000 professionals across 900 offices worldwide.

What Our Clients Say: Meaningful Connections, Professional Support

At RSM in Kuwait, we recognize that exceeding client expectations is essential for sustainable growth. Aligned with RSM Global’s Vision (2030), our strategy focuses on creating a human-centered, digitally enabled and insight, driven experience in all client interactions, reinforcing our commitment to “The Power of Being Understood.”

Strategic Voices to Podcasts

Explore our expert podcasts and stay updated on key topics

Where You Are Part of The Change

We offer opportunities to work across Assurance, Tax and Consulting in a collaborative, diverse environment. Our firm supports your development through structured learning, practical experience and a culture built on integrity and growth.

%20Annual%20Reports.png)