The purpose of this article is to warn property owners and property management agencies of a risk which, for wrongly informed taxpayers, may have serious consequences.

This newsletter is addressed to co-owners of commercial buildings who have chosen to opt for VAT registration and more particularly to the real estate agencies who manage “properties with divided ownership” structures, known in Switzerland as PPE.

Most co-owners of such buildings are usually corporations (SA, SàRL…) which call upon the services of real estate agencies for the management of their buildings.

Situation

As a reminder, a PPE is a co-ownership structure where several people each own a building plot. From a legal point of view, these different actors can form an informal partnership (“société simple”) when the property management is carried out jointly.

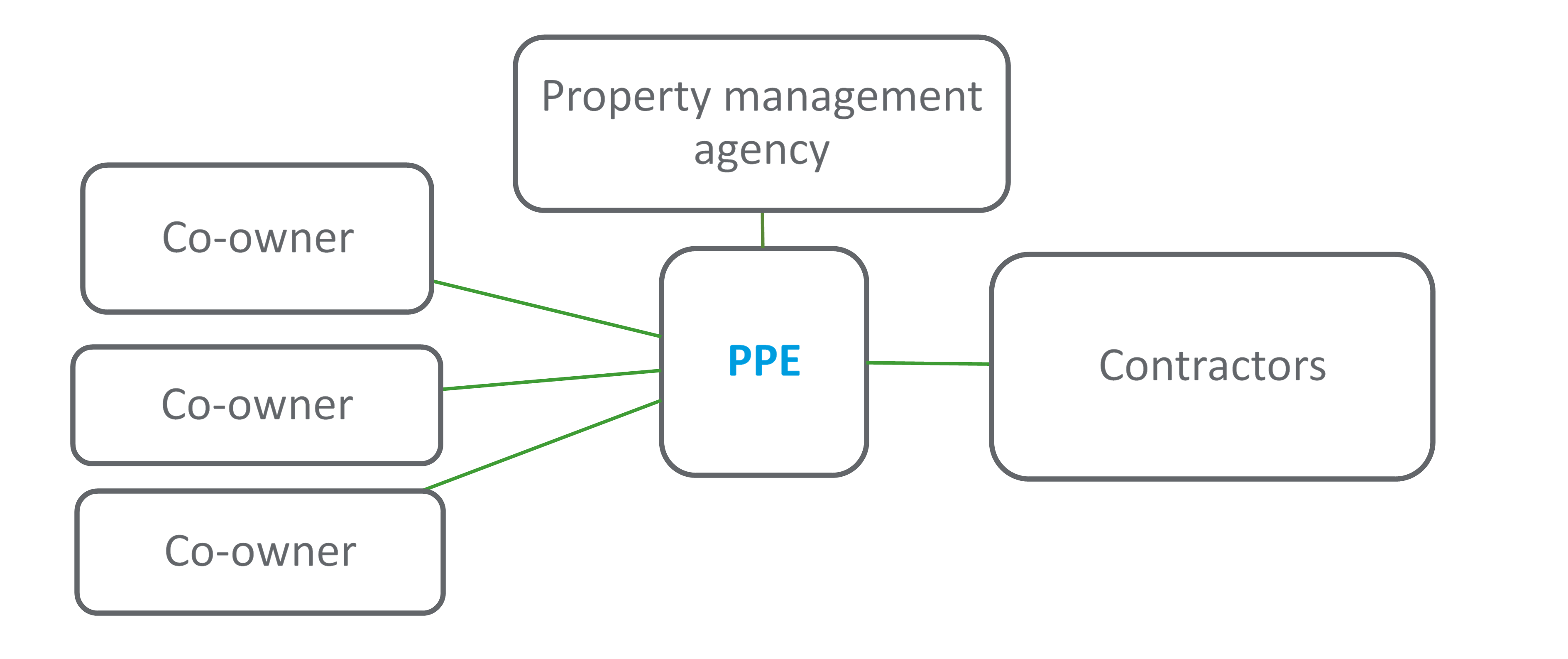

The administration of a PPE is usually structured as follows:

- Each of the co-owners of a PPE concludes, individually or jointly, a management contract with a real estate agency;

- The real estate agency manages the PPE;

- The PPE, an informal partnership represented by the agency, orders services from different providers (third parties) for the maintenance of the building on behalf of the PPE;

- These providers send invoices to the PPE which is therefore, with regard to the service providers, the invoice recipient;

- The real estate agency pays the invoices and then distributes the invoices among the co-owners who pay monthly instalments and the balance at the end of the annual period.

As mentioned above in the figure, the PPE appears as an intermediary between the service providers and the co-owners. The co-owners do not appear individually to the providers but as a single entity.

A PPE gives rise to a “community of owners per floor” (CPPE). This CPPE has its own patrimonial and operational capacity allowing it to carry out contractual operations with third parties. It can therefore conclude contracts with service providers for the maintenance of the buildings and be the recipient of invoices. This is the exact point of the present article. This patrimonial and operational capacity is based on contractual agreements between the co-owners, for example through a real estate agency.

VAT issue : Input tax

The general principle of VAT is that persons (individuals and corporations) who are registered to VAT can obtain a refund of the input tax incurred on their own expenses. However, the situation changes when invoices are sent to the CPPE, and that is the main issue.

The tax authorities consider the CPPE to be the sole recipient of invoices if it orders services from third parties in its own name and on its behalf. Consequently, even if the real estate agency managing the CPPE re-invoices the services to the co-owners individually, this second transaction does not change the identity of the beneficiary of the services from the point of view of the tax authorities. Thus, since the invoices are addressed to the CPPE, only the CPPE is the taxpayer and can claim the deduction of the input tax invoiced by the providers. In order to do so, the CPPE need to be registered to VAT itself!

It is important for PPE members to be aware that, even if they are individually registered to VAT, they will not be able to reclaim the input tax on providers invoices if they were not the direct recipients of the invoices. The PPE is the intermediary entity between the service providers and the co-owners. If the invoices are sent to the PPE, then only the PPE can reclaim the input tax. The PPE will therefore have register to VAT.

In conclusion, owners and property management agencies must pay special attention to the recipient of the invoices they receive. If they are addressed to the PPE, then only the PPE will be able to reclaim the input tax (if the PPE is registered to VAT). If the PPE is not registered to VAT, even when the co-owner are individually registered and/or the property management agency is, the input tax is a final expense that the co-owners will have to bear and for which they will not be able to obtain a refund, despite the fact that they are individually registered to VAT.

We therefore invite any co-owner or property management agency to contact our specialists to review their situation and to regularize it (if necessary).