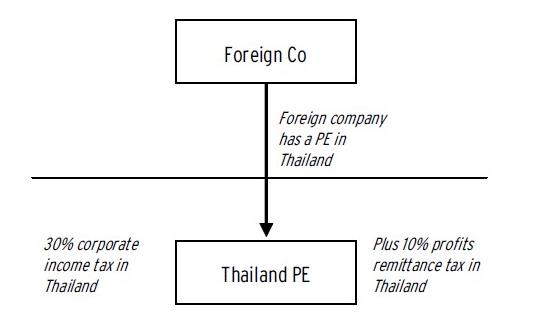

RSM Nelson Wheeler continues to see cases of foreign companies putting themselves within the PE tax net in Thailand, and this article summarizes the all-important determinative PE tests that are contained in the majority of Thailand’s Double Tax Treaties. Once a foreign company has or is deemed to have a Permanent Establishment (“PE”) in Thailand, it will be subject to 30% corporate income tax in Thailand, as well as 10% profit remittance tax (i.e. a total of 37% tax) on the income or gains that the foreign company has earned from Thailand.

The Assets Tests

The “assets” tests ask whether a foreign company has a PE by reason of it having assets in Thailand. These assets are:

- A place of management;

- A branch;

- An office;

- A factory;

- A workshop;

- A warehouse, in relation to a person performing storage facilities for others; and,

- A mine, oil or gas well, quarry or any other place of extraction of natural resources. The “assets” test determine a PE according to whether a foreign company has a fixed place of business at its disposal, and one “asset” that may cause a PE to exist (particularly for services companies) is an office. The following examples demonstrate the office asset test:

- An employee of a foreign company uses an office at a Thailand company’s premises to ensure that the Thailand company complies with obligations under its contracts or agreements with the foreign company. In this case, the foreign company’s employee is carrying on activities related to the business of the foreign company in Thailand and the office that is at his disposal at the Thailand company’s premises could constitute a PE of the foreign company.

- A foreign company’s salesman makes visits to a Thailand company to take sales orders and in so doing he meets with the purchasing officer at the Thailand company’s office. In this case, the office at the Thailand company is not at the disposal of the foreign company’s salesman from which the salesman works and therefore the office would not constitute a fixed place of business through which the business of the foreign company is carried on. (However, in this case, the “agency” tests could deem a PE (see below)).

The Activities Tests

The second series of tests concern the “activities” of a foreign company in Thailand, and the Double Tax Treaties prescribe that the following shall be deemed a PE:

- A building site, construction, assembly project or installation project, or supervisory activities in connection therewith, if such site, construction, project or activities last more than 6 months; and,

- The furnishing of services, including consulting services, through employees or other personnel engaged by a foreign company for such purpose if activities of that nature continue (for the same or a connected project) for a period or periods totaling more than 6 months within any 12 months period.

Building sites, construction, assembly or installation projects include not only the construction of buildings, but also includes roads, bridges, canals, renovation of buildings, roads, bridges and canals, and the laying of pipelines and excavating and dredging. Assembly and installation projects include not only assembly and installations of a construction project, but also include installations of plant and equipment and machines. Onsite planning and supervision of a building, construction, assembly or installation project are also included. Activities of furnishing of services include consulting services, professional advisory services and any other services of an independent nature.

The Agency Tests

The third series of tests are the “agency” tests, and the Double Tax Treaties prescribe that the activities of an agent in Thailand could deem a foreign company to have a PE in Thailand, as follows:

- Where an agent in Thailand habitually exercises in Thailand an authority to conclude contracts in the name of the foreign company; or

- Where an agent in Thailand habitually maintains in Thailand a stock of goods belonging to the foreign company from which he regularly delivers on behalf of the foreign company; or

- Where an agent in Thailand habitually secures orders in Thailand wholly or almost wholly for the foreign company or for other foreign companies, which are controlled by the first-mentioned foreign company or have a controlling interest in it. The “agency” tests deem a foreign company having a PE in Thailand if there is, under the above conditions, an agent in Thailand acting for the foreign company, even though the foreign company itself may not have a fixed place of business in Thailand. The agency tests include agents who not only have “authority to conclude contracts” but also agents who “secure orders” in Thailand, and thereby bind a foreign company’s participation in a business activity in Thailand. The deeming of a PE in Thailand is not only confined to an agent who enters into contracts literally in the name of the foreign company, but also to agents who possess authority to solicit and receive (but not finalize) orders, which are sent to a foreign company. Habitually exercising contracts and habitually securing orders reflect the principle that the activities are more than just occasional. When a foreign company carries on business dealings through a general commission agent or other agent of an independent status, the foreign company may not be subject to tax in Thailand, but only if the agent is acting independently and in the ordinary course of his business. Where an agent’s activities in Thailand are subject to instructions or control by a foreign company, such an agent cannot be regarded as independent. Likewise, an agent cannot be regarded as being independent if he devotes his activities wholly or almost wholly for a foreign company

Managing Taxation Risk

Managing taxation risk requires you to be aware of the Revenue laws and practices of the Revenue officers. Should your company be found not to comply with the requirements, it could be exposed to additional taxes and penalties.

Steven Herring CA

Senior Taxation Consultant

RSM Nelson Wheeler Tax Consulting