RSM Focus – Newsletter for February 2022

RSM Audit & Assurance Services Thailand

By Surachai Damnoenwong, Audit Director

Bill-and-hold arrangements occur when the Company bills a customer for a product that it transfers at a point in time, but retains physical possession of the product until it is transferred to the customer in the future. This might occur to accommodate a customer’s lack of available space for the product or delays in production schedules.

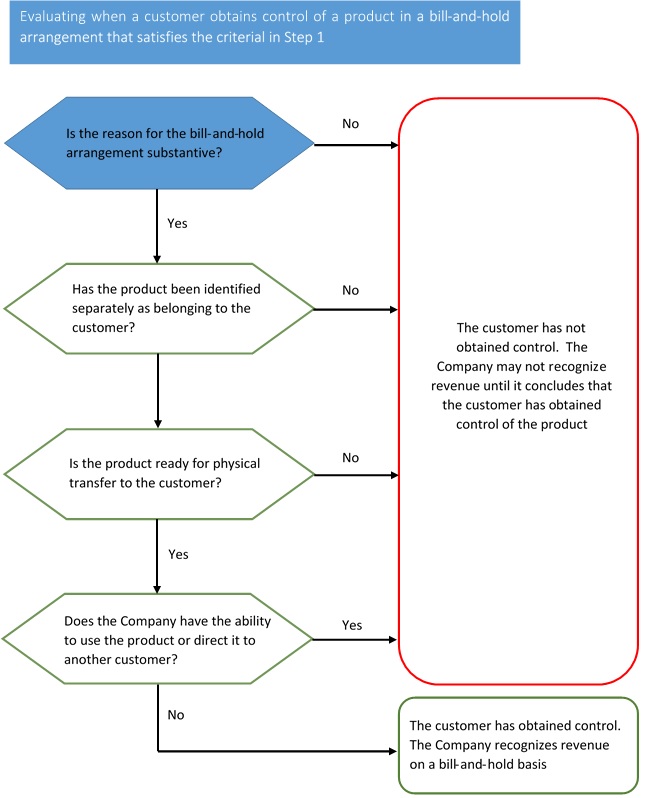

To determine when to recognize revenue, the Company needs to determine when the customer obtains control of the product. Generally, this may occur at shipment or delivery to the customer, depending on the contract terms. The standard provides criteria that have to be met for a customer to obtain control of a product in a bill-and-hold arrangement. These are illustrated below: -

A further explanation of these criteria can be summarized as follows: -

- The product must be identified separately as belonging to the customer. Even if the Company’s inventory is homogeneous, the customer’s product must be segregated from the Company’s ongoing fulfilment operations.

- The product currently must be ready for physical transfer to the customer. In any revenue transaction recognized at a point in time, revenue is recognized when the Company has satisfied its performance obligation to transfer control of the product to the customer. If the Company has remaining costs or effort to develop, manufacture or refine the product, the Company may not have satisfied its performance obligation. This criterion does not include the actual costs to deliver a product, which would be normal and customary in most revenue transactions, or if the Company identifies a separate performance obligation for custodial services, as discussed below.

- The Company cannot have the ability to use the product or to direct it to another customer. If the Company has the ability to freely substitute goods to fill other orders, control of the goods has not passed to the buyer. That is, the Company has retained the right to use the customer’s product in a manner that best suits the Company.

The reason for the bill-and-hold arrangement must be substantive (e.g., the customer has requested the arrangement).

A bill-and-hold transaction initiated by the selling Company typically indicates that a bill-and-hold arrangement is not substantive. In general, it should be the customer to request such an arrangement and the selling Company would need to evaluate the reasons for the request to determine whether the customer has a substantive business purpose. Judgement is required when assessing this criterion. For example, a customer with an established buying history that places an order in excess of its normal volume and requests that the Company retains the product needs to be evaluated carefully because the request may not appear to have a substantive business purpose.

If a Company concludes that it can recognize revenue for a bill-and-hold transaction, the standard states that the Company needs to further consider whether it is also providing custodial services for the customer that would be identified as a separate performance obligation in the contract.

A selling Company may utilize International Commerce Terms (Incoterms) to clarify when delivery occurs. Incoterms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law. For example, the Incoterm ‘EXW’ or ‘Ex Works’ means that the selling Company ‘delivers’ when it places the goods at the disposal of the customer, either at the seller’s premises or at another named location (e.g., factory, warehouse). The selling Company is not required to load the goods on any collecting vehicle, nor does it need to clear the goods for export.

Under an Ex Works arrangement, the Company’s responsibility is to make ordered goods available to the customer at the Company’s premises or another named location. The customer is responsible for arranging, and paying for, shipment of the goods to the desired location and bears all of the risks related to them once they are made available.

As a result, it makes sense to evaluate all Ex Works arrangements using the bill-and-hold criteria discussed above to determine whether revenue recognition is appropriate prior to shipment.

Worked example – Bill-and-hold arrangement

Company A enters into a contract to sell a trailer truck to Customer B, which is awaiting completion of a manufacturing facility and requests that Company A hold the trailer truck until the facility warehouse space is available.

Company A bills and collects the nonrefundable transaction price from Customer B and agrees to hold the trailer truck until Customer B requests delivery. The transaction price includes appropriate consideration for Company A to hold the trailer truck indefinitely. The trailer truck is complete and segregated from Company A’s inventory and is ready for shipment. Company A cannot use the trailer truck or sell it to another customer. Customer B has requested a written contractual document that the delivery be delayed, with a specified delivery date.

Company A concludes that Customer B’s request for the bill-and-hold basis is substantive. It also concludes that control of the trailer truck has been transferred to Customer B and that it will recognize revenue on a bill-and-hold basis.

The obligation to warehouse the goods on behalf of Customer B represents a separate performance obligation. Company A needs to estimate the stand-alone selling price of the warehousing performance obligation based on its estimate of how long the warehousing service will be provided. The amount of the transaction price allocated to the warehousing obligation is deferred and then recognized over time as the warehousing services are provided, if any.

This article was put together by Khun Surachai Damnoenwong who heads up RSM Audit Services (Thailand) Limited based on the information and rules contained in IFRS 15 - Revenue from contracts with customers in respect of Bill-and-hold arrangements and more details can be obtained from https://annualreporting.info/bill-and-hold-arrangements/. If readers wish to learn more details of RSM auditing service Thailand and the services that we provide here in the Kingdom of Thailand or alternatively would like to use our auditing services in Bangkok or afar, please contact us on [email protected].