By Surachai Damnoenwong, Audit Director

The RSM audit firm in Thailand has operated in the Kingdom since 2001 when it was set up due to the demand for such international services in the region. Khun Surachai was involved in the original set us and has led this area of the RSM Thailand business from its very outset.

The negative goodwill (NGW) amount, also known as the “bargain purchase” amount, is the difference between the purchase price paid for an asset and its actual fair market value.

Negative goodwill is an accounting principle that occurs when the price paid for an asset is lower than its fair value in the market and is considered as a “discount” to the buyer.

Tangible/Intangible Assets and Negative Goodwill

It is important to distinguish between tangible and intangible assets:

Tangible assets come in a physical form and hold monetary value. Primary examples include property, plant, and equipment.

Intangible assets lack physical form, do not hold monetary value, and can be unidentifiable at times. Examples of intangible assets include intellectual property (patents, copyrights), brand recognition, and useful life.

Goodwill accounts for the value of the intangible assets – such as brand recognition and intellectual property –, which can be highly valuable for well-established and/or innovative companies. Intangible assets are not included in the calculation of the market value but may be included in the purchase price.

However, the presence of negative goodwill itself implies that the purchase price is lower than the fair value – indicating that intangible assets have a discounted or no value or that the company is being sold under pressure without reaping the benefits of its intangible assets.

Therefore, negative goodwill implies that the selling company is under extremely unfavorable circumstances and may be either financially distressed, under high selling pressure, and/or facing high debt obligations, which as a direct result leads to a discount on the purchase price of a company.

Example

Company XYZ faced growing competition and incurred debt obligations that it could not cover. The board of directors had two choices – either file for bankruptcy or sell the company.

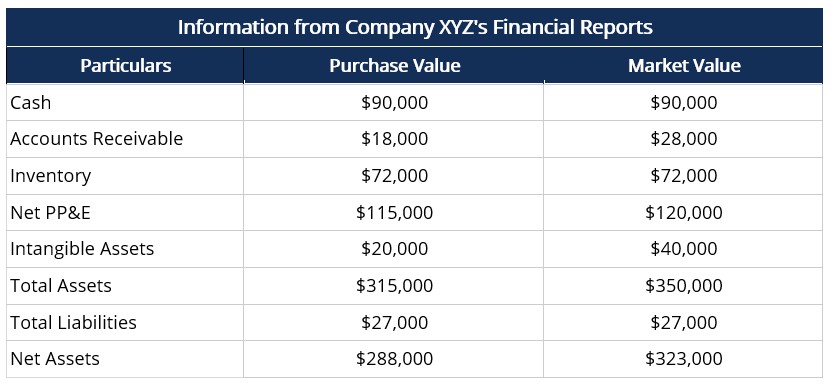

The company was recently sold for $288,000, which was lower than its fair market value. The table below reports consolidated information from Company XYZ’s financial statements:

The purchase value of accounts receivable is lower than the fair market value due to deteriorating relations with debtors and difficulty in collecting payments.

The purchase value of property, plant, and equipment (PP&E) is lower than the fair market value because the company failed to account for depreciation accurately.

The intangible assets of the company, including intellectual property and customer base, were weighed down due to the current financial situation – growing competition and high debt obligations.

Negative Goodwill vs. Goodwill

Negative goodwill occurs when the purchase price paid for an asset is lower than its value in the market. In contrast, goodwill occurs when the purchase price is higher than its market value – i.e., the goodwill amount is the premium paid by the buyer for the intangible value of the company’s assets.

While negative goodwill is an indicator of unfavorable circumstances, the presence of goodwill (i.e., “positive” goodwill) implies that the intangible value of assets is high, and the company is under relatively low pressure to sell – this situation favors the seller.

Negative goodwill usually arises due to one of the following:

Forced or financially distressed sale of the company

Companies that are financially distressed and under pressure to sell may be willing to sell the company at a discount in the form of negative goodwill since the value of intangible assets for a distressed firm is likely to be lower.

Incorrect valuation of assets

Valuation of assets, especially long-term fixed assets, may be incorrect – given that macroeconomic factors are constantly changing – and result in inaccurate market values. Similarly, an inaccurate valuation of intangible assets may also result in lower market values and negative goodwill.

Accounting for Negative Goodwill

According to US GAAP and IFRS, both goodwill and negative goodwill must be recognized and accounted for in the acquiring company’s financial statements.

NGW in the Income Statement

Negative goodwill must be recognized as a “gain on acquisition” in the acquirer’s income statement, under non-cash sources of income.

Should you require any advice on the contents of this article or alternatively wish to learn more about the RSM audit Thailand services, please do not hesitate to contact us for more information on [email protected]