Key takeaways

VAT in France will be required to receive invoices in electronic format, and gradually issue them according to a schedule set by the tax authorities. This nationwide reform, introduced under the 2024 Finance Law, marks a further milestone in the digitalisation of corporate accounting and tax processes.

But how can you prepare with confidence? What are the concrete obligations? What constitutes a compliant electronic invoice? And most importantly: how can an accounting firm support you effectively in this regulatory and technological transition?

In this article, our experts provide a comprehensive analysis of the key issues surrounding electronic invoicing. You will also find guidance on selecting the right platforms (PPF, PDP, OD), understand the impacts on your organisation, and discover our tailored support solutions designed to turn this reform into a lever for performance and automation for your business.

The keypoints to understand the reform

Why is electronic invoicing becoming mandatory?

The rollout of electronic invoicing in France follows the transposition of EU Directive 2014/55/EU. The reform primarily aims to combat VAT fraud by allowing the tax authorities to monitor transactions in real time. It also supports the goal of modernising commercial exchanges. For companies, the reform helps reduce processing times, minimise errors, and simplify administrative management.

Who is affected and when?

All businesses subject to VAT and established in France will gradually be required to issue and receive invoices in electronic format. This includes microenterprises, SMEs, mid-sized companies and large corporations alike.

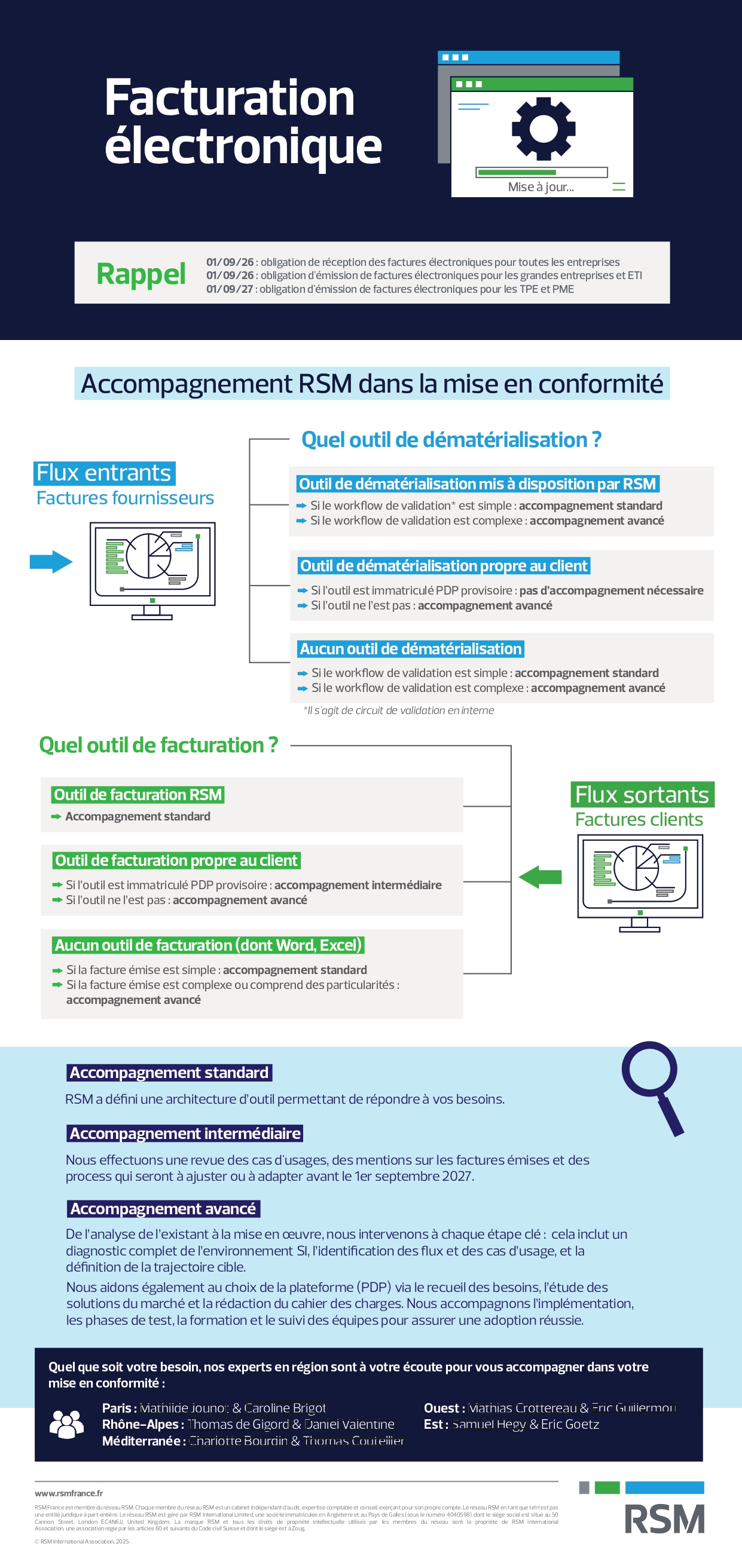

The rollout schedule sets out a phased deployment:

This gradual approach will allow each organisation to prepare and adapt to the new regulatory framework.

E-invoicing and e-reporting

Two systems will structure data exchanges under the reform: e-invoicing and e-reporting.

E-invoicing involves the electronic transmission of invoices between businesses subject to VAT in France (domestic B2B). These invoices will no longer pass directly between supplier and customer, but via a government-certified platform (Partner Dematerialisation Platform – PDP), ensuring their compliance and real-time transmission to the tax authorities. Throughout its lifecycle, the e-invoice must reflect updated status changes such as made available, received, or rejected.

E-reporting applies to transactions that do not fall under e-invoicing. It comprises two components :

- Transaction e-reporting, which applies to sales to individuals (B2C), exports, and intra-community deliveries (excluding goods imports).

- Payment data e-reporting, applicable only to service transactions and companies that have not opted for VAT on accrual. It requires reporting of received payments, enabling tracking of VAT due and, eventually, the pre-filling of VAT returns.

Transmission frequency depends on the type of data and the company's VAT regime.

Invoices under e-invoicing are transmitted in real or near-real time upon issuance or receipt through the selected platform.

- For transaction e-reporting, submission to the PDP is aligned with reporting obligations: monthly for companies under the standard VAT regime, quarterly for others.

- Payment data e-reporting must be submitted monthly to the tax authority via the PDP.

How to Prepare for Electronic Invoicing

Anticipate the Impact on Your Accounting and IT Processes

Implementing electronic invoicing involves more than just selecting a Partner Dematerialisation Platform (PDP). It is a cross-functional project that touches on tax, IT/data, internal processes, and overall company structure.

Approaches vary depending on company size and structure.

For large companies and mid-sized firms (ETIs), a structured approach is required: mapping incoming and outgoing flows, analysing tax impacts, involving IT teams to ensure system interoperability, and revisiting internal processes. Finance, IT, and tax departments must all be involved to ensure compliance and long-term viability.

For SMEs and microenterprises, the priority is to anticipate upcoming changes without being caught off guard. This means assessing current tools, evaluating organisational impacts (who does what, how, and within what timeframe). In this process, the accountant plays a central role: as a close and trusted partner, they are best positioned to guide companies in their technical choices, explain tax implications, and adapt management processes. By addressing the four key pillars – tax, IT/data, processes, and organisation – businesses can turn this requirement into an optimisation opportunity.

Choosing the Right Platform (PDP, OD)

All companies will be required to send and receive invoices via a Partner Dematerialisation Platform (PDP). Invoices can no longer be exchanged by email or in simple PDF format. Dematerialisation Operators (ODs) may provide technical support, but alone do not fulfil the regulatory obligations.

For large companies and ETIs, using a PDP is essential. Their complex IT systems, high invoice volumes, and varied business partners require a solution with automation, reporting, and advanced ERP integration capabilities.

SMEs and microenterprises can rely on a PDP provided by their accountant, who often manages the technical and regulatory aspects of the reform.

Ensuring Compliance of Electronic Invoices

E-invoicing involves sending structured XML files in one of the three formats accepted under the reform: Factur-X, UBL, and CII. UBL and CII are pure XML formats. Factur-X is a Franco-German format that combines XML with a readable PDF, easing the transition from PDF to full e-invoicing.

These formats pose significant challenges for commercial and invoicing solutions. They require:

- Adapting invoice data, particularly by including new mandatory fields: customer SIREN, nature of the operation, and delivery address. The structured format must also identify different third parties involved in the invoicing (billed party, payer, ordering party), which can impact how third-party records are modelled in systems.

- Ensuring tools are able to comply with the new format and transmit structured files rather than PDFs.

Why seek expert support?

This reform involves tax, IT, and process-related challenges. While e-invoicing requires regulatory compliance, it is also an opportunity to optimise and automate workflows and ensure secure implementation.

1. Above all, expert support guarantees compliance with a highly technical and evolving regulatory framework, with specific rules depending on transaction types, VAT regimes, or industry sectors.

In this context, RSM plays a key role: actively involved in the subject for several years, RSM contributes to standardisation and policy development through national bodies such as Afnor and CNCC. This engagement enables them to anticipate changes, interpret texts, and provide practical solutions to real-world situations.

With RSM, you can count on experts who guide you at every step, interpret regulatory requirements, identify your specific use cases, and ensure implementation is in line with the calendar.

2. The generalisation of electronic invoicing offers a major opportunity to automate and secure invoice management for both suppliers and customers.

On the supplier side, integrating incoming invoice flows from the PDP into the accounting system eliminates manual entry—often a source of errors and delays. It also improves audit trails and optimises the entire Procure-to-Pay (P2P) process, including validation workflows.

On the customer side, the reform requires secure e-invoice delivery and precise invoice lifecycle management. This includes handling technical rejections and customer refusals. In parallel, accurate invoice data becomes essential to improve cash flow forecasting and enhance financial visibility.

3. This reform should not be seen merely as a constraint but as a true opportunity for digital transformation.

It encourages businesses to modernise their administrative and financial practices through automation, error reduction, and faster processing. Beyond dematerialisation, it paves the way for broader digital exchanges with business partners. By structuring invoice data, companies can strengthen supplier and customer relationships, streamline exchanges, and improve transparency. This reform can become a strategic lever to rethink the entire administrative and financial value chain.

Implementing electronic invoicing is far more than a technological shift: it is a profound transformation of companies’ administrative, accounting, and tax processes. Between regulatory compliance, invoice flow optimisation, and digitalisation opportunities, the stakes are both numerous and strategic.

In this context, partnering with a trusted advisor like RSM ensures a smooth transition. With its combined expertise in accounting, tax, and digital services, RSM supports businesses at every stage of implementation, tailoring its approach to each company’s unique needs and goals.

Choosing RSM means choosing a successful, structured, and value-generating transformation.

Thanks to its expertise in accounting, tax, and digital matters, RSM supports businesses at every stage of the deployment process, taking into account their specific needs and objectives.

Discover our services Facturation électronique et e-reporting