Italy runs a self-assessment system based on the residence concept. Indeed, Italian tax resident individuals are liable to income taxes on their worldwide income according to the cash principle.

Under certain conditions however, earned income derived from overseas employment duties are taxable up to the extent of a “notional compensation”, which could be lower than the income effectively earned.

Article 51, paragraph 8-bis of ITC states that the taxable basis of employment income earned by an Italian tax resident working abroad on a continuous and exclusive basis for more than 183 days in a 12-month period is restricted to a notional compensation.

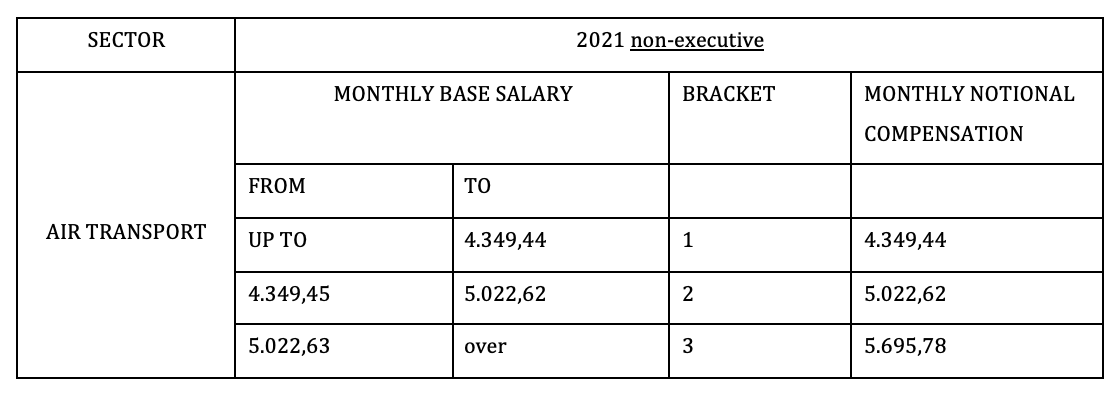

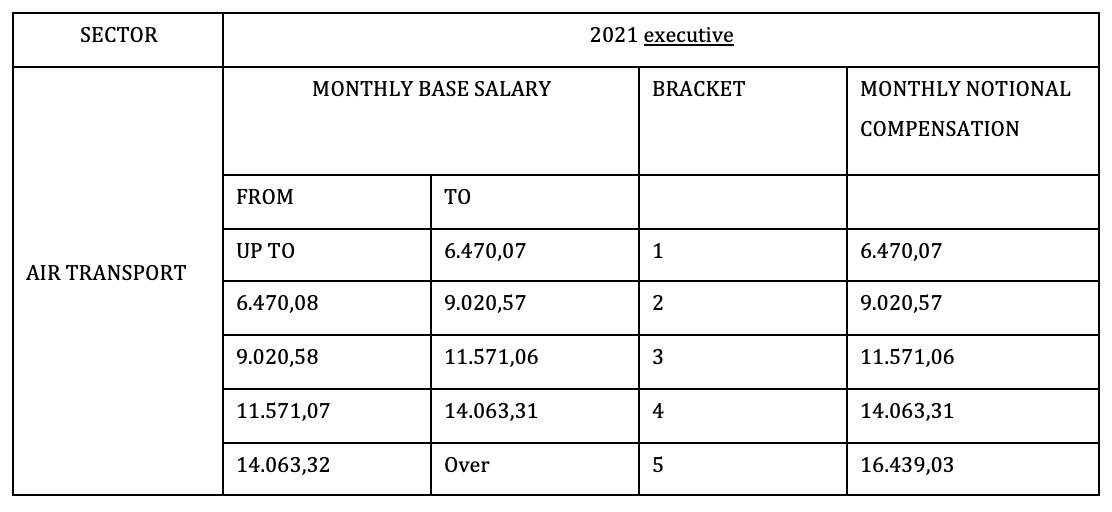

Said compensation, which is determined considering the employee’s working level, the sector of activity and the base salary, is capped without regard to the actual income received by the employee and it’s an “all-inclusive” remuneration; this means that absorbs all the remuneration items, including fringe benefits, related to the employment relationship.

The cap is set annually by a Decree of the Italian Ministers of Labor, Treasures and Finance for different industries (please refer to the tables below for the notional compensation applicable in the aviation sector for the tax period 2021).

Based on the above, for benefitting of the relieved taxation two concurrent requirements have to be met:

- The employment activity must be performed exclusively outside of Italy.

- The employment activity shall be performed in a continuous way outside of Italy for at least 183 days in a 12 months period.

Regarding the first requirement, the employment contract should state that the activity shall be performed exclusively outside of Italy.

The “nationality” of the employer is not relevant for the purpose.

Regarding the second requirement, as the goal is to avoid that the more favorable tax treatment is applied to an activity performed abroad on an occasionally basis (i.e. business trips), the performed activity shall be carried out of Italy on permanent basis., i.e. of at least 183 days; to this end the Italian tax authorities have clarified that:

- the 183 days in the 12 months period could be not consecutive,

- holidays, weekends, sickness period are counted as spent abroad for the purpose to reach the minimum period required, independently from the place they are actually spent and

- the 12-month period could be different from the tax period.

It is worth noting that the Italian tax authorities are empowered to check whether the taxpayers meet the mentioned conditions which may concern, on the basis of our experience:

(1) the circumstance that the contract is not ruled by the Italian law and therefore it cannot be determined which notional compensation must be applied and

(2) whether the employee has truly spent abroad the minimum period required.

Regarding point 1, although the contract will be ruled by a not Italian Labor Law, it may be argued that the provisions contained in the Italian National Collective Labor Contract ruling the minimum compensation, duly apply.

Regarding point 2, the accurate maintenance of the employee travel diary along with the related supporting evidences should be enough to prove the contrary.

Finally, it must be pointed out that, should the income deriving from the overseas duties also taxed in the foreign country where the activity is “performed”, the double taxation will be eliminated through the tax credit mechanism, either pursuant to the relevant tax treaty with Italy or to the Italian domestic legislation.

Italy recognizes a tax credit for direct taxes definitely paid in the foreign country by employee on the income subject to double taxation (i.e. the notional compensation if lower than the income subject to taxation in the foreign country) up to the Italian tax liability.

Here below the two tables of “fixed national income” both for a non-executive and an executive one