Real Estate: Buying a house with a right to build

A real boom for Swiss households?

At the end of 2021, a famous Swiss e-commerce platform decided to offer real estate for purchase at unbeatable prices.

How do they do it? By selling properties with a surface right.

In a real estate market where access to property is increasingly difficult, this initiative has proven to be a real success as the first properties offered for sale found buyers within minutes of being put online.

This new commercial operation has highlighted a form of acquisition relatively unknown to individuals, but which could nevertheless prove advantageous in the face of the increased prices of buildable land in Switzerland today.

What are the advantages and disadvantages of surface right?

Let’s look back at the economic and fiscal stakes of this innovative approach.

Is real estate ownership an unattainable luxury in Switzerland?

Real estate experts are clear. In Switzerland, access to property has never been so difficult, especially for young households, and this trend is not going to improve.

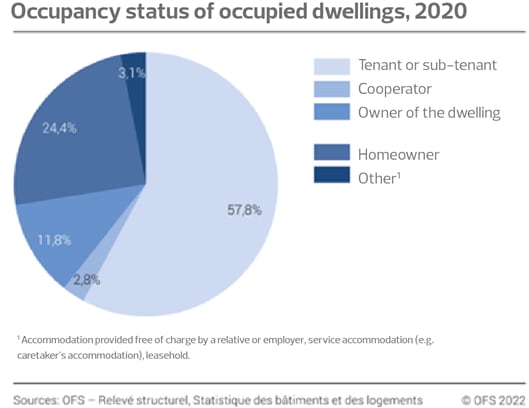

Various studies and the latest official statistics confirm this. Indeed, the acquisition of a property has become more of an exception and Switzerland remains above all a country of tenants, even though ownership remains in principle more advantageous than renting.

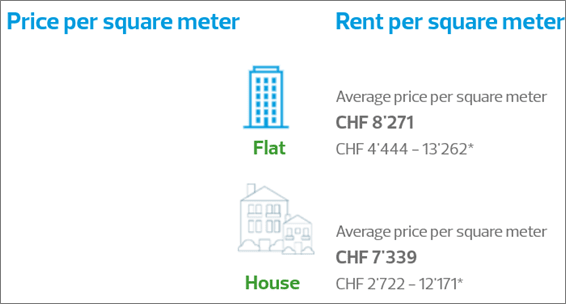

The main barrier to home ownership is the evolution of real estate prices. Over the past ten years, property prices have risen five times faster than household income. Financial feasibility is therefore a major obstacle for people seeking home ownership. Lack of capital and insufficient income make it difficult for people with average incomes to acquire a home in Switzerland.

https://realadvisor.ch/fr/prix-m2-immobilier

https://realadvisor.ch/fr/prix-m2-immobilier

With the tightening of the criteria for granting mortgage loans, the banks have also contributed to making home ownership more difficult, in particular with the generalized requirement of a down payment of 20% of the purchase price (of which 10% does not come from the occupational pension scheme). This requirement is proving to be a real barrier to entry for many households.

Moreover, with the current financial guidelines, most banks require, in addition to this personal contribution, that the financial expenses of the future property do not exceed 33% of the gross income of the household. This practice, known as the "one-third rule", further increases the difficulties of access to property in Switzerland.

This credit crunch is unlikely to improve in the coming years as the Swiss National Bank recently decided to raise domestic interest rates, following the European Central Bank's decision to raise key interest rates in the eurozone after a decade of negative interest rates.

This decision will undoubtedly contribute to a tightening of credit conditions for Swiss households and this change should therefore significantly reduce demand. This decrease in demand could also be accompanied by an increase in supply, as some homeowners seek to sell their properties due to the high mortgage rates.

Finally, it should be noted that considering career starters’ lower incomes and the time needed to accumulate assets, the age group between 25 and 30 seems to be the most penalized. FSO statistics show that the proportion of homeowners is only 8.1% at age 30, but increases to 30% at age 40.

The "miracle" solution proposed by some sellers is real estate leasing. Is it an alternative to classic ownership? To better understand how it works, it is necessary to go back to a key concept of the operation: the surface right.

Real estate leasing, an alternative to traditional ownership?

'' This method of temporary land disposal is increasingly popular with public authorities, but not only. ''

The surface right allows, for a determined period of time, to separate the ownership of a piece of land from that of the constructions built on it.

The beneficiary has the possibility to build on a piece of land that does not belong to him, a property of which he becomes the owner. In some cases, it is also possible to acquire directly the ownership of a construction already existing on the land.

He does not own the land on which the construction is built, but has exclusive use of it and acquires the yield of the entire building that has been built.

It should also be mentioned that the surface right is generally granted in return for the payment of an annuity comparable to rent for the use of the land. Economically, it constitutes the remuneration for the long-term use of the land and is intended to compensate for the decrease in the market value of the land. With this rent, the owner of the construction partly returns the market value of the land to the owner of the land.

In the case of the online real estate sales offered on the famous e-commerce site, the building lots remain the property of private investors. The houses and apartments built on these plots of land and put up for sale have been transferred to individuals with a 99-year surface right.

At the end of this period, if the investor - the owner of the land - does not wish to extend the term of the contract, he has the option to pay fair compensation, set according to market prices, and buy back the housing units. The acquired buildings then become part of the land and the property of the investor.

The law also provides for the possibility of an early return, if the owner of the construction exceeds his real right or seriously violates the contractual obligations. Thus, the 99-year term is never definitively guaranteed. The owner of the building and the land can also decide by agreement to terminate the surface right before its expiry.

In this case, the already built properties were transferred to the buyers in exchange for an annual rent ranging from approximately 2.75% to 3% of the purchase price and paid to the investor.

What are the (dis)advantages for the owners?

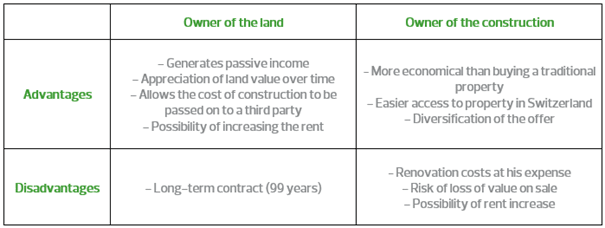

Buying a property with surface rights can sometimes prove to be more economical than buying a conventional property as according to estimates, the properties recently put up for sale online by the merchant site were sold at a price approximately 40% lower than the price of an equivalent apartment in conventional ownership.

Nevertheless, not owning the land is a significant disadvantage. Indeed, the owner of the building does not benefit from the increase in value of the land on which his property is located and may even suffer a loss if he ever wishes to sell his property, as buildings do not tend to appreciate in value over time and regular renovation costs correlatively reduce the potential capital gain in case of sale.

On the other hand, the rent is generally subject to an indexation clause allowing it to be re-evaluated according to various criteria, such as the Swiss consumer price index or the rental price index. As a result, the annual land rent representing a percentage of the purchase price is likely to vary over time. In practice, this indexation exists in more than 90% of the cases and takes place at variable frequencies defined in the contract.

In the end, it is likely that over the full term of the 99-year contract, the price that the purchaser of the property will ultimately pay for this rent will exceed the value of the land, even though the land is not ultimately owned.

From the point of view of the landowner, this right allows him to delegate the construction and management of real estate to third parties while retaining a certain amount of control over the use made of the land, and also to generate passive income thanks to the rents received for the use of the land. By allowing the financial cost of construction to be borne by third parties, the surface right allows the construction of housing to be financed in a balanced manner.

What are the tax implications for the purchasers of the building right?

As landowners in Switzerland, purchasers of houses with a surface right are considered as classical landowners from a tax point of view, even if they do not own the land.

As a result, the tax treatment remains the same as for freehold property. The tax obligations remain similar, and they have to indicate both the tax value and the rental value of their property in their annual tax return. They are thus subject to wealth tax and income tax in Switzerland. Therefore, the tenant-owner pays the property tax and the wealth tax for the rented land, while the landowner pays only the income tax for the surface right.

It is important to note that the deduction of annuities paid to the owner of the land is not allowed at the federal level and in most cantons. This approach is based on the principle of equal treatment of tenants who cannot deduct their rent from their taxable income.

However, such a deduction is allowed in some cantons, such as the Canton of Vaud, when the building is occupied by the taxpayer. In this case, the pensions paid may be deducted up to a maximum of 20% of the rental value of the building.

Regarding authorized deductions, taxpayers can deduct maintenance costs and interests related to mortgage debt. It is possible to choose between a lump-sum deduction or a deduction of the actual maintenance costs. It should be noted that maintenance costs are expenses incurred to keep a building in the same condition as it was at the time of its acquisition in order to guarantee its continued use.

Conclusion and perspectives

In a way, the surface right must be considered as a combination of the status of property owner and the status of tenant.

Given the current situation of the Swiss real estate market, it can be predicted that surface rights will continue to develop in order to compensate for the lack of housing supply in the major Swiss cities.

While we believe that surface rights are undeniably a step forward for Swiss households wishing to become homeowners, the question remains as to whether, in the long term, it really represents an economic advantage for Swiss owners.

Indeed, they will have to consider the impact of such an acquisition with great care. If it seems attractive at first glance, the multiple aspects involved - in particular the tax burden and the risk of loss of value - may hold some very unpleasant surprises for tight budgets that would put a large part of capital into the property acquired in this form. The current increases in interest rates and costs of living are also to be carefully considered.

In general, it can be concluded that for the owner who acquires such property at the beginning of the 99-year lease, the risk is quite limited. On the other hand, for the owner who aims at a long-term investment or who makes an acquisition close to the end of the lease, the risk is quite different.

Our experts are at your disposal for any questions on the subject.