We welcome you to the first edition of our Hospitality Thought Leadership series

Hospitality Industry in the UAE

The Covid-19 pandemic had negatively affected the travel and tourism industry including hotels, destination attractions and other hospitality services due to weak consumer sentiment. The UAE government has taken several targeted measures and introduced reforms to revive the industry. These include UAE Golden Visa, five year and long term muti-entry tourist visa, besides providing fiscal relief to affected businesses.

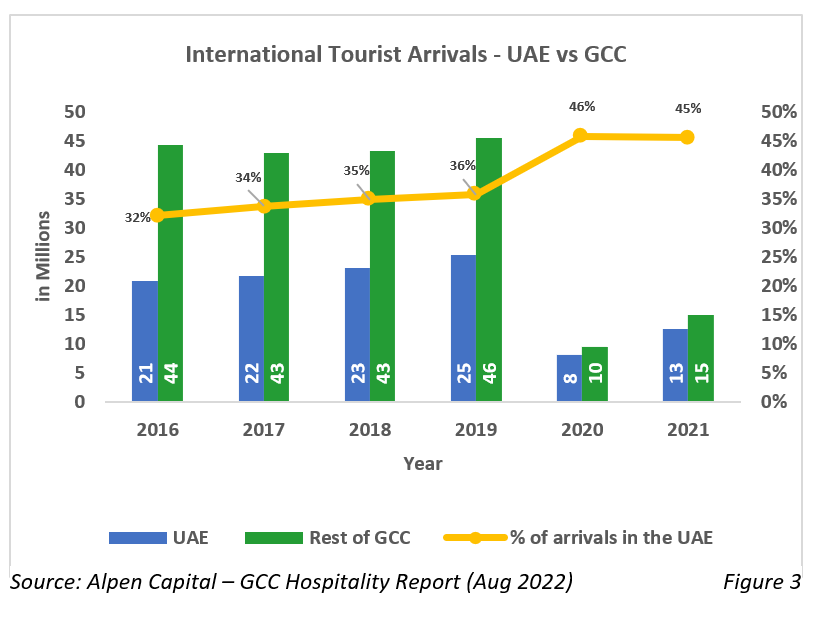

UAE has the highest contribution to the sector in terms of tourist arrivals among the GCC countries. Pre-pandemic (2016-2019), the international tourist arrivals into the UAE increased at a CAGR of circa 6.6%. Even during the peak of the pandemic (2020 - 2021), the number of international tourists into the UAE increase by circa 55.6% primarily supported by the government’s continuous efforts to ensure COVID-19 safety measures coupled with the overwhelming response of the EXPO 2020 Dubai.

UAE was also named the most popular tourist destination for 2021 by various statistics bodies that track tourism activities.

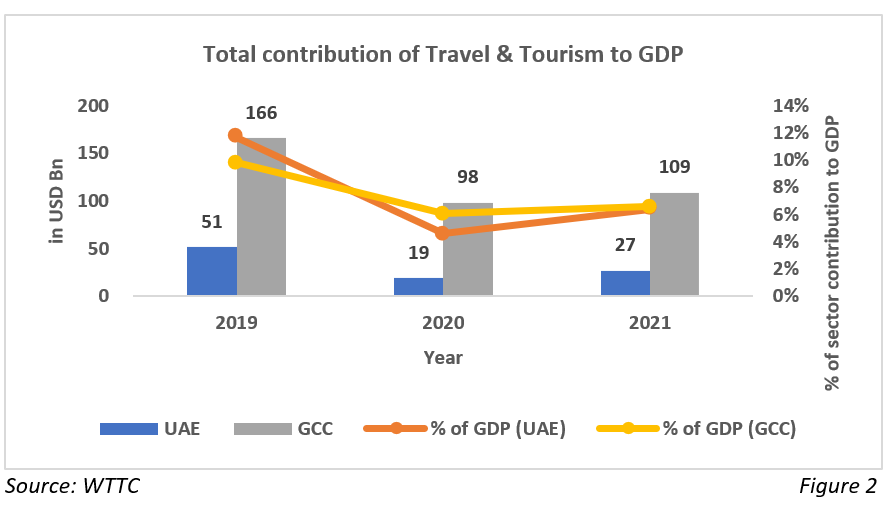

The travel and tourism sector of UAE contributed to circa 6.6% of the GDP in 2021 as compared to circa 6.4% for the GCC.

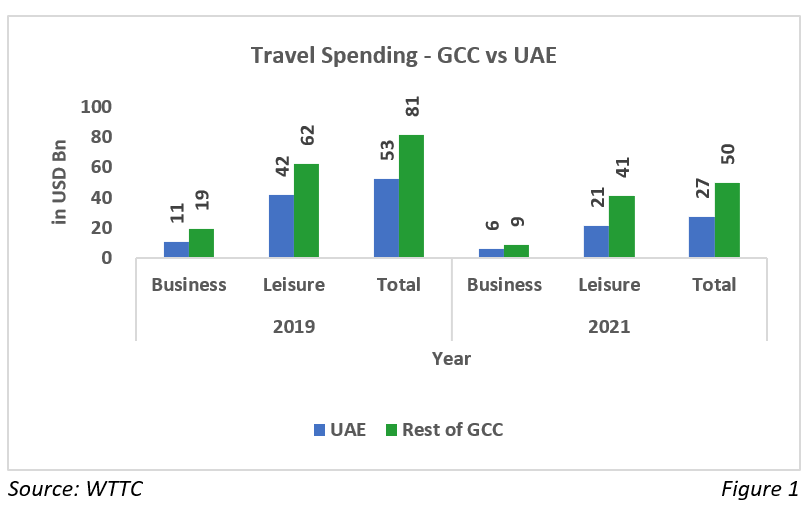

UAE and Saudi Arabia continue to remain the most sought-after destinations for travel and tourism with the two countries cumulatively accounting for more than 64.4% of the total travel and tourist spending within the region in 2021. UAE ranks top in the GCC with total travel and tourism spending revenues.

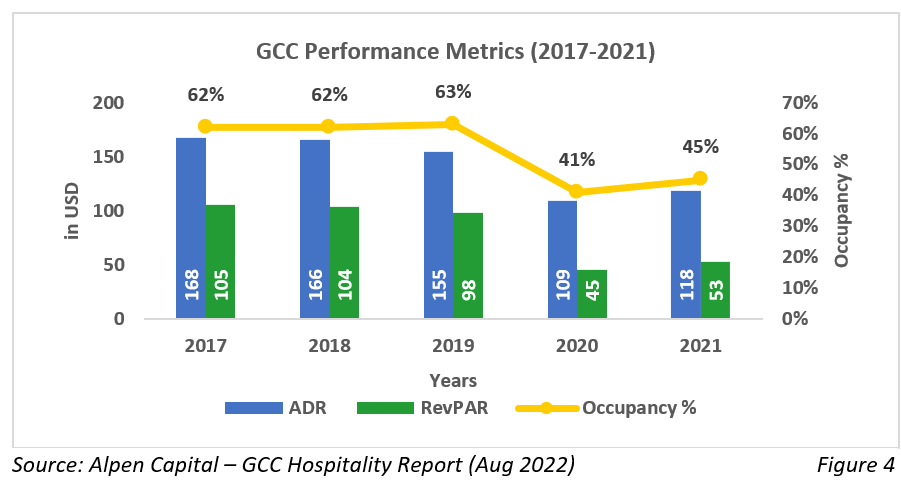

With increasing tourist activity in the UAE, developers have introduced inventory and brands have managed to keep occupancy percentages healthy. However, the same has been achieved at the expense of pricing.

Research indicated the travel and tourism sector of UAE contributed to circa 6.6% of the GDP in 2021 as compared to circa 6.4% for the GCC.

Research indicated the travel and tourism sector of UAE contributed to circa 6.6% of the GDP in 2021 as compared to circa 6.4% for the GCC.

UAE and Saudi Arabia continue to remain the most sought-after destinations for travel and tourism with the two countries cumulatively accounting for more than 64.4% of the total travel and tourist spending within the region in 2021. UAE ranks top in the GCC with total travel and tourism spending revenues, which can be attributed to a diverse range of destination offerings that the country provides.

With increasing tourist activity in the UAE, developers have introduced inventory and brands have managed to keep occupancy percentages healthy. However, the same has been achieved at the expense of pricing.

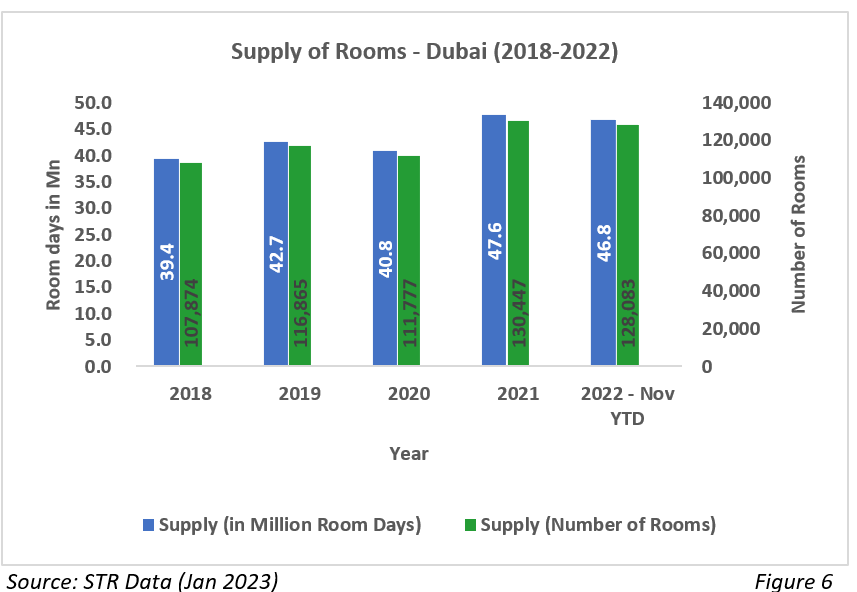

The total room supply in the UAE has increase from 138k rooms in 2017 to 175k rooms in 2021 with a CAGR of circa 6.1%.

Key Trends and Challenges for the industry in the UAE

Shifting focus to non-luxury segment

As the hospitality industry matures, it has diversified the asset base with the introduction of mid-scale brands, budget hotels and Serviced Apartments. As a mature leisure destination, Dubai has the largest concentration of serviced apartments in the UAE, which currently accounts for circa 73.2% of the total serviced apartment supply in the country. The resorts and serviced apartments have fared better than conventional hotels during the pandemic, owing to its purpose-built design. Affordable options such as mid-tier brands and aggregators like Airbnb have been growing as pricing pressure has increased on the guest’s end.

Fast Forward Technology Advancement

The pandemic has further accelerated the adoption of technology to enable services such as online bookings and contactless payments.

The primary challenges for the industry include ability of hotel operators to adopt to the technological advancements and guest needs, ever-increasing competition, greater demand for operational efficiency driven by economic challenges, rising interest rates and inflation costs.

Artificial Intelligence (AI) and Robotics are becoming an integral part of future of hospitality industry. The Hospitality sector globally including MENA are seeing major technology transformation in the recent years. Additionally, the entire sector has been on a accelerated pace towards digital adoption e.g., wireless front desk check ins, contactless payments etc. Plugs and sockets may probably disappear completely. The trend will continue towards hidden or invisible technology. The future is where AI and personal service will compete but also complement each other.

Dubai Hotel Performance- Performance metrics - Dubai [1]

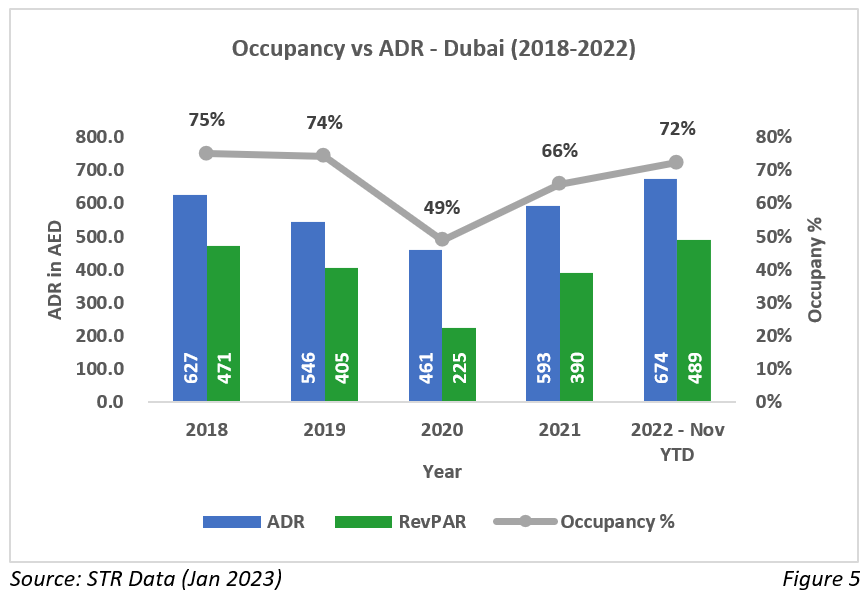

In line with the GCC metrics, Dubai has also been able to maintain the occupancy levels pre pandemic at the cost of the ADRs and RevPAR. Post pandemic, the occupancy levels have risen primarily due to events such as the Expo 2020, the FIFA World Cup in Qatar, and the rise in business confidence. The ADRs and RevPAR have reached peak levels owing to the demand for rooms which has been increasing at a CAGR of circa 5.9% over the past 4 years. However, the supply of rooms in the emirate has been increasing at a CAGR of circa 4.4% resulting in maintenance of higher prices.

[1] The data sourced from STR pertains to a total of 838 hotels across Dubai bifurcated into Economy, Luxury, Mid-Scale, Upper Mid-Scale, Upscale and Upper Upscale classes. The bulk of the establishments fall into the Upscale class.

RSM UAE Contacts:

Baasab Deyb

Partner, RSM UAE

Rajesh Tacker

Partner, RSM UAE

Rohit Basu

Director, RSM UAE

Authored by:

Sumey Gumaste, Senior Consultant, RSM UAE