The Ministry of Finance (MoF) of the United Arab Emirates (UAE) announced the introduction of a Federal Corporate Tax (CT) effective from the financial years starting on or after 1 June 2023. The UAE intends to align with the international standards for tax transparency, cement its position as a leading global hub for business and investment, and accelerate development while preventing harmful tax practices.

While the Corporate Tax law is yet to be issued, the UAE MoF and Federal Tax Authority (FTA), have released The Frequently Asked Questions document (FAQ) while announcing the introduction of the Corporate Tax and plans to provide further information on the UAE CT regime towards the mid of 2022.

WHAT WE KNOW:

Effective Date

The CT is set to become effective for the financial years starting on or after 1 June 2023 in the UAE. Below are a few examples determining the effective date for different financial years.

|

Sr. No |

Financial Year |

CT Effective for the First time for the Year starting: |

|

1 |

1 January to 31 December |

1 January 2024 |

|

2 |

1 April to 31 March |

1 April 2024 |

|

3 |

1 July to 30 June |

1 July 2023 |

|

4 |

1 October to 30 September |

1 October 2023 |

Applicability & Scope

The CT shall apply to all business and commercial activities carried out by legal persons and individuals (who have or are required to obtain a commercial license or permit).

UAE CT will not apply to an individual’s salary and other employment income.

The entities engaged in extracting natural resources shall remain subject to Emirate level corporate taxation.

The entities operating in free zones will continue to benefit from the current tax incentives if they comply with all regulatory requirements and do not conduct business with mainland UAE. However, they will be required to register and file a CT return.

Tax Base

As per the FAQs released by the MoF, CT will be payable on the profits of UAE businesses as reported in their financial statements that are prepared in accordance with international accounting standards, with some exceptions and adjustments. However, information regarding the adjustments is yet to be announced.

Entities may be able to carry forward excess losses on meeting certain conditions and they shall be also able to utilize losses incurred as from the CT effective date to offset taxable income in subsequent financial periods.

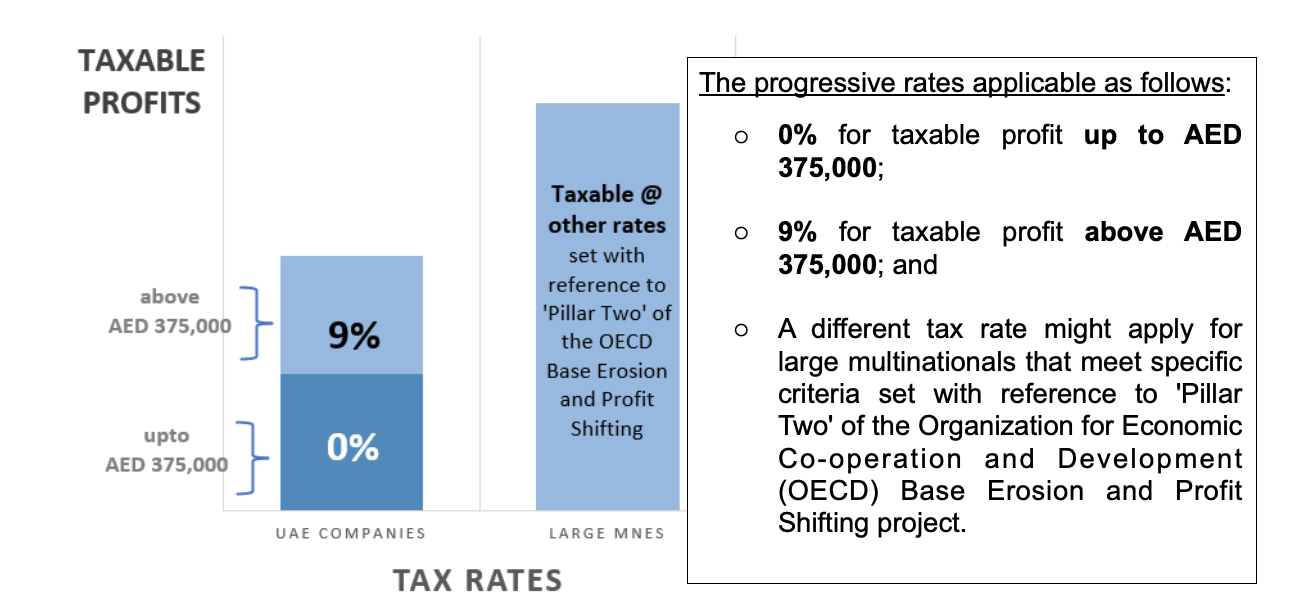

Tax Rates

As per the FTA FAQ document, “large” refers to a multinational corporation that has consolidated global revenues in excess of EUR 750m (c. AED 3.15 bn) in line with GloBE rules.

Exempt Income

The FAQ document provides information on the exempt income, which includes the following:

- Dividends and capital gains of qualifying shareholding will be exempt from Corporate Tax. A qualifying shareholding refers to an ownership interest in a UAE or foreign company that meets certain conditions.

- Qualifying intra-group transactions and reorganizations

Conditions and information on other UAE CT exemptions and exclusions are yet to be announced.

Other Salient Features

- Transfer Pricing: Transfer Pricing and documentation requirements will apply to UAE businesses with reference to the OECD Transfer Pricing guidelines.

- Relief of double taxation: Credit against the Foreign taxes against the UAE Corporate Tax payable.

- Advance Tax: No advanced or provisional CT filings are required.

- Withholding Tax: There will be no withholding tax on either domestic or cross border payments.

- Grouping: A UAE group can elect to form a tax group and be treated as a single taxable person provided certain conditions are met. In this case, only one single tax return will need to be filed per group.

The FAQs clarify that meeting certain conditions may offset tax losses between group companies.

WHAT WE DO NOT KNOW YET:

Conditions for Free Zone exemptions

Free zone businesses will be subject to UAE CT, and free zone companies that meet all regulatory requirements and do not conduct business with Mainland UAE only will be allowed to enjoy the tax holidays allowed by the free zones. We expect the tax laws and regulations to specify what those requirements are to avail free zone exemptions.

Depreciation rates guidance

Since depreciation on fixed assets impacts profits, we expect that the tax laws will specify the depreciation method and rates on all types of assets. We expect clear guidance to be released on first-time implementation.

Related party transactions guidance

As per the FAQs, UAE businesses will need to comply with transfer pricing rules and documentation requirements set with reference to the OECD Transfer Pricing Guidelines. We expect guidance on the same to be disclosed in due course.

Timelines for filing returns and paying taxes

Only one CT return will need to be filed electronically per financial period (generally a year). Further guidance is to be issued by the Authorities in regards to timing of filing returns and payment of taxes in due course.

Interest on delayed payments, penalties for non-filing etc

As per the FAQs, businesses will be subject to penalties for non-compliance with the CT regime similar to other taxes in the UAE (e.g. UAE VAT) i.e delayed payments and non-filing. Further information on the UAE CT compliance obligations and applicable penalties will be released in due course.

Conditions for capital gains exemption

The FAQs state that capital gains earned by a UAE business from its qualifying shareholdings will be exempt from UAE CT, however conditions to claim such exemption have not yet been released.

Additionally, it will be interesting to see the provisions of the UAE CT on the Transitional Rules and Anti-Avoidance Rules when released.

NEXT STEPS

UAE businesses will need to assess how CT will apply to their activities and ensure they are ready to implement CT in 2023. As a first step, businesses should

- Understand the proposed corporate tax to assess the implications on the legal structure, business model, contracting, accounting, profit, transfer pricing, information systems & data management, and the organization structure.

- Conduct impact assessment of the new regulations

- Begin necessary preparations for a smooth implementation

CONTACT US

Our team of tax experts can support you in understanding the potential impact of CT, and how this may affect your specific business. This could involve the following:

- Conduct and deliver technical Tax Trainings and Workshops

- Perform qualitative impact and readiness/maturity assessments

- Provide implementation support on tax practices

Rakesh Pardasani Baasab Deyb Shahim Mukadam

Partner Partner Tax Manager