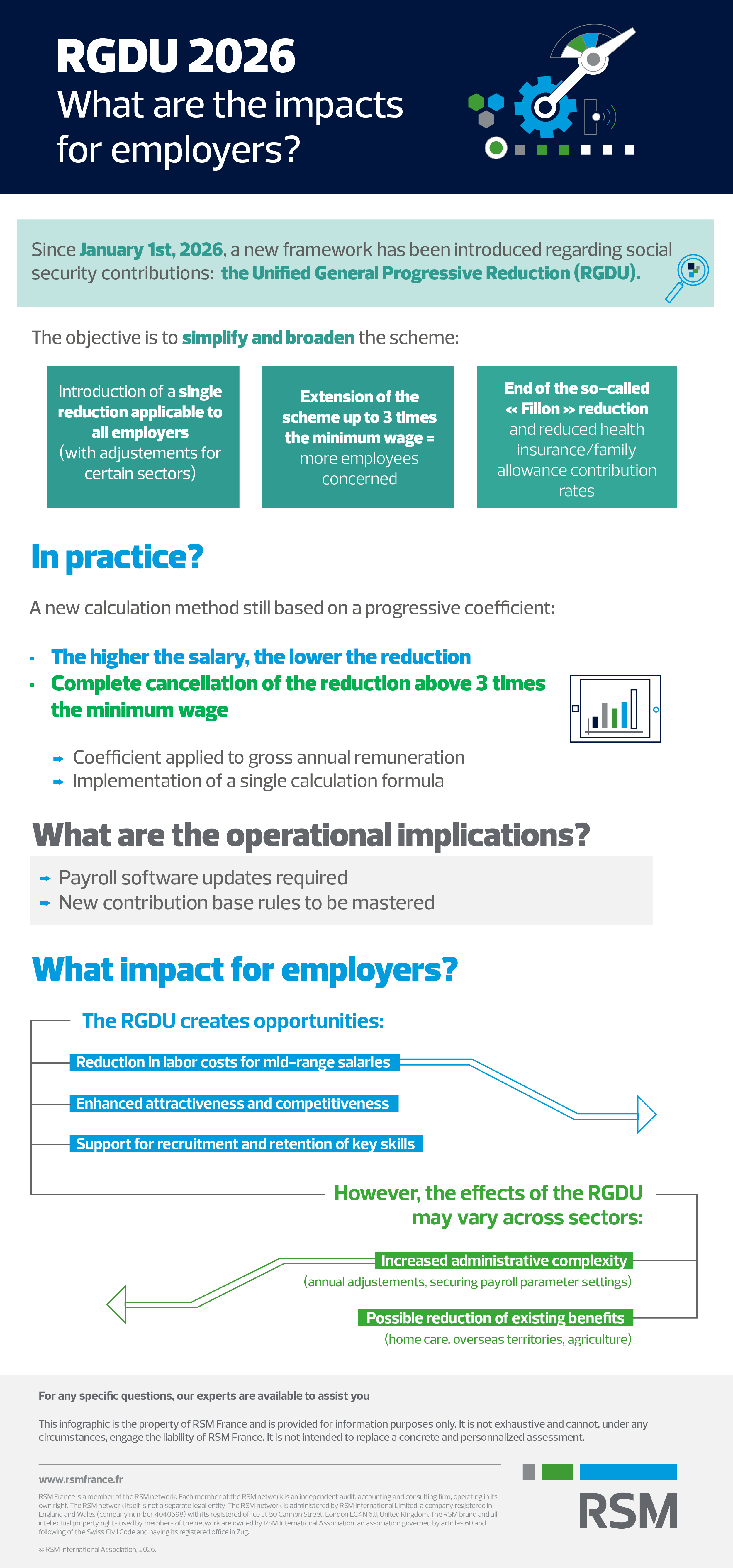

As of January 1, 2026, companies must adapt to a new framework governing social security contribution relief.

Decree No. 2025-887 of September 4, 2025 abolishes the “Fillon reduction” and the reduced health insurance and family allowance contribution rates, replacing them with a single mechanism: the Unified Progressive General Reduction (RGDU).

Presented as a simplification reform, the RGDU significantly broadens eligibility, as the reduction will now apply to salaries of up to three times the statutory minimum wage (SMIC). While the reform aims to enhance clarity and consistency, its effects will vary across sectors and pay levels.

Our experts provide an in-depth analysis of the reform: its objectives, the mechanics of the new calculation method, and its implications for employers.

A Reform Focused on Simplification and Extension

For many years, employer social contribution relief was based on a complex set of rules, with the Fillon reduction capped at 1.6 times the SMIC and specific reduced rates applicable to certain sectors. The introduction of the RGDU seeks to unify this fragmented landscape through a single formula applicable to all employers and industries.

The most significant innovation lies in the extension of the eligibility ceiling.

Whereas the Fillon reduction excluded salaries above 1.6 SMIC, the RGDU will allow remuneration of up to 3 SMIC to benefit from a reduction. This change directly benefits intermediate and skilled profiles—technicians, supervisors, and junior executives—whose employer labor costs may now be reduced.

Whereas the Fillon reduction excluded salaries above 1.6 SMIC, the RGDU will allow remuneration of up to 3 SMIC to benefit from a reduction. This change directly benefits intermediate and skilled profiles—technicians, supervisors, and junior executives—whose employer labor costs may now be reduced.

Conversely, for certain sectors that historically benefited from particularly favorable schemes—such as home care services, overseas territories (LODEOM scheme), and agriculture—the reform represents a shift. These derogatory mechanisms will be aligned with the RGDU framework, which may in some cases result in reduced advantages compared to the previous regime.

In practical terms, the RGDU increases the number of eligible employees and simplifies administration for employers, even though the calculation method remains technical.

Calculation Mechanics: A Redesigned Progressive Coefficient

The scheme is based on a single coefficient, as set out in Article D.241-7 of the French Social Security Code. Its principle is progressive reduction: the higher the salary, the lower the relief rate, until it is fully phased out beyond 3 SMIC.

Unlike the Fillon reduction—which could be calculated either on an annualized basis or per pay period, and whose assessment base included unemployment insurance contributions, work stoppages/occupational illness, and supplementary pensions—the RGDU is intended to be more streamlined and consistent. Nevertheless, this simplification requires a thorough review of payroll practices and adjustments to payroll software systems.

The reduction is determined by applying a coefficient to the annual gross remuneration. The formula is as follows:

![]()

*The result obtained from this formula is rounded to four decimal places, to the nearest ten-thousandth.

For the general case:

- Tmin = 0,200 (minimum floor of 2%)

- Tdelta = 0,3781 ou 0,3821 depending on the FNAL rate

- P = 1,75 in 2026

Illustrative examples

These examples illustrate that the reduction remains substantial at the level of the SMIC and gradually decreases as remuneration increases, before stabilizing at the 2% floor at 3 SMIC.

What Are the Impacts for Employers?

For most companies, the RGDU represents a competitiveness opportunity. Extending the reduction up to 3 SMIC lowers labor costs for qualified profiles, often strategic in sectors facing recruitment pressures. In industry, construction, and high value-added services, the reform may support both recruitment and retention of key talent.

However, the impact is more nuanced for certain specific regimes. In home care services, full exemptions that previously applied in some cases will disappear in favor of a progressive reduction subject to annual regularization. Organizations will need to manage additional administrative complexity and may see reduced benefits for employees slightly above the SMIC.

In overseas territories, the removal of exemptions beyond 3 SMIC may negatively affect qualified employment and weaken local competitiveness. The agricultural sector will also lose certain specific arrangements as it adapts to a uniform framework.

From a practical standpoint, the reform requires heightened vigilance. Payroll software must be updated to incorporate the new formula, and payroll managers must closely monitor year-end adjustments. A thorough understanding of the assessment base rules is essential, including:

- Inclusion of the value-sharing bonus (PPV),

- Neutralization of overtime pay premiums,

- Proration of the reference SMIC.

Paid leave, now treated as effective working time, continues to qualify for relief without reducing the benefit. Termination indemnities (dismissal, retirement, mutual termination) remain excluded from the assessment base, except for the portion subject to contributions. These technical details can significantly affect the final amount of relief.

The Unified Progressive General Reduction marks the end of the Fillon reduction era and opens a new chapter in France’s policy of employer social contribution relief. By extending eligibility up to 3 SMIC, it supports intermediate wage levels and strengthens the attractiveness of employment in France. Yet behind the simplification lies a degree of fragility, particularly for specific regimes whose advantages are reduced.

For companies, the challenge is twofold: to technically integrate the reform into payroll systems and to anticipate its financial impacts in order to secure workforce management from the scheme’s entry into force in January 2026 onward.

Our team of HR advisory and support experts is here to understand your strategy, challenges, and economic environment. We offer a multidisciplinary, flexible, and fully tailored service.

Discover our HR, social and pay Consulting team