It came as quite a surprise to me seeing instructions in Mandarin at Manaus Airport, where you can hardly find Chinese tourists. In fact, Chinese capital owns almost a quarter of Azul Brazilian Airline's equity. China is now one of the biggest lenders in Latin America and Caribbean region (LAC). In recent years, Chinese banks have made more loans to LAC than World Bank or Inter-American Development Bank.

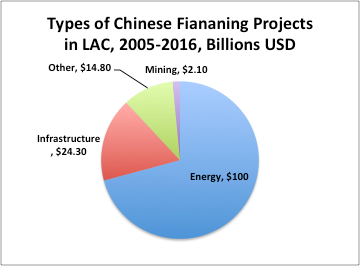

Source: China-Latin America Finance Database

The China Development Bank (CDB) and the Export-Import Bank of China (Ex-Im Bank) provided the money for these projects. These two banks are the major policy banks in China, solely owned by the Chinese government. Energy sector is the primary focus of their financing objective. Without any doubt, Brazil has attracted a significant proportion of Chinese investment for its rich endowment in natural resources. During the year of 2016, more than 15 billion US dollars flew from China's state-owned banks to Brazilian entities.

Securing Global Supply for China

The Chinese financial involvement of the region is more than diplomatic. It also serves strong economic purposes. The rapid growth of Chinese economy demands more energy and minerals from abroad since the domestic supply is rather limited. Thus, securing global supply is one of the chief targets of Chinese investment.

The investment environment is more favorable in Latin America, comparing with Middle East or Africa. Venezuela, Ecuador and Brazil are big oil exporters in the globe. It's natural for China to build strategic long-term relationship with LAC nations. Indeed, the Chinese government is very generous towards the financing needs of the extractive industries in LAC. For example, in the most recent deal with Brazil, China Development Bank provided five billion USD debt finance to Petróleo Brasileiro (PetroBras). In return, PetroBras promised to sell 100,000 barrel per day in the next ten years to three Chinese petroleum companies.

Recent Major Policy-Lending Between China and Brazil

|

Date |

Amount |

Purpose |

Debtor |

Creditor |

|

Dec. 2016 |

5 Billion USD |

Debt Financing |

PetroBras |

CDB |

|

Feb. 2016 |

10 Billion USD |

Debt Financing |

PetroBras |

CDB |

|

May 2015 |

1.3 Billion USD |

Loans for Aircraft Sales to China |

Embraer |

Ex-Im Bank |

|

May 2015 |

3.2 Billion USD |

Loans for Ship Purchases from China |

Vale |

Ex-Im Bank |

|

May 2015 |

1.5 Billion USD |

Loans for Equipment Purchases from China |

PetroBras |

CDB |

|

April 2015 |

1.2 Billion USD |

Loans for Soy-processing industrial line construction |

Government |

CDB |

Digesting China's Excess Capacity

Besides energy sector, infrastructure area is the second largest destination for Chinese investment. Overseas projects not only create opportunity for domestic firm to expand their global business, but also help to digest the domestic excess industrial capacity. Investment in overseas infrastructure projects boosted external demands for Chinese manufacturing products, reducing the domestic pressure for cutting excess industrial capacity. For instance, many construction projects in LAC involve purchasing manufacturing goods from China.

Chinese economy is usually characterized by high investment, high exports and moderate consumption. As the growth of housing sector and international demand slows down, excess capacity in traditional manufacturing industry appears to be a pressing issue. Industries like steel and aluminum cannot adjust their capacity easily. More importantly, these mostly state-owned firms employ a large work force. Laying off these unionized blue-collar workers proves to be easier said than done.

Opportunities for Brazil

Infrastructure in Brazil significantly lags behind its economic status, which has become a bottleneck of development. It is a historical opportunity for Brazil to catch up its crumbling infrastructure. Any upgrades in transportation will help lower the cost of exporting and enhance Brazil's competitiveness in global market.

In addition to the financial hardship brought by the current recession, the austerity program imposed by Brazilian government strictly limits spending on infrastructure. The incoming Chinese capital is an excellent alternative. For example, China State Grid acquired more than 50 percent of the Brazilian electricity company CPFL Energia with 4.5million USD. The company is now able to build more power transmission lines and extend their services in Brazil. This will to improve the overall economic efficiency nationwide.

China's Capital Control and Challenges

However, potential conflicts might arise in future. The two countries have different business practices in areas including environmental protection, labor standards, indigenous rights. If these issues were not handled properly, they will hinder the completion of projects. Moreover, both sides have to seek innovative ways to expedite their bureaucratic processes. International investors doubt about the political stability in Brazil.

Another concern come up recently is about China's tightening capital controls. The interest rate hike by the Federal Reserve made it more favorable to bring money back to United State. Foreign capital accelerated their paces of moving out. Moreover, some Chinese firms and families try to transfer their asset abroad, seeking for higher returns. All these put downward pressure on RMB values. As shown in the graph, RMB depreciated in the last quarter of 2016.

Source: People's Bank of China and Bank of China

In response, Chinese authority has tightened capital controls and spent their foreign exchange reserves to stabilize the currency exchange rate. There is new window guidance from the regulators to commercial banks. Several international companies encountered difficulties for international remittance since then. The drop on official reserves position epitomizes the interventions in the currency market. The policy seems to be effective as the data suggests. The reserves position grew slightly higher for the first quarter of 2017 and the RMB stopped to depreciate.

These measures have nontrivial impacts for Chinese capitals flowing to Brazil. Policy banks might be more selective in their loan approval process. Traditional investment in Brazil's energy sector or infrastructure is unlikely to be affected, since it accords with China's strategic long-run interest. For other firms wishing to expand their business in Brazil, the financial channel is likely to be more constrained. If China's economic prospective improves, we can expect less control and a more stable growth of China's investment in Brazil in the future.

Para mais informações, entre em contato:

Janaína Guimarães - [email protected]

Executive China Desk - LATAM