The Ministry of Finance and the State Administration of Taxation (STA) have recently promulgated a series of tax incentives for enterprises in the manufacturing industry and others, as well as small, medium and micro enterprises, with a new combined tax and fee support policy to further increase the relief efforts for enterprises. We hereby review the recent tax benefits and share our insights.

Definition of Terms

|

Terms |

Definition |

|

VAT Small Scale Taxpayer |

Annual value-added tax sales are 5 million RMB and below. |

|

Small, low-profit businesses (“micro-enterprises”) |

Engaged in national non-restricted and prohibited industries, while complying with:

1. Annual taxable income ≤ 3 million RMB 2. Number of employees ≤ 300 3. Total assets ≤ 50 million RMB |

|

SMEs |

Engaged in national non-restricted and prohibited industries, in line with:

1. Information transmission industry, construction industry, leasing and business service industry: employees 2,000 people, or operating income 1 billion RMB or assets 1.2 billion RMB; 2. Real estate development and operation: operating income 2 billion RMB or total assets 100 million RMB; 3. Other industries: less than 1,000 employees or operating income of less than 400 million RMB. |

|

Manufacturing and other industries enterprises |

Value-added tax arising from "manufacturing", "scientific research and technical services", "electricity, heat, gas and water production and supply" and "transportation, warehousing and postal services" in the "National Economic Industry Classification" Taxpayers whose sales account for more than 50% of all VAT sales |

Corporate Income Tax

Accelerated Depreciation of Assets

|

Small and Medium Enterprises (SMEs) |

||

|

Applicable Period |

Newly purchased equipment and appliances with a unit value of more than 5 million yuan from January 1 to December 31, 2022 |

|

|

Depreciation Policy |

The current tax law stipulates that the minimum depreciation period is 3 years |

100% one-time tax deduction for the current year |

|

The current tax law stipulates that the minimum depreciation period is 4 years, 5 years and 10 years |

50% is deducted as a one-time pre-tax deduction for the current year, and the remaining 50% is deducted before depreciation for the remaining years according to regulations |

|

|

Prepayment |

Yes |

|

|

Reference |

《财政部 税务总局关于中小微企业设备器具所得税税前扣除有关政策的公告》(财政部 税务总局公告2022年第12号 ) "Announcement of the Ministry of Finance and the State Administration of Taxation on Policies on Pre-tax Deduction of Equipment and Appliances for Small and Medium-sized Enterprises" (Announcement No. 12 [2022] of the Ministry of Finance and the State Administration of Taxation) |

|

*The loss formed by the enterprise that chooses to apply the above policies in the current year can be carried forward in the next 5 tax years. Enterprises that enjoy other policies carry-forward with the current regulations.

Lower Effective Tax Rate

|

Small and micro enterprises |

Applicable Period |

||

|

Effective Tax Rate |

The part of annual taxable income ≤ 1 million yuan |

2.5% |

January 1, 2021 - December 31, 2022 |

|

1 million yuan the part of annual taxable income ≤ 3 million yuan |

5% |

January 1, 2022 - December 31, 2024 |

|

|

Prepayment |

Yes |

||

|

Reference |

《财政部 税务总局关于进一步实施小微企业所得税优惠政策的公告》(财政部税务总局公告年第号) "Announcement of the Ministry of Finance and the State Administration of Taxation on Further Implementing the Preferential Income Tax Policies for Small and Micro Enterprises" (Announcement No. 13 [2022] of the Ministry of Finance and the State Administration of Taxation) |

||

VAT

Periodic Exemption

|

Small Scale Taxpayer |

|

|

Tax Free Period |

From 1 April 2022 to 31 December 2022* |

|

Income Exemption |

|

|

Reference |

《财政部 税务总局关于对增值税小规模纳税人免征增值税的公告》(财政部 税务总局公告2022年第15号) "Announcement of the Ministry of Finance and the State Administration of Taxation on Exempting Small-scale VAT Taxpayers from Value-Added Tax" (Announcement No. 15 [2022] of the Ministry of Finance and the State Administration of Taxation) |

*From January 1 to March 31, 2022, small-scale taxpayers are subject to a taxable sales income of 3%, and VAT is levied at a reduced rate of 1%.

|

Taxpayers providing Public Transport Services |

|

|

Tax Free Period |

From 1 January 2022 to 31 December 2022 |

|

Income Exemption |

Income derived from the provision of public transport services is exempt from VAT. |

|

Reference |

《财政部 税务总局关于促进服务业领域困难行业纾困发展有关增值税政策的公告》(财政部 税务总局公告年第号) 第三条 "Announcement of the Ministry of Finance and the State Administration of Taxation on the Value-Added Tax Policies for Promoting the Relief and Development of Difficult Industries in the Service Industry" (Announcement No. 11 [2022] of the Ministry of Finance and the State Administration of Taxation) Article 3 |

Staged Arrangement for Tax Refund

|

Small business, micro business, manufacturing and other industries |

|||

|

Refund conditions |

|

||

|

Application |

Enterprises/Industry |

Incremental Tax Credit |

Stock Tax Credit |

|

|

Micro-enterprises |

Refund of incremental tax credits available from April 2022 tax filing period |

From April 2022 tax filing period, you can apply for a one-time refund of the existing tax credit |

|

Small Enterprises |

May 2022 tax filing period can apply for a one-time refund of the existing tax credit |

||

|

Medium-sized manufacturing enterprises |

From the tax filing period of July 2022, you can apply for a one-time refund of the remaining tax credit |

||

|

Large-scale manufacturing and other industries |

You can apply for a one-time refund of the remaining tax credit from the tax filing period in October 2022 |

||

|

Incremental/Stock Tax Credit Calculation Method |

Incremental/stock tax credits allowed to be refunded = incremental/stock tax credits × input composition ratio × 100% |

||

|

Reference |

《财政部 税务总局关于进一步加大增值税期末留抵退税政策实施力度的公告》(财政部 税务总局公告年第号) "Announcement of the Ministry of Finance and the State Administration of Taxation on Further Strengthening the Implementation of the VAT Refund Policy" (Announcement No. 14 [2022] of the Ministry of Finance and the State Administration of Taxation) |

||

- Incremental Tax Credit:

(1) Before the taxpayer obtains a one-time tax refund for the existing stock, the incremental tax credit is the newly increased tax credit at the end of the current period compared with March 31, 2019.

(2) After the taxpayer obtains a one-off tax refund for the existing stock, the incremental tax credit shall be the tax credit at the end of the current period.

*Stock Tax Credit:

(1) Before the taxpayer obtains a one-off tax refund for the existing stock, if the amount of the tax retained at the end of the current period is greater than or equal to the amount of the tax retained at the end of March 31, 2019, the amount of the remaining tax is the amount of the tax retained at the end of March 31, 2019.

(2) If the tax credits at the end of the current period are less than the tax credits at the end of March 31, 2019, the existing tax credits are the tax credits at the end of the current period.

(3) After the taxpayer obtains a one-off tax refund for the existing stock, the amount of the stock remaining tax is zero.

*Medium Business, Small Business and Micro Business:

It is determined in accordance with the operating income indicators and total assets indicators in the "Regulations on the Classification Standards for Small and Medium-sized Enterprises" (Gongxin Bulian Enterprise [2011] No. 300) and the "Regulations on the Classification Standards for Financial Industry Enterprises" (Yin Fa [2015] No. 309).

*Options for tax refunds from retained VAT for carry forward credit and VAT refund-upon-collection or refund-after-collection policy

According to Article 10 of Announcement No. 14, taxpayers who have obtained tax refunds from retained VAT for carry forward credit since 1 April 2019 shall not apply for the VAT refund-upon-collection or refund-after-collection policy. Taxpayers can apply for the VAT refund-upon-collection or refund-after-collection policy after paying back all the tax refunds from retained VAT for carry forward credit that have been obtained at one time before October 31, 2022.Taxpayers who have enjoyed the VAT refund-upon-collection or refund-after-collection policy since 1 April 2019 can apply for the tax refund from retained VAT for carry forward credit in accordance with the regulations after repaying all the tax refund from VAT refund-upon-collection or refund-after-collection policy.

Super Deduction for input credit

|

General taxpayer of value-added tax in production and living services |

|

|

Applicable Period |

Extended until December 31, 2022 |

|

Tax Incentives |

For production and living service taxpayers, the deductible input tax for the current period will continue to be deducted by 10% and 15% of the tax payable respectively. |

|

Reference |

(1) Announcement of the Ministry of Finance and the State Administration of Taxation on Clarifying the Value-Added Tax Deduction Policy for the Living Service Industry (Ministry of Finance and the State Administration of Taxation Announcement No. 87 [2019]) (2) Article 1 of the Announcement of the Ministry of Finance and the State Administration of Taxation on VAT Policies for Promoting the Relief and Development of Difficult Industries in the Service Industry (Announcement No. 11 [2022] of the Ministry of Finance and the State Administration of Taxation) |

Other Taxes

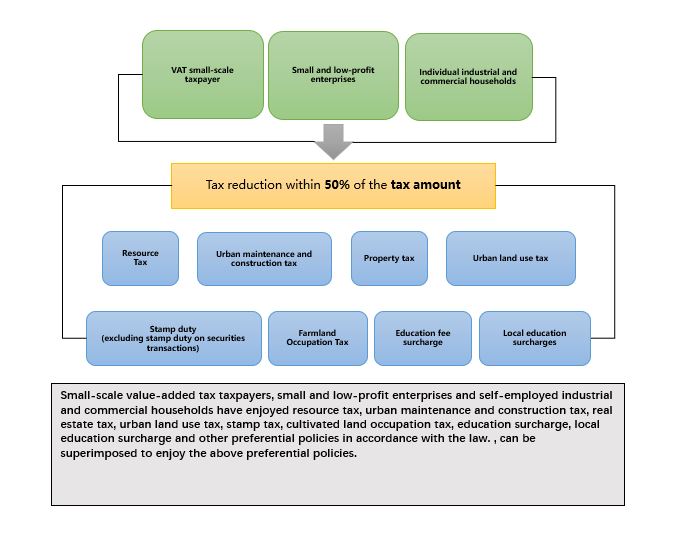

Reduction and exemption of "six taxes and two fees" for small and micro enterprises

The people's governments of provinces, autonomous regions and municipalities directly under the Central Government shall determine according to the actual situation of the region and the needs of macro-control, and reduce the "six taxes and two fees" for the following types of enterprises. The policy implementation period is from January 1, 2022 to December 31, 2024.

Reference:《财政部 税务总局关于进一步实施小微企业“六税两费”减免政策的公告》(财政部 税务总局公告2022年第10号)"Announcement of the Ministry of Finance and the State Administration of Taxation on Further Implementing the "Six Taxes and Two Fees" Reduction and Exemption Policy for Small and Micro Enterprises (Ministry of Finance and State Administration of Taxation Announcement No. 10 [2022])

RSM Observations

With the most recent Covid-19 outbreak, the economic situation is not clear. The introduction of the above-mentioned policies has provided certain cash flow support for enterprises, thereby alleviating the operating pressure of enterprises in the short term and providing guarantee for later operating activities. We recommend relevant companies to pay attention to various policy updates regularly and make preparations as soon as possible to fully enjoy the benefits of the policy:

- Enterprises should assess their own status (including industry attributes, enterprise scale, annual sales of value-added tax, tax credit rating, etc.) in a timely manner to determine whether they are eligible for various types of tax reduction and exemption enterprises; check whether you meet the conditions for applying for a monthly full refund of the incremental tax credits and a one-time refund of the existing tax credits. Eligible enterprises should actively communicate with the competent tax authorities to understand the handling procedures and relevant practical matters, so as to smoothly obtain the refund of the existing tax credits. At the same time, enterprises that meet the conditions for applying for a refund of the retained tax can also choose not to apply for a refund of the retained tax and carry forward the retained tax to the next period to continue the deduction. It is recommended that relevant companies make appropriate choices based on their specific circumstances.

-While enjoying relevant preferential policies, enterprises should also pay attention to the requirements of relevant tax laws and regulations and make corresponding plans to avoid relevant risks. For example, pay attention to separate accounting of tax-exempt income and taxable income and issue VAT invoices in accordance with laws and regulations. If the tax-exempt and tax-reduced items are concurrently operated, the sales of the tax-exempt and tax-reduced items shall be calculated separately; if the sales volume is not calculated separately, no tax-exemption or tax reduction shall be allowed. Where taxable sales are subject to tax-exemption provisions, special VAT invoices shall not be issued; if there are concurrent operations in business and some items comply with tax-free preferential policies, they shall be dealt with separately during accounting and issued for taxable income subject to tax-exempt preferential policies General VAT invoices, so as to avoid being required by the competent tax authorities to pay back taxes.

-When an enterprise finds that it is eligible for multiple tax incentives after evaluation, it must carefully judge whether it can enjoy the tax reduction and exemption preferentially or separately:

- According to the relevant provisions of the Announcement of the State Administration of Taxation on Matters Concerning the Annual Final Settlement and Payment of Enterprise Income Tax, enterprises are engaged in projects that are eligible for the halving of corporate income tax (such as eligible environmental protection, energy and water conservation projects, eligible Technology transfer, integrated circuit production projects, etc.), and enjoy preferential tax rate policies such as small and low-profit enterprises, high-tech enterprises, technologically advanced service enterprises, integrated circuit production enterprises, key software enterprises and key integrated circuit design enterprises. The halving is superimposed to enjoy the part of tax reduction and exemption, and adjustments are made. In some cases, those who give up the preferential policy of halving the project and only enjoy the preferential policy for small and micro enterprises can enjoy the maximum preferential treatment.

- We recommend that enterprises that comply with the policies of VAT refund upon collection and refund after collection should focus on the application timing in Announcement No. 14 and compare the benefits that could be obtained under different tax incentives, and shall determine whether it is necessary to change the tax preferential treatment currently enjoyed by the enterprise.

In practice, we recommend that enterprises do a good job of calculating and comparing various tax incentives before making tax declarations to ensure that enterprises can enjoy the relevant tax preferential policies to the greatest extent. Our RSM Tax team will pay close attention to the dynamics of relevant policies and practical matters in the following weeks. If you want to have a more in-depth and specific discussion on the relevant issues involved in this article, you are welcome to contact us (tax@rsmchina.com.cn)