Faced with the impact of the Covid-19 pandemic in 2020 and the sharp decline in global transnational direct investment, China's actual use of foreign capital throughout the year has grown against the trend, achieving "three increases”, in total amount of foreign investment, growth rate, and global share. The effect of the implementation of the "Foreign Investment Law of the People's Republic of China" has achieved its legislative purpose and has provided a stronger legal framework for China to further open-up to the global economy, while effectively utilizing foreign investment.

From the operational perspective, foreign direct investment enterprises may overlook the changes required under this new law.

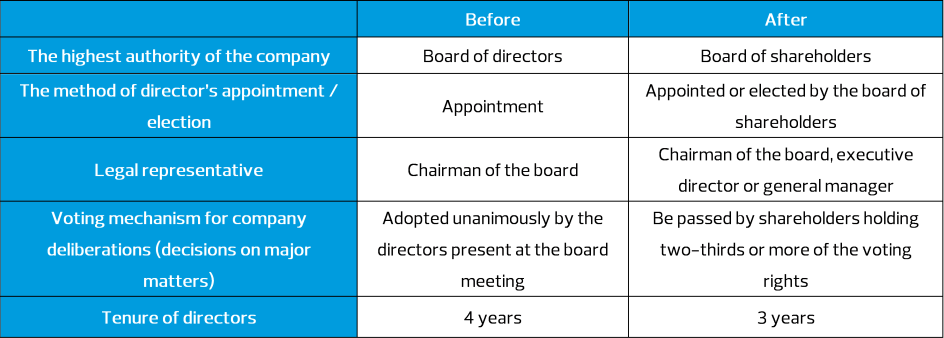

The RSM Tax Team has listed the key content of the governance structure changes, so that enterprises can proceed with the required changes.

Regulatory Background

In order to actively promote foreign investment in China, and to protect the legitimate rights and interests of foreign investors and regulate the administration of foreign investment, on March 15, 2019, the Second Session of the 13th National People's Congress voted and passed the "Foreign Investment Law of the People's Republic of China" (Presidential decree No. 26,hereinafter referred to as “Foreign Investment Law”), effective as of January 1, 2020. The "Law of the People's Republic of China on Sino-foreign Equity Joint Ventures", "Law of the People's Republic of China on Wholly Foreign-owned Enterprises", and "Law of the People's Republic of China on Sino-foreign Cooperative Joint Ventures" shall be repealed simultaneously. On December 12, 2019, the 74th Executive Session of the State Council passed the "Implementation Regulations for the Foreign Investment Law of the People's Republic of China" (State Council Order No. 723, hereinafter referred to as "Implementation Regulations"). The promulgation and implementation of the above laws and regulations indicates that China's legal system for foreign direct investment management is now more uniform and has reached a new level.

The Foreign Investment Law stipulates that any investment activity directly or indirectly carried out by foreign natural person, enterprises or other organizations (hereinafter referred to as "foreign investors") shall be subject to the Company Law of the People's Republic of China, the Partnership Enterprise Law of the People's Republic of China and other applicable laws. The relevant competent authorities shall review the licensing applications filed by foreign investors under similar conditions and procedures as those for domestic investment. In accordance with the non-retroactive principle, foreign direct investment enterprises established in accordance with the Law of the People's Republic of China on Sino-foreign Equity Joint Ventures, the Law of the People's Republic of China on Wholly Foreign-owned Enterprises or the Law of the People's Republic of China on Sino-foreign Cooperative Joint Ventures before January 1, 2020 may keep the original organizational forms for five years after the implementation of the Foreign Investment Law (hereinafter referred to as the "transition period"), or adjust its organizational form and organizational structure in accordance with the Company Law of the People's Republic of China, the Partnership Enterprise Law of the People's Republic of China and other applicable laws. However, with effect from 1 January 2025, where an existing foreign direct investment enterprise has not adjusted its organization structure and complete the registration change pursuant to the law, the Administration for Market Regulation shall not process the applications for any other registration matters of the said enterprise and shall announce relevant incompliance issue to the public. Hence, the legislative intent of the Foreign Investment Law is still to encourage and promote foreign direct investment enterprises to change their own governance structure in accordance with current laws and regulations of commercial entities in order to form a unified and equal regulatory system.

Main Issues

A. What are the company's internal preparations for adjustments during the five-year transition period?

If the highest authority of foreign direct investment enterprises established before January 1, 2020 is the board of directors, it is necessary to adjust the organization form, structure and operating rules within five years after the implementation of the Foreign Investment Law in order to apply the provisions of the Company Law. The company shall discuss and decide on the functions and powers of the shareholders' meeting and the board of directors in accordance with the requirements of the Company Law, formulate and adopt new legal registration documents such as articles of association.

B. What adjustments companies need to make when the highest authority is changed from a board of directors to a board of shareholders? What changes and adjustments should be made in the articles of association?

The shareholders of the company shall consult and decide on the updated organization structure following the requirements of the Company Law of the People's Republic of China, and the contents of the corresponding articles of association that need to be adjusted are as follows:

Foreign direct investment enterprises shall amend its articles of association within five years following the implementation of the Foreign Investment Law (before December 31, 2024), and apply for alteration registration, the articles of association record, or director record, etc. to the registration authority in accordance with the law.

C. What are the differences in regulations of the selection of the company's legal representative?

The scope of candidates for legal representative has been expanded. The original Law of the People's Republic of China on Sino-foreign Equity Joint Ventures disclosed that the legal representative shall be the chairman of the board of directors. While now the legal representative could be the chairman, executive director or general manager after the implementation of the foreign investment law.

D. What are the specific requirements for the selection of directors, supervisors, and senior management personnel?

The qualifications of the company's directors, supervisors and senior management personnel shall be strictly in accordance with the provisions of Article 146 of the Company Law of the People's Republic of China as follows:

Article 146: The following persons shall not act as a director, supervisor or senior management personnel:

a.a person who has no civil capacity or who has limited civil capacity;

b.a person who has been convicted for corruption, bribery, conversion of property or disruption of the order of socialist market economy and a five-year period has not lapsed since expiry of the execution period or a person who has been stripped of political rights for being convicted of a crime and a five-year period has not lapsed since expiry of the execution period;

c.a person who acted as a director, factory manager, manager in a company which has been declared bankrupt or liquidated and who is personally accountable for the bankruptcy or liquidation of the company; and a three-year period has not lapsed since the completion of bankruptcy or liquidation of such company;

d.a person who has acted as a legal representative of a company which has its business license revoked or being ordered to close down for a breach of law and who is personally accountable, and a three-year period has not lapsed since the revocation of the business license of such company; and

e.a person who is unable to repay a relatively large amount of personal debts.

Where the election or appointment of a director, supervisor or senior management personnel is in violation of the aforesaid provisions, such election or appointment shall be void. A director, supervisor or senior management personnel who encounters the circumstance set out in the first paragraph of this Article shall be terminated by the company.

E. What are the adjustments on the company's profit distribution ratio and method, or the validity of investment contracts?

During the five-year transition period after the implementation of the Foreign Investment Law, foreign direct investment enterprises need to adjust their organizational form and organizational structure, etc. in accordance with the law. After adjustments, the original joint venture or cooperative parties agreed in the contract for the transfer of equity or rights, profit distribution method, remaining property distribution method, etc., can continue to be proceeded in accordance with the agreement.

F. What do companies need to change at the Administration for Market Regulation?

For foreign direct investment enterprises established before January 1, 2020, if the highest authority, legal representative or director formation method, voting mechanism, etc. agreed in the company's articles of association are inconsistent with the mandatory provisions of the Company Law, the Company shall amend its articles of association within five years after the implementation of the Foreign Investment Law and apply for alteration registration, the articles of association record, or director record, etc. to the registration authority in accordance with the law.

G. What should be noted for a newly-established company?

The organizational structure and form of a company established after January 1, 2020 shall have been subjected to the requirements of the Company Law or the Partnership Enterprise Law of the People's Republic of China.

H. Are there any special provisions on the organization of a listed company?

There is no special provision for listed companies with foreign capital. For the listed companies whose organizational structure, organization form and rules of voting mechanism have met the provisions of the Company Law, no special adjustments are required in their organizational form and organizational structure.

RSM Comments

The promulgation of the Foreign Investment Law and its implementation regulations is an important measure for China to deepen its opening-up and encourage foreign investment. It is also a solid step to fully implement the core concept of rule of law, promote the integrated and standardized development of domestic and foreign investment management.

Efforts in promoting equal rights, rules and opportunities for all enterprises and in building a favorable market competition environment and policy also show China's firm will and determination to promote economic globalization.

At the same time, foreign direct investment enterprises, which are important commercial players in the market, should also actively respond to and implement the relevant requirements of the Foreign Investment Law and check whether the terms of articles of association or agreements continue to be in compliance with the provisions of the Company Law or Partnership Enterprise Law. For any content inconsistencies, enterprise shall have internal discussions, clause formulation, and internal approval as soon as possible, so as to clarify their own reporting obligations and submit a change (record) application to Administration for Market Regulation and other relevant departments. It is important to avoid missing the deadline for reporting. In this process, companies can also seek professional institutions to address relevant legal and practical questions or assist in completing changes to their governance structure.

RSM will continue to focus on, collect and share relevant policy with you. If you have any questions, please feel free to contact us at [email protected]