On October 16th, 2022, in his opening speech of the 20th Party Congress, Xi Jin Ping, President of the People’s Republic of China, stated that one of China's overall development objectives for the year 2035 was for China to join the ranks of the world's most innovative countries. He added “with nationwide R&D spending rising from 1 trillion yuan to 2.8 trillion yuan, the second highest in the world. Our country is now home to the largest cohort of R&D personnel in the world”, highlighting the clear plan the Chinese government wants to follow.

China has been an increasingly popular destination for foreign capital. Looking at inbound investment in China, Foreign Direct Investment (“FDI”) remains a strong element in China’s rapid expansion in world trade. Foreign investors should also have in mind China is transitioning from a manufacturing-based economy to an innovation-based one, pushing hard towards high tech innovation as a way for the country to develop its own core technology and thus reduce its exposure to the global supply chain. The increase in consumption spending, supported by mobile payment platforms and the increase of their use among the Chinese population made China an e-commerce powerhouse representing a major opportunity for foreign businesses that are capable to target Chinese consumers with their products and services.

Over the last few years, there has been a rise in China-based tech companies growing their international business, with firms such as Tencent and ByteDance taking the lead going global. Looking at China’s current strategic positioning, how can tech companies find opportunities within the plan when operating in China?

Local Market Development Trends

As a result of constant economic development over 3 decades, China is no longer the “World Factory” it was 30 years ago, where most foreign manufacturing industries would invest here seeking affordable labor. The Chinese market now has tremendous opportunities for foreign investors to explore, especially in advanced-technology production and services.

To maintain economic growth, standards of living, and meet the demand of its increasingly educated workforce, China undertook the further development of its economic and technological competitiveness with MIC ("Made in China") 2025 issued in May 2015 by Premier Li Keqiang. The industrial policy aims to upgrade the manufacturing capabilities of Chinese industries, growing from producing low-tech goods (which was achieved by lower labor costs and supply chain advantage) into a more high-tech intense powerhouse. China’s official business plan has been focusing and prioritizing 10 high tech industries including advanced information technology; automated machine tools and robotics; aerospace and aeronautical equipment; ocean engineering equipment and high-tech shipping; modern rail transport equipment; energy saving and new energy vehicles; power equipment; new materials; medicine and medical devices; and agricultural equipment.

To achieve this plan, a number of specific policies have been implemented including reduced corporate income tax rate for qualified high-tech companies, increased tax deduction for R&D activities, direct state-funding of R&D, roadmap stating specific targets for factors such as R&D spending share, productivity, digitization and environmental protection.

In this climate, there is still abundant opportunities for high-tech enterprises s in China but identifying and engaging with such opportunities would require a deep understanding of these emerging policies. As an example, tech companies willing to operate and remain compliant in China should pay particular attention to local regulations, not only to the China tax rules but other compliance requirements such as foreign exchange rules, the newly issued data security law, industry restrictions, etc.

How are foreign invested tech companies approaching China?

Foreign tech companies may get access to China market either by acquiring / investing into an existing target company in China or setting up their own subsidiary here. The former way would be useful if there are certain industry restriction for foreign investors (e.g., fintech sector) while the latter would provide more autonomy in management and IP protection in the local market.

If the foreign investor chooses to acquire / invest into an existing target company in China, it shall assess the target company by due diligence from a legal, financial, and tax perspective to ensure there is no major historical compliance risk and the value of the company is reasonable. From a business perspective, the investors shall also pay special attention to the core tech team, as they may be the key value of the target company, and their related stock incentive plans.

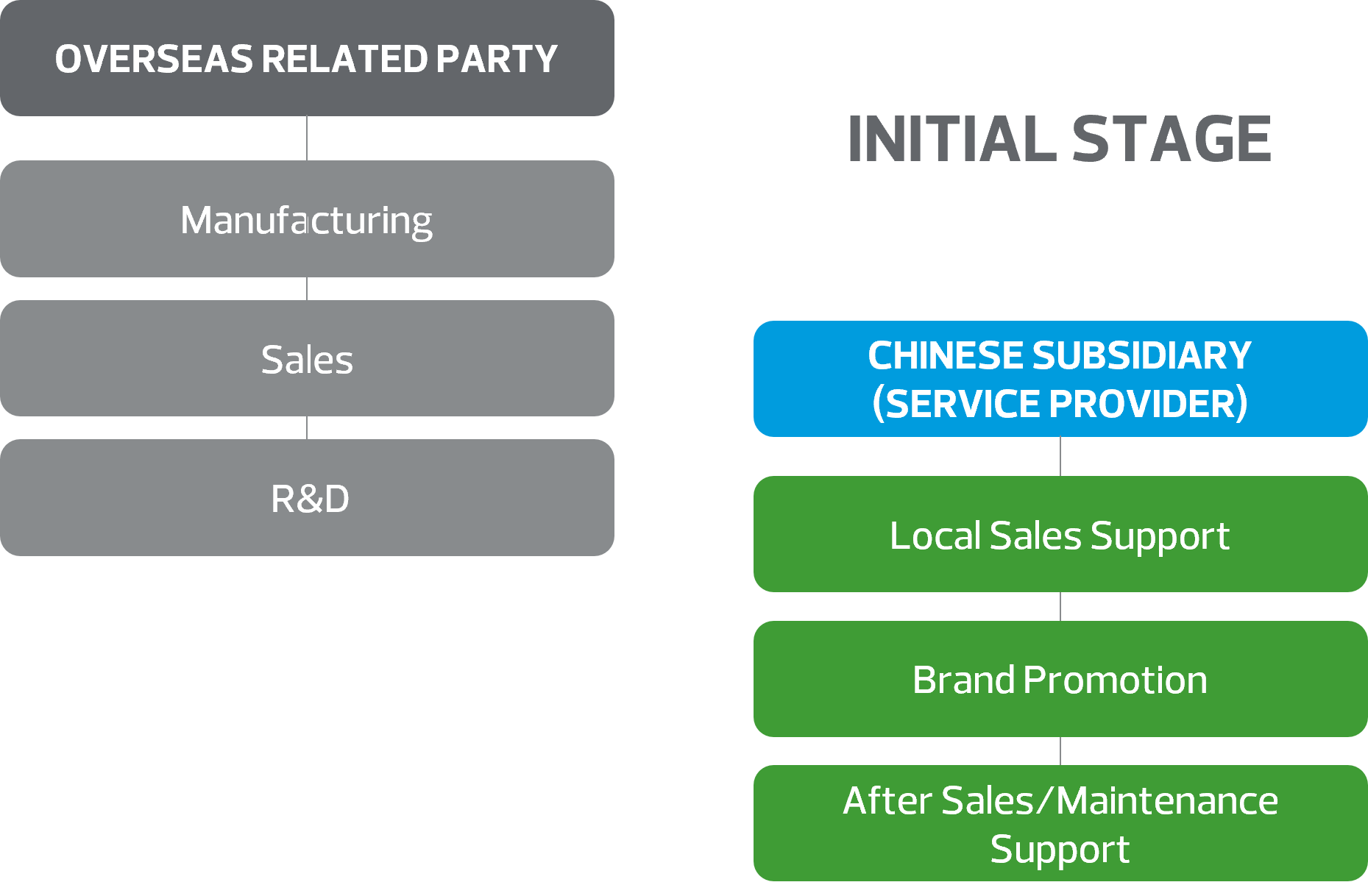

In the case of setting up subsidiary in China, the function to be undertaken by the Chinese subsidiary could be gradually upgraded along with the changing need from the China market. Normally, at the initial stage, the Chinese company will function as a service provider to overseas related party, e.g., the overseas related party keeps selling to the Chinese customers while the Chinese subsidiary hires a local team to provide local sales support, repair and maintenance for China customers and further promote the brand in China.

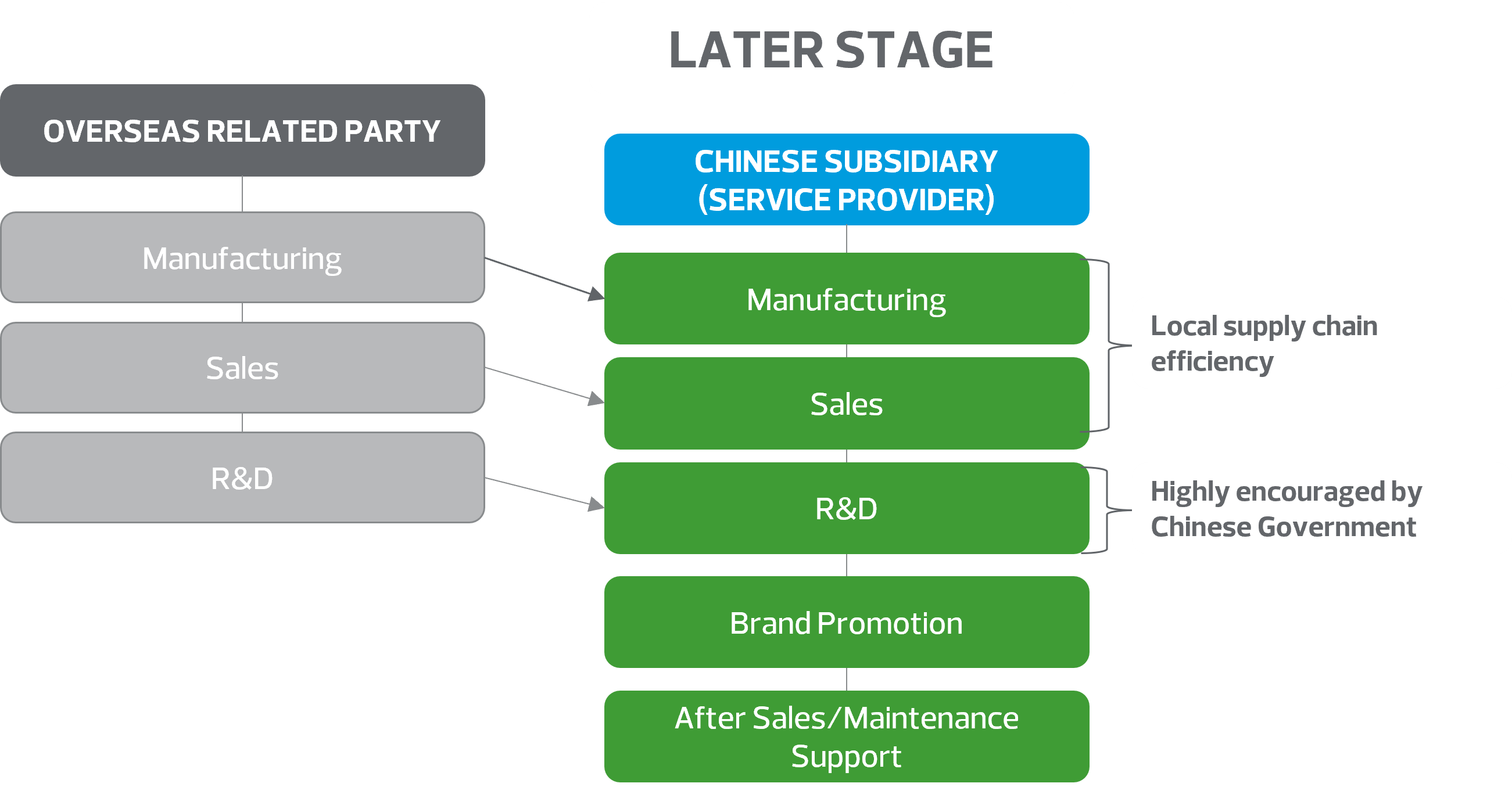

If the brand is well received in China, foreign investors may consider shifting the trading or even manufacturing function to China as well to achieve local supply chain efficiency. We have also seen many tech companies setting up R&D centers in China to support global R&D efforts, especially in big cities like Shanghai and Shenzhen that could provide well trained local talents, with labor cost relatively lower than in the West. Also, such R&D activities are highly encouraged by the Chinese government and could be entitled to many financial and tax incentives. In some cases, the Chinese local operation becomes very mature, there could be local IP registered in China based on which the local entities may apply for hi-tech entities where are would be further preferential tax treatment and financial support from the authorities.

What are key considerations for tech companies in China?

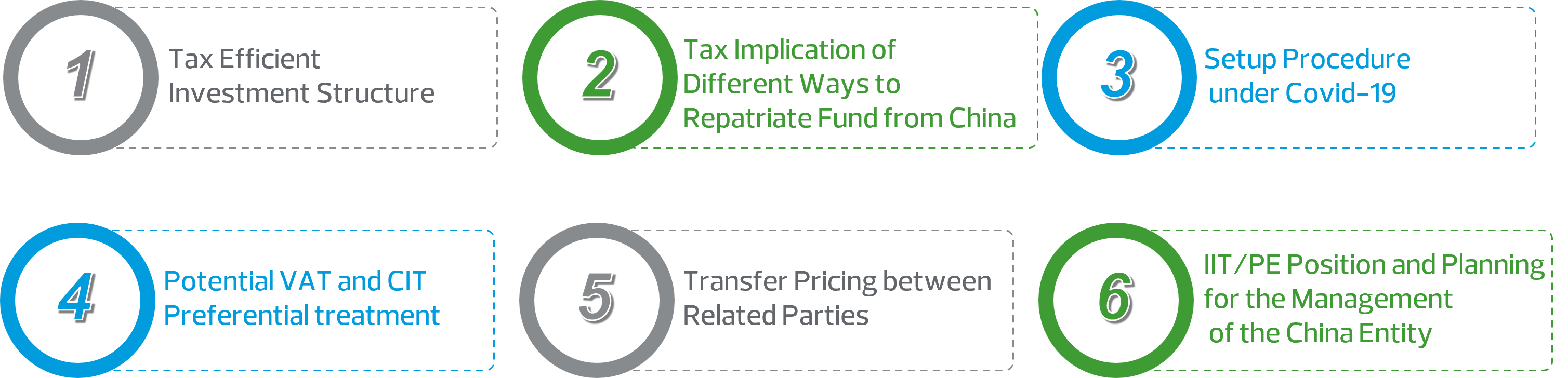

When considering expanding a business into the China market, given the country’s sophisticated tax and local requirements, foreign investors should plan well ahead and identify certain key areas before moving forward.

Setting up the legal entity in China – Investment Structure and site selection

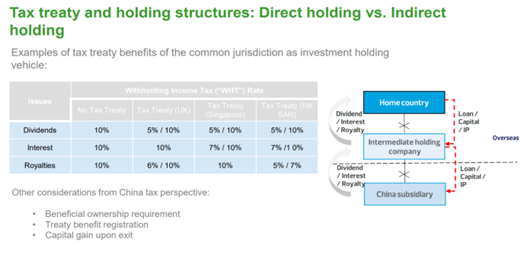

While foreign investors plan to set up a legal entity in China, the first common question they should raise is whether to use the parent company in the home country directly or use an intermediate holding company in a jurisdiction that provides better treaty benefits. It will be necessary to compare different structures from tax and foreign exchange perspectives to choose the most optimal one since this will increase tax efficiency for future profit repatriation and any other types of cross-border payments.

While comparing and choosing the desired holding structure, it is important to look at not only the tax treaty terms but also the requirement to enjoy the tax treaty according to the Chinese tax rules, such as beneficial ownership requirement. If the intermediary holding company does not have substance, it would not be able to fulfill such requirements and needs to further assess the eligibility from upper shareholder’s level whether it can apply the tax treaty benefits.

Upon deciding the holding structure, the investors will appoint an agent to help with the company establishment process in China, which will involve approval from different Chinese authorities. If the intended business is to hire talents to engage in R&D activities or the investment scale is substantial (which are both encouraged by the local government), it is also essential to select a site that offers favorable financial subsidy. Depending on each project’s need, such site selection process will involve negotiations with different local authorities on case by case basis before choosing the most suitable location. The financial subsidy could be in various forms including rental exemption or discount, investment grant, tax rebates etc.

Operating the legal entity in China – Tax Overview and Key Tax Incentives

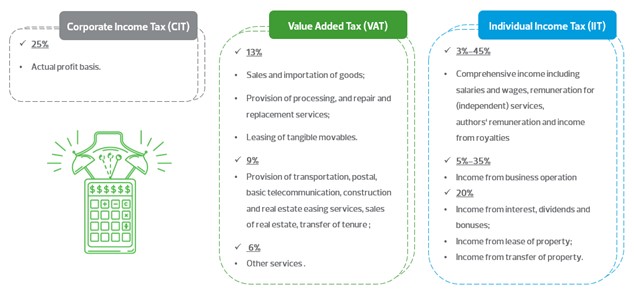

The standard rate of CIT (“Corporate Income Tax”) was revised to 25% in January 2008. Under the prevailing PRC CIT law and regulations, a company will be subject to CIT on actual profit basis. All taxable profit in China would be subject to a corporate income tax for which the statutory rate is 25%.

Sales of goods and services would be subjected to VAT. The VAT rate would range from 6% to 13%.

In China, all entities as employers, should withhold individual income tax (IIT) on behalf of the employees upon their monthly payroll. IIT would range from 3% to 45% on a progressive basis. Expatriate employees working in China may enjoy certain IIT incentives, e.g., benefit-in-kind items that are exempted from IIT under proper arrangement. Short-term foreign travelers might also be subject to PRC IIT depending on their length of stay in China.

There are also different tax incentives in China. For tech companies, the common preferential tax treatment that may apply are summarized as below:

- VAT:

- Qualified exported goods or services would be exempted from VAT.

- Qualified exported goods or services could further enjoy VAT zero-rated treatment, which means the associated input VAT could be refunded besides VAT exemption.

- The refund of incremental overpaid VAT, which is actually the input VAT that the taxpayers would continue to deduct in the future could be applied to return in advance. By returning VAT that has not yet been deducted, it will directly improve the cash flow of the enterprise and ease the pressure of capital withdrawal.

- Software products developed and produced by a VAT general taxpayer could be subject to levying and collection of VAT at the tax rate of 13%, and the policy of forthwith levy and forthwith refund shall be implemented for the portion of VAT actually paid which exceeds 3%.

- CIT:

- Eligible high-tech companies and advanced tech service companies can enjoy a reduced CIT at 15%, from an original statutory rate of 25%.

- The maximum tax loss carry-forward period would also be extended from the statutory 5 years to 10 years.

- Qualified R&D expenses incurred by Tech companies could be deducted up to 100% accelerated for the purpose of CIT deduction. If intangible assets are formed, the accelerated rate would be increased to 200%.

- The equipment and appliances newly purchased by high-tech enterprises from October 1, 2022 to December 31, 2022 are allowed to be deducted in full lump sum in the calculation of taxable income and 100% additional deduction before tax.

- Various CIT exemption/reduction treatment could be applied on integrated circuit and software industry companies if certain conditions can be met.

All the tax incentives mentioned above would be subjected to very specific requirements and procedures with the tax bureau and other authorities. The general recommendation would be to seek tax advisers for further guidance on relevant tax considerations that apply to your business in China.

What practical advice can we give?

Overall, tech companies are welcome by the Chinese government in light of the national development plan, and tech business is attracting high demand in the local market too. A general recommendation we would give to any foreign tech business in China would be to ensure companies plan ahead all major aspects of their future investment in China, to mitigate risk, identify favorable options, and build a reliable and realistic timeline.

Contact us: tax@rsmchina.com.cn