During the operation and investment cycles of multinational companies in China, there will always come a time where the China subsidiaries will need to make remittance. Foreign multinational companies with subsidiaries in China would generally be aware that the country has a stringent system of foreign exchange controls, which tightly restricts funds going in and out of the country.

The process of cash remittance from China is a challenging issue, making it critical for multinational companies to think ahead before reaching any operational or investment decision. Treasury arrangement can be achieved when planned appropriately, taking into serious consideration the tax implications and timeframe. Limiting complications that are often associated with the process.

What are the common remittance needs for China subsidiaries? What are the key tax implications they should consider before proceeding? What are the potential challenges they may face from tax perspective? In this month’s newsletter, we look at the most effective ways for companies to repatriate profits out of China.

COMMON NEEDS FOR CASH REMITTANCE

There are 2 main different needs for cash remittance that will bring in tax implications to both foreign recipient and Chinese payor:

- Dividend Repatriation

- Intercompany Payment

DIVIDEND REPATRIATION TO THE PARENT COMPANY

When a foreign invested enterprise (FIE) has been making profit, dividend repatriations are expected for some of the investors. For this FIEs must fulfill certain requirements and submit certain documents.

- A FIE can only repatriate profit after its registered capital has been injected within the time limits set out in the company’s Article of Association.

- A FIE generally can only repatriate profit once a year after the annual audit and tax compliance procedures are completed. This is to ensure a 25% Corporate Income Tax (CIT) has been paid off regarding the profit to be distributed.

- A company can only repatriate profits if their accumulated losses of the previous years are made up.

- Last but not the least, not all profits can be repatriated after-tax clearance. It is mandatory to place 10% of annual profits in a reserve fund until it reaches 50% of the registered capital of the enterprise.

Despite the fact dividends are after-tax profits; they would normally be subject to an additional 10% withholding CIT when repatriated to the foreign investors. If a Double Tax Avoidance agreement (DTA) is available, and the parent company qualifies as the beneficial owner, a preferential withholding CIT rate of 5% (or even lower) may apply.

If non-resident parent enterprises decided to re-invest the dividends derived from FIEs into projects encouraged by the country, the withholding CIT on this part of the dividends could enjoy deferral treatments by fulfilling certain conditions.

TAX IMPLICATIONS

With preferential withholding CIT rate, whether the investors can be determined as the Beneficial Owner (BO) has always been a key focus for both the tax authorities and the investors.

On February 3, 2018, China’s State Taxation Administration (STA) released the STA Announcement [2018] No.9, which set out safe harbor and major negative factors qualifications for the obtention of BO status:

|

SAFE HARBOR FOR BO STATUS |

MAJOR NEGATIVE FACTORS FOR BO STATUS: |

|

|

|

|

|

|

|

|

A recipient of Chinese-sourced dividends may also be recognized as a BO even though they fail to qualify as a BO themselves under the following scenarios:

· The person who can qualify as a BO is a tax resident of the country (region) of which the applicant is a resident;

· The person who can qualify as a BO is not resident of the country (region) of which the applicant is a resident, but the said person and, in situations where the shares are held indirectly, any intermediary shareholders all are "qualified persons.”

Although the above announcement and related explanation provided relaxation for the tax treatment application scope, in practice there are still many controversies around the BO qualification.

CASE DISCUSSION

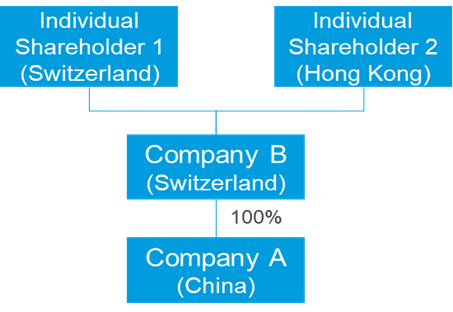

Company A is a wholly foreign owned enterprise (WFOE) in China, and its parent Company B is tax resident of Switzerland. Besides holding the WOFE, Company B maintained a certain level of distribution business and has only one employee. Company B’s shareholders are two individuals - one is tax resident of Switzerland, and another is tax resident of Hong Kong SAR.

In this case, the company and local tax authorities may have below disagreements:

· Company B believe it is a BO as it has substance as a shareholder and a genuine distribution business, while the local tax authorities believe Company B’s substance is too weak as it has only one low level administrative employee, who would not be able to manage the investment and distribution activities, as well as assuming the corresponding risks.

· Even if Company B cannot be recognized as BO directly, Company B claims that its shareholders are all BOs – the individual who is a Switzerland resident can meet safe harbor rules, and the individual who is a Hong Kong resident is a qualified person. However, the local tax authorities will not agree as in practice Company B cannot provide all required supporting documents for safe harbor and qualified person for upper shareholders.

Further questions:

- If Individual Shareholder 1 could fall under safe harbour while Individual Shareholder 2 could not be justified as a BO, can the dividend still enjoy the reduced 5% WHT?

- If Company B and local tax authorities reached an agreement that it is a BO now, can relevant undistributed profit of Company A prior to the timepoint when shareholder obtains BO also enjoy the reduced 5% WHT?

With all the above practical uncertainties, it would be essential to assess the situation and plan well ahead. It is important to understand local practices before applying any treaty benefit.

INTERCOMPANY PAYMENT

Intercompany service payment is another scenario that China affiliates often encounter when making remittance. It happens when foreign investors or foreign related parties provide services (such as human resources, information technology), or intangible assets (such as trademark, patent, or know-how) to Chinese affiliates.

Although the intercompany transactions are subject to turnover taxes, surcharges, and possibly withholding CIT too. These intercompany payments can be deducted from the Chinese payor’s CIT taxable income by fulfilling certain requirements. The payment should be a legitimate claim since the tax authorities and SAFE are closely scrutinizing these types of payments and may see them as a potential tool for tax avoidance. To reduce the risk of potential tax investigation, the service provider should keep good supporting documentation to prove that the service was authentic, beneficial to the recipient and the transfer pricing was within arm’s length, etc.

TAX IMPLICATIONS

Key tax considerations under intercompany transactions are around the deductibility before CIT of the Chinese service recipient, and the withholding CIT of the intercompany payment.

· Deductibility (for the Chinese payor): Related party outward service fee payments shall satisfy various requirements including but not limited to the necessity of the services, the authenticity of the services, true benefit brought to the Chinese entity, the reasonableness of the pricing (i.e., in arms’ length) and etc.

· Withholding CIT (for the foreign service provider):

- For interest and royalty payments, 10% WHT or lower if the treaty benefit conditions are satisfied;

- For service fee payment, technically, no WHT would be applied on no “PE” basis if relevant treaty benefit conditions are satisfied. However, in practice, a non-WHT position would be difficult to be achieved.

CASE DISCUSSION

Company A is a Chinese subsidiary of Company B, a US company. Company B is the headquarter of the group, a holding company and runs a shared service center(“SSC”) as well. Company B provides IT, legal, finance and other shared services to Company A as well as other subsidiaries around the world and charged service fees at cost plus 5% mark-up.

The above is very common among MNCs with below key areas that should be well-considered and prepared in advance:

· Whether relevant services can fulfill the necessity and benefits tests with sufficient supporting documents:

o Accounting services focusing on consolidated reporting requirements, or for group tax accounting (Fin48, Cbcr, etc.) – The services are not necessary or of benefit to Company A for its operation in China.

o Marketing services for industry event charged to Company A – What’s the nature of the marketing services and where are the sales revenue booked? Should Company A or Company B itself bear the costs? Does Company A also make payments for trademark royalty at the same time?

o CEO cost allocated and charged to Company A – Is it stewardship or beneficial services? If claim it’s partially beneficial services, how to support the allocation?

· For IT services, is it pure service or containing software element? Would it be deemed as royalty for providing the software using license?

· The remittance process has been changed from pre-approval by the authorities to filing system. This means Company A should keep a good record of supporting documents in order to support “no PE” status and apply for treaty benefit. But how, and what’s enough to support?

The above key considerations are suggested to be internally assessed and prepared in advance so as to smooth remittance process for the overseas party as well as to secure the deduction for the China entity. In this case, the Chinese tax bureau enquired and challenged the outward service fee payment during the follow-up inspection. Effective communication with the tax bureau would be important to explain the nature of the services, pricing methodology and also to manage the level of supporting document.

RSM OBSERVATIONS

Fund repatriation process in China is still under development and technically some of the procedures are becoming simplified (e.g., the process may be expediated with less documents required, the treaty benefit conditions have been extended to other eligible group companies etc.). Nowadays , the overall practice of Chinese tax bureaus is to actually increase follow-up inspections. When inspected, the process can be complicated and lengthy. It is still critical for investors to be well aware of the fund repatriation framework and key tax considerations. Management should seek professional advice to plan ahead their strategy around the needs of their business, so as to increase the chances of successful remittance and to limit tax risks.

Feel free to contact us at [email protected]