Crossing the 50-employee threshold is a strategic milestone: it triggers social and legal obligations that shape labor relations, strengthen employee protection, and introduce new HR management practices

To turn this transition into an opportunity, employers are well-advised to anticipate these changes in order to ensure compliance and avoid penalties

Our RSM experts break down the key obligations, both existing and new, that companies must now adhere to

Crossing the 50-employee threshold is a strategic milestone for any company. This threshold triggers a range of social and legal obligations that structure labor relations, strengthen employee protections, and introduce new human resources management practices. To turn this transition into an opportunity, employers are well-advised to anticipate these changes in order to ensure compliance and minimize the risk of penalties.

A reminder of the key basic social obligations:

Failure to comply with these legal and regulatory obligations can lead to financial and administrative penalties, as well as potential disputes with your employees.

Our experts, Kim Scheffer and Loïc Wira, break down the key existing and new obligations that companies must comply with. The obligations presented below are in addition to those mentioned above.

Obligations related to employee representation

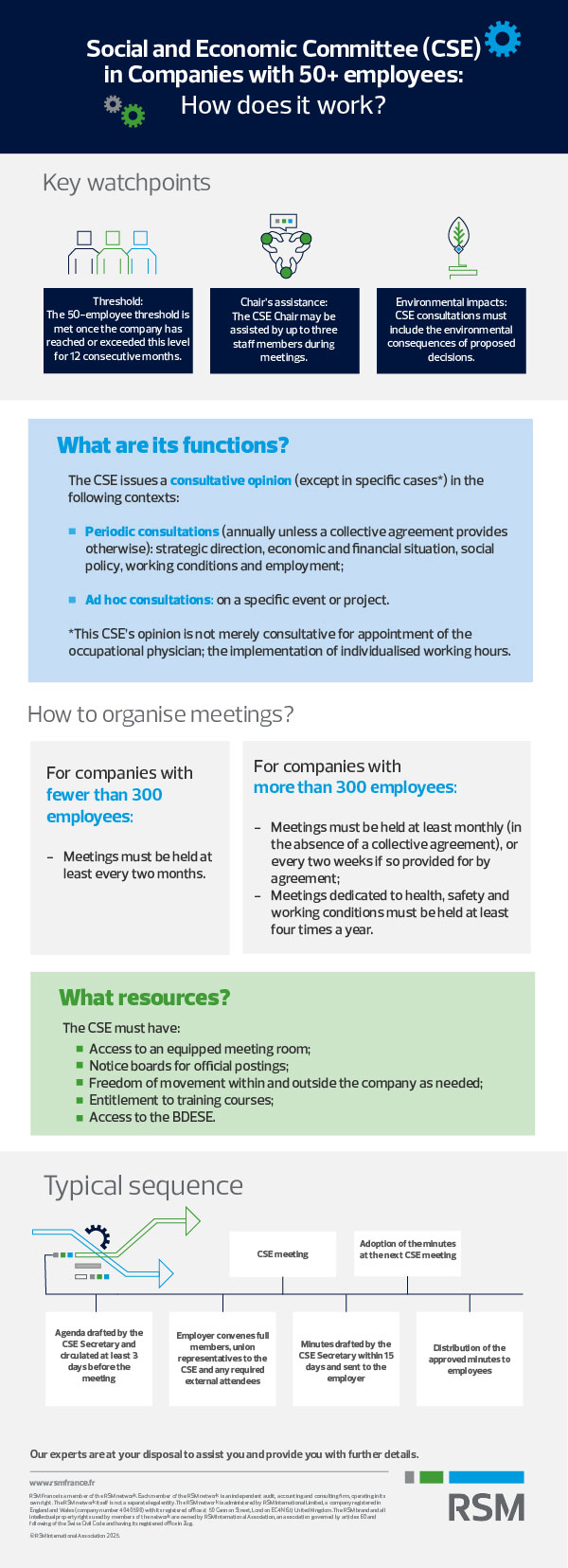

Mandatory implementation of the CSE

The establishment of the Social and Economic Committee (CSE) is mandatory for companies with at least 11 employees (Article L.2311-1). However, crossing the 50-employee threshold—sustained for twelve consecutive months—triggers an expansion of the CSE’s responsibilities. The committee must then be consulted on strategic orientations, the company’s economic and financial situation, as well as its social policy.

In companies with fewer than 50 employees but at least two separate sites, a CSE must be established at each site, along with a central CSE at the company level.

The composition of the CSE varies according to company size: for companies with 50 to 74 employees, the employee delegation includes 4 full members and 4 alternates.

The CSE meets every month or every two months depending on the company’s size, with the possibility of adjustments through an agreement. Delegation hours are also determined by company size.

Representatives are elected for a four-year term, unless a collective agreement sets a duration between two and four years. This new framework requires employers to anticipate professional elections and adjust internal organization to comply with the new legal obligations.

Legal missions of the CSE for companies with 50+ employees

The CSE’s responsibilities are exercised at varying degrees—recurring, occasional, or exceptional—and cover strategic areas such as labor law, occupational health and safety, the environment, and more recently, corporate social responsibility (CSR). For companies that have crossed the 50-employee threshold, the following additional missions and competencies apply:

→ Recurring meetings

The CSE meets regularly to maintain ongoing social dialogue between the employer and employees. Its missions include:

- Presentation of individual and collective grievances:

The CSE serves as the primary point of contact for employees to assert their claims regarding the application of labor law, collective agreements, and company-level agreements.

- Mandatory consultations – the committee is periodically consulted on key topics:

Work organization (schedules, leave, overtime)

Working conditions (safety, ergonomics, workload)

Social policy, employment, and professional training

These consultations generally take place during the legally mandated monthly meetings, ensuring regular monitoring of social issues.

→ Exceptional Meetings

In specific circumstances, the CSE is consulted to provide its opinion or support employees in particular processes:

- Collective economic dismissals: Prior consultation with the CSE is legally required before any employer decision.

- Redeployment of an unfit employee: The committee provides an opinion on possible redeployment options in accordance with medical recommendations.

- Discrimination and harassment: The CSE assists affected employees by guiding them toward appropriate legal remedies.

CSE Alert Rights: The committee has several alert rights enabling rapid intervention in high-risk situations: - Violations of individual rights (discrimination, harassment, infringement of personal freedoms)

- Serious and imminent danger to worker health or safety

- Serious risk to public health or the environment

- Economic alert rights

→ CSR

Since the entry into force of the CSRD directive and the DDADUE law of April 30, 2025, companies subject to non-financial reporting obligations must consult the CSE on sustainability information as provided in Articles L. 232‑6‑3 and L. 233‑28‑4 of the French Commercial Code.

This requirement primarily concerns large companies—i.e., those with more than 250 employees, annual revenues exceeding €40 million, or total assets over €20 million—as well as listed companies, excluding micro-listed companies. It also progressively applies to certain small and medium-sized listed companies. Companies with more than 50 employees that are not listed are only concerned by this consultation if they belong to a consolidated group subject to these non-financial reporting obligations.

The CSE consultation must take place at least once a year, as part of one of the three major recurring mandatory consultations: strategic orientations, economic and financial situation, or the company’s social policy. Outside of this framework, there is no general obligation to consult the CSE for each operational decision related to sustainability issues.

Furthermore, in companies with more than 50 employees, the CSE has the right to expert support, allowing it to be assisted by an accountant or an occupational health, safety, and working conditions expert. The committee may also now incur civil liability and take legal action.

Our Experts’ Opinion:

While the legal provisions are highly demanding, requiring employers to consult with their CSE before any strategic decision and to be informed of any deviations, we recommend taking the time to analyze all of these obligations and turn them into an opportunity. Indeed, establishing a relationship of trust with your CSE—based on mutual engagement—can become a major asset for the company.

CSE Operating Resources

In companies with more than 50 employees, the Social and Economic Committee (CSE) is provided with material, financial, and human resources appropriate to its responsibilities.

→ Material Resources

The employer must provide, in particular, a dedicated space, equipment, and access to a notice board to facilitate communication with employees.

It is also recommended to provide a secure digital space, for example on the company intranet, to allow the CSE to share information in an accessible manner. Additionally, providing a dedicated phone line or email address helps facilitate communication between elected representatives and employees, especially in the context of remote work or across multiple sites.

→ Financial Resources

The CSE is managed through two separate budgets:

- A operating budget, set at 0.2% of the gross payroll, constitutes a mandatory subsidy provided by the employer. It is intended to cover the committee’s day-to-day operational needs, such as meetings, training for elected representatives, expert consultations, purchase of equipment, and communication activities.

- A social and cultural activities (ASC) budget finances initiatives aimed at improving employees’ working conditions and quality of life. It covers a wide range of benefits, including discounted tickets (holiday vouchers, cinema tickets, amusement parks), leisure support, educational assistance, organization of trips or events such as Christmas parties, raffles, or in-company activities.

The ASC budget is not mandatory. Its amount is usually determined by company agreement or established practice. In the absence of an agreement, the employer’s contribution cannot be lower than the amount provided the previous year.

These two budgets are legally separate. The operating budget cannot normally be used to fund ASC, except in exceptional cases regulated by law. The CSE must also ensure rigorous management and equitable distribution of benefits among employees.

→ Right to Training

In addition, the training of full CSE members—essential for the exercise of their responsibilities in economic, social, health, safety, and working conditions matters—is funded separately by the employer. This support ensures that employee representatives have the necessary skills to perform their duties effectively.

Drafting a CSE-specific internal regulation provides an opportunity to formalize all rules and operational resources.

Our Experts’ Opinion:

Having an active CSE that offers benefits and activities to employees is a powerful driver for improving working conditions and employee engagement. The CSE’s initiatives can help retain current employees and serve as a strong showcase during recruitment efforts.

Social obligations

Internal regulations: a mandatory framework to strengthen

Since the Pacte Law of May 22, 2019, the internal regulations have become a cornerstone of internal organization for companies with 50 or more employees. The 50-employee threshold must be reached for twelve consecutive months. The company’s internal regulations must include the following elements:

- General rules of discipline, as well as the nature and scale of applicable sanctions;

- Health and safety measures, including instructions for using equipment, protective gear, and hazardous substances;

- Conditions under which employees may be mobilized at the employer’s request to restore safe working conditions when they are compromised;

- Employees’ defense rights in the event of disciplinary proceedings;

- Provisions against moral and sexual harassment, as well as sexist behavior;

- Protection for whistleblowers.

The employer—responsible for drafting or amending the document—must consult the CSE to obtain its opinion. The internal regulations can apply even if the CSE has not approved them, but they must indicate the effective date.

Furthermore, the employer must file the internal regulations with the clerk of the labor tribunal (Conseil de Prud’hommes) relevant to the company, and also make them publicly available (for example, via the company intranet or by posting in the premises).

The employer is also responsible for raising employee awareness and implementing concrete measures to promote respect for digital disconnection.

→ Implementation of the Right to Disconnect

The right to disconnect aims to preserve employees’ work-life balance. It is part of a preventive approach, encouraging employees not to use professional digital tools outside of working hours.

In companies with more than 50 employees, this topic must be addressed during the mandatory annual negotiations. In the absence of an agreement with employee representatives, the employer is required to develop a charter outlining the terms of implementation of this right.

Additionally, the employer is responsible for raising employee awareness and implementing concrete measures to ensure respect for the right to disconnect.

Our Experts’ Opinion:

Beyond the mandatory legislative reminders, the internal regulations can be an excellent tool to reinforce good conduct, reduce “irritating” behaviors, and establish a solid foundation that can legitimize disciplinary action if necessary.

Professional interviews

The professional interview has been a legal requirement under the French Labor Code since 2014. It must be conducted every two years for each employee, regardless of their contract type or working hours.

The content of the interview is determined either by a collective agreement or by the employer, in line with the company’s strategic orientations. This interview focuses on professional development and maintaining employability.

In case of non-compliance, companies with at least 50 employees may face a €3,000 contribution to the CPF account of each affected employee, doubled if the payment is not made. Failure to comply may also engage the employer’s liability.

Our Experts’ Opinion:

Properly conducted professional interviews can help identify employees’ aspirations for career development, whether vertical progression or a move to an entirely different skill area.

Failing to conduct these interviews can create a legal vulnerability. For example, an employee sanctioned for poor performance or misconduct could defend themselves by highlighting the employer’s failure to organize these interviews or provide adequate training.

Agreement to implement

→ Egapro Agreement and index

Companies with at least 50 employees are also required to negotiate an agreement on professional equality. The agreement can be established for a fixed or indefinite term. However, the employer must reopen negotiations each year, or on the date specified in the procedural agreement, and at least every four years.

This agreement must set out concrete measures to reduce pay gaps, improve women’s access to management positions, and support work-life balance.

In the absence of an agreement with social partners, the employer must develop a unilateral action plan. This document, filed with the Dreets and published on the company website, specifies progression objectives, monitoring indicators, and planned actions to achieve professional equality.

Additionally, companies must calculate and publish their Gender Equality Index, or Egapro Index. This index is mandatory for all companies with at least 50 employees. Each year, before March 1, companies must calculate their score based on 4 or 5 indicators (pay gaps, salary increases, promotions, maternity leave, and top earners) and publish the results on their website and on the Ministry of Labor platform. These data must also be included in the BDESE and communicated to the CSE.

If the score is below 75/100, corrective measures must be defined and published. Failure to publish or insufficient results over three consecutive years may result in a financial penalty of up to 1% of the payroll.

Learn How to Calculate and Interpret the Egapro Index

Our experts' opinion :

In May 2025, the government confirmed that the Gender Equality Index will be completely redesigned in 2026, for implementation in 2027, to comply with European provisions on pay transparency. This new index is still under discussion with social partners and is expected to be clarified by summer 2026.

It has already been announced that the revised index will include seven indicators, six of which will be automated via the DSN, while the seventh will need to be reported manually at least once every three years. This new indicator will focus on pay gaps for positions of equal value, regardless of gender.

In addition to other announced obligations (including posting a salary range in job offers and granting employees access to average salaries for their roles), it is important to review compensation policies ahead of the reform’s implementation

→ Hardship agreement

Companies must also conclude a hardship prevention agreement or, failing that, implement an action plan. This requirement applies to companies where a significant proportion of employees are exposed to occupational risk factors such as manual handling, awkward postures, vibrations, night work, or exposure to hazardous chemicals (Articles L.138‑29 to L.138‑31 of the Social Security Code).

In the absence of an agreement or action plan, the company may face a penalty of up to 1% of the payroll. The agreement or action plan, concluded for a maximum duration of three years, must cover themes defined by decree (hardship prevention, workstation adaptation, exposure reduction, and support for affected employees). Companies with 50 to 299 employees may be exempt from this penalty if they are covered by a sector-wide extended agreement in compliance.

This agreement must be submitted to the administrative authority to ensure compliance and avoid sanctions.

It should not be confused with the DUERP (Occupational Risk Assessment Document), which is mandatory for all companies from the first employee. The DUERP identifies occupational risks and provides for appropriate preventive measures.

Our Experts’ Opinion:

While the hardship agreement responds to a legal obligation, it can also serve as an HR management tool and a real lever for social policy—improving working conditions, reducing sick leave, retaining employees in “difficult” positions, strengthening social dialogue through CSE involvement, and better targeting training programs, among other benefits.

The BDESE

Reaching 50 employees triggers the employer’s obligation to implement an Economic, Social, and Environmental Database (BDESE) (Articles L.2312‑18 of the Labor Code). This system is essential to ensure transparency with employee representatives and to facilitate social dialogue within the company.

The BDESE centralizes all the information necessary for the consultation and information of the Social and Economic Committee (CSE) regarding the company’s major economic, financial, social, and environmental orientations. It must include data on employment trends, remuneration, professional training, gender equality, and the environmental impacts of the company’s activities.

For companies with 50 to 300 employees, the minimum content of the BDESE is defined by decree. Its implementation must also comply with accessibility rules: it must be available at all times to CSE members and regularly updated. Failure to maintain a BDESE constitutes an obstruction to the functioning of employee representative bodies and may expose the employer to sanctions.

Our experts' opinion:

The BDESE is not just a formality; it is also a strategic tool.

Staff facilities

Crossing the 50-employee threshold requires the employer to provide a dining area that complies with hygiene and safety regulations (Article R.4228‑22 of the Labor Code).

At the request of the CSE or employees, this space must be equipped with a sufficient number of tables and chairs, a refrigerator for food storage, a microwave or other heating device, a source of drinking water, and adequate ventilation.

Failure to comply with these obligations may result in sanctions from the labor inspectorate.

Additionally, restrooms provided for employees must be accessible to people with disabilities, in accordance with the requirements of the Labor Code (Article R.4228‑1).

Compensation & social contributions: what are the obligations?

Crossing the 50-employee threshold has significant implications for compensation and employee benefits. The company becomes subject to several legal frameworks designed to strengthen value sharing and enhance employee well-being.

Un dispositif de partage de la valeur

Companies with more than 50 employees are required to implement a profit-sharing scheme, allowing employees to benefit from a redistribution of the company’s profits. The amount of the special participation reserve is calculated according to a legal formula, although a more favorable alternative formula may be established by agreement.

Profit-sharing is typically accompanied by a company savings plan (PEE), which facilitates the management and capitalization of these funds by employees.

Note: Some companies may be exempt from this obligation under certain conditions, for example if a sectoral or company agreement provides otherwise, or in cases of specific economic circumstances.

Our Experts’ Opinion:

It is possible to optimize the compensation policy by negotiating a profit-sharing agreement with an alternative formula, allowing for a higher payout while reducing the company’s social contributions. Similarly, this scheme can be combined with a bonus plan, a value-sharing premium, or other incentive arrangements.

Other obligations triggered by crossing the threshold

Crossing the 50-employee threshold also entails additional social contributions:

- Contribution to the construction effort (PEEC) at 0.45% of gross payroll;

- National Housing Assistance Fund (FNAL) at 0.50%;

- Social flat-rate contribution of 20% on amounts paid under the profit-sharing scheme.

These contributions must be included in the Nominative Social Declaration (DSN) no later than the 5th of the month following payment.

Crossing the 50-employee threshold marks a turning point for the company, signaling a strengthened social dialogue and new responsibilities for the employer.

Anticipating these obligations and seeking the right guidance is essential to ensure compliance, avoid penalties, and build a sustainable social policy.

Beyond a more demanding legal framework, these measures also present an opportunity to enhance employee engagement and improve quality of work life.

RSM experts, specialists in HR, Social, and Payroll Consulting, support companies across all sectors in defining and implementing their strategies. Our tailor-made solutions are adapted to the size, maturity, and industry of your business.

Discover our HR, Social & Payroll Consulting services.