In recent years, cryptocurrencies have gained a reputation for being innovative, feature-rich and having the potential for large returns. The success of cryptocurrencies, particularly Bitcoin, which has received the most media coverage, has naturally led to questions concerning their value and tax treatment. At the time of writing, Swiss tax law has not made any specific provisions for cryptocurrency, unlike some of our neighbouring countries, such as France. The taxation of these digital assets will therefore be based on existing legislation and the established practice of tax authorities. In this article, we will explain in depth everything you need to know about the taxation of cryptocurrencies in Switzerland.

What is cryptocurrency?

Cryptocurrencies are currencies that are encrypted and virtual, generated by a decentralised, peer-to-peer computer network. The best-known network of this kind is blockchain, which is verified by “miners”. Miners are users who make IT resources available to ensure the security of the transactions. They manage the blockchain system and verify that the user carrying out the transaction is actually in possession of the cryptocurrency. This process, known as “mining”, is carried out using complex mathematical equations and is remunerated by the creation of cryptocurrency issued by the system.

Different types of cryptocurrency

To determine the tax treatment of a given cryptocurrency, we must first understand its classification. The Swiss Federal Tax Administration (FTA) has identified three types of cryptocurrency, based on guidance from FINMA (the Swiss Financial Marketing Supervisory Authority):

- Native tokens: these tokens can be used as a method of electronic payment and confer no rights on the issuer. These are “pure” cryptocurrencies, such as Bitcoin or Ether, and are the main focus of this article.

- Asset-backed tokens: these tokens are issued as part of a round of fundraising (ICO/ITO) by an issuer and incorporate issuer rights. They can represent debt obligations, by which the issuer must pay interest to the holder, and can even entitle the holder to voting rights under company law.

- Utility tokens: these tokens are also issued as part of a fundraising round. Unlike asset-backed tokens, they do not confer any rights of ownership or payment to the holder. The only entitlement they provide is the use of an electronic service available on a blockchain-based system.

Tax rules for native tokens

In Switzerland, cryptocurrency assets and certain capital gains must be declared on your tax return. To ensure that they are correctly declared, you must take account of the declared value and the origin of the cryptocurrency. Their tax treatment will be different depending on whether they originated from the taxpayer’s private or business wealth.

Income tax

The first thing to note is that capital gains arising from a private wealth asset are exempt from income tax. This rule also applies to capital gains from cryptocurrency. The realised gains arising from the disposal of cryptocurrency are therefore not subject to tax. Conversely, any losses arising from the disposal of cryptocurrency assets are not tax-deductible.

There are, however, situations in which cryptocurrency is not considered to be part of an individual’s private wealth. In fact, cryptocurrency is considered to be business wealth when it is derived from self-employment. This is the case when the virtual currency is used in regular trading. How can you determine if your cryptocurrency is considered to be part of regular trading? Well, there are a number of criteria, the main being:

- Foreign financing

- Disposal of the cryptocurrency after holding it for a period of less than 6 months

- A total volume of transactions in any calendar year that exceeds five times your total assets at the beginning of the tax period

- The need to raise capital from cryptocurrency transactions to make up for lost income

We should, however, make it clear that only a full assessment of your circumstances will determine if the activity should be considered to be that of a professional trader.

Furthermore, there are different tax treatments in each Canton. Every Canton has the freedom to determine whether or not an individual’s cryptocurrency transactions should be considered self-employed activity. Taking into account the discretion given to the authorities, it is recommended that you seek advice from a specialist if you envisage carrying out any significant transactions.

This is a very important consideration, as it can have a real impact on your assets. The disadvantages of the business wealth classification mostly relate to taxation and OASI (old age and survivors’ insurance). If the cryptocurrency transactions are considered to be business-related, then all gains are considered to be taxable. The gains can no longer be considered exempt, unlike those arising from private wealth. Moreover, since cryptocurrency is considered to be a virtual security, any securities (of the physical kind) activity judged to be business-related is likely to include cryptocurrency activity by definition, and vice versa. On the other hand, given that OASI contributions are calculated based on actual income arising from business wealth, these contributions can also be deducted from realised cryptocurrency gains. This involves an increase in business costs. And on the plus side? Those who hold cryptocurrency as part of their business wealth can deduct any realised losses, as well as any downward adjustments in value!

For blockchain miners, the main question is whether the mining is carried out as a self-employed activity. If so, the cryptocurrency received constitutes self-employed taxable income. Because they are considered to be business wealth, capital gains made as a result of their disposal will also be taxable.

It’s interesting to note that the classification of mining is the subject of debate in Switzerland. For example, the Cantons of Bern and Zurich have determined that a miner’s activity should always be considered to be self-employed activity, whilst the FTA and the Cantons of Zug and Lucerne look at the nature of such activity on a case-by-case basis before making their decision.

In terms of self-employment or cryptocurrency trading, the taxable income is made up of cryptocurrency obtained through mining on the one hand, and realised capital gains arising from business wealth on the other, i.e. the realised gains from the sale or from a purchase made after short-selling the cryptocurrency.

Wealth tax

Under Swiss tax law, cryptocurrencies are considered to be items that can be valued and traded. They are therefore assets that are subject to wealth tax. Tax rates vary from one canton to another.

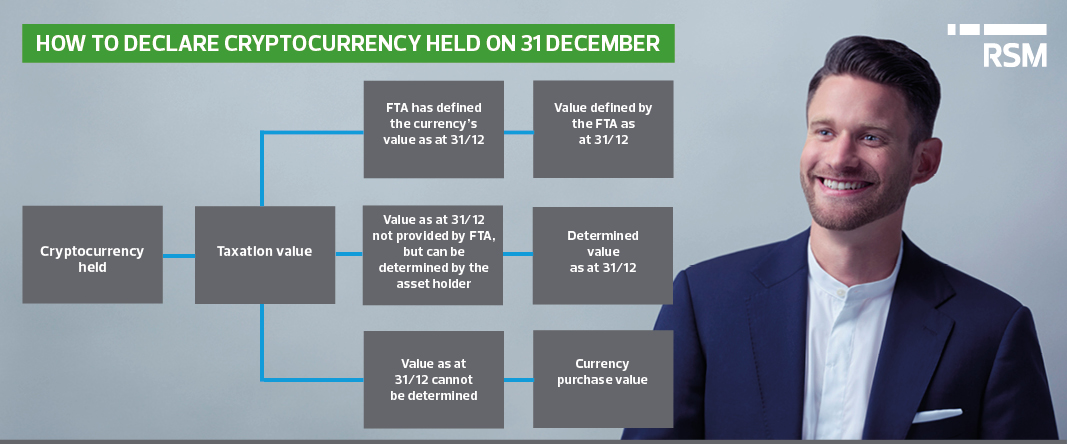

The Swiss Federal Tax Administration defines the taxation value of the most commonly used cryptocurrencies on 31 December each year. These include Bitcoin, Bitcoin Cash, Ether, Litecoin and Ripple. Taxpayers must refer to this taxation value when declaring their virtual assets. If the FTA has not provided a value for a cryptocurrency, the asset holder must declare the value as of 31 December using the value defined by the platform on which the assets are held. If the platform does not allow the user to determine the value of the virtual currency, the taxpayer must declare the purchase value.

The diagram below summarises how to declare cryptocurrency held on 31 December of each year:

The value for tax purposes on business wealth is determined in the same way as it is for private wealth, i.e. according to the taxation value of the currency on 31 December of that year.

Tax rules for asset-backed tokens

Tax treatment of asset-backed tokens depends on the relationship that exists between the investor and the issuer under civil law.

If the holder receives interest in return for their investment, they must pay tax on their income in the same way as a taxpayer who receives interest on other types of investment. Along similar lines, the payment of benefits by the issuer to the token-holder that are calculated based on a share of profits is considered to be taxable income from wealth.

Capital gains tax arising from asset-backed token transactions follows the same rules as those described above for native tokens.

For wealth tax, the rules described for native tokens also apply here.

Tax rules for utility tokens

Tax treatment of utility tokens also depends on the relationship that exists between the investor and the issuer under civil law.

If these tokens only confer the right to access a service and no payment is made to the token-holder, there is no taxable income.

In terms of capital gains tax and wealth tax, the same rules as described for native tokens apply to utility tokens.

Voluntary disclosure

Why is it important to properly declare cryptocurrency? Because any taxpayer who does not declare their assets is at risk of being subjected to an additional tax assessment and, in parallel, tax evasion proceedings. The outcome of the latter process could be a fine amounting to between a third and three times the amount of tax owed.

However, it is still possible to avoid the fine by declaring your cryptocurrency through a voluntary disclosure. It’s worth noting that this opportunity is only offered once and it doesn’t mean that you can avoid paying taxes or late payment interest. To be eligible for this process, the tax authorities must have no prior knowledge of the tax evasion. The taxpayer must cooperate fully with the authorities to establish the tax amount owed and pay it back.

If you are required to undergo this procedure, we are of course available to advise you.

Plans for taxation

aIn light of the rapid changes in blockchain technology and the new challenges posed by cryptocurrencies, the Federal Department of Finance (FDF) has been reviewing Swiss tax law. In June 2020, it published a report (in French) detailing the likely need for tax law changes to handle developments in distributed ledger technology.

The FDF examined whether there was a need to take action on income tax, wealth tax, VAT, withholding tax and stamp duty. The report concluded, however, that the existing Swiss regulations were satisfactory. On one hand, the current legal framework, which is endorsed in practice by the authorities, can account for the majority of circumstances encountered. On the other, the status quo ensures Switzerland is an attractive hub for innovation and investment in cryptocurrencies.

There have been similar initiatives at an international level. For example, the OECD prepared a report on the taxation of virtual currencies in October 2020 and presented a country-by-country overview of tax treatment. However, this document only touched upon general, non-binding considerations that the public policymakers could take into account for taxation of cryptocurrencies.

Whilst there are no current plans to amend Swiss tax law, a proactive approach remains necessary. It’s only by closely monitoring technological changes that potential future tax issues for both individuals and professionals can be anticipated.

We hope that this article has helped you to better understand the tax issues surrounding cryptocurrencies in Switzerland. If you want to stay up to date with the latest tax developments on this type of asset, please follow us on LinkedIn and keep an eye on our Newsroom.