Audit committees are recognised by leading businesses as playing an integral role in the oversight of the internal and external audit functions and in supporting management by reviewing the assurances on governance, risk management, the control environment and monitoring the statutory audit process.

In our view, companies regardless of size or nature can benefit from having audit committees as they can contribute to enhancing controls, operations and ultimately the long-term success of the organisation.

Requirements to have an Audit Committee

Prior to June 2014, and as a result of EU Directive 2006/43, only ‘Public Interest Entities’ were required to have an audit committee. Public Interest Entities include:

- companies with shares quoted on the stock exchange;

- banks and other credit institutions;

- insurance companies.

However, with effect from 1 June 2015, Section 167 of the new Companies Act 2014 (‘the Act’) introduced a requirement for the directors of all large companies to establish an audit committee.

A large company/group is defined as one with:

- a balance sheet total, in the most recent financial year and the year immediately preceding that year, of over €25 million and

- a turnover of over €50 million.

However, if the board of directors decides not to establish an audit committee, the directors shall, in the directors’ report included within their financial statements, disclose the basis for that decision.

Where the directors are found not to have complied with the requirements of the Act, they will be guilty of an offence carrying a fine of up to €5,000 or imprisonment not exceeding six months or both.

What is an audit committees and who should be a member?

The board should ensure that the audit committee consists of directors who are knowledgeable and competent in financial matters, have adequate independence and are not afraid to challenge management. While the audit committee of a public interest entity must contain at least two independent non-executive directors of the company, the Act’s only requirement with regards the composition of an audit committee is that it should include one non-executive director who is independent and suitably qualified.

‘Independent’ means that they have not, in the three years preceding their appointment, either had a material business relationship with the company, held a position of employment or been engaged in the daily management of the company. ‘Suitably qualified’ means that the non-executive director has competence in accounting or auditing.

What is an Audit Committee’s role?

Audit committees are an integral part of a company’s internal control and corporate governance function and, as such, the role of the audit committee typically includes the following:

- monitoring the effectiveness of the systems of internal control, internal audit and risk management

- monitoring the financial reporting process

- monitoring the statutory audit of the financial statements

- appointing, reviewing and monitoring the independence of the statutory auditors.

There are many responsibilities which an audit committee undertakes. The responsibilities will vary depending on the size and the nature of the business of the company. Risk management remains an important area of focus for audit committees, as they are tasked with identifying corporate risks and ensuring relevant mitigating controls are in place. In larger companies this has resulted in risk management committees being established, usually stemming from the audit committee, but ultimately it comes back to the audit committee for monitoring.

The audit committee is responsible for the appointment and oversight of the work of the external auditor and in this regard they should seek to appoint an audit firm with relevant expertise. The committee will review the proposed audit approach and an active audit committee will stay involved with the auditors throughout the year and not just at the beginning and/or end of the audit.

In relation to the internal audit function, the audit committee will review and approve the audit plan and meet with management and the internal auditors regularly to discuss matters arising from internal audit reports.

What are the advantages of having an audit committee?

The remit of an audit committee is often broad covering areas such as financial reporting, operations, risk management and compliance.

An audit committee brings an objective perspective to the company’s internal controls and processes and can benefit the company over the long term. It can also assist in identifying and assessing the company-wide risks and recommend actions to mitigate those risks. The overall independence and integrity of the internal audit function is strengthened by having the internal auditor reporting directly to an audit committee. Similarly, an active audit committee that meets with external auditors can share perspectives and gain valuable insights about best practice and how it could be adopted by the company.

By strengthening the internal controls and corporate governance, an audit committee can assist the company in mitigating the risk of fraud.

Relationship between Audit Committee, Internal and External Auditors

Today’s regulatory environment can be challenging on audit committees who are under significant pressure to keep up to date with financial oversight requirements and guidelines. This pressure can be alleviated by having effective relationships with highly skilled and technically proficient internal and external auditors.

Both formal and informal engagement among the audit committee, internal auditors and external auditors are important in enhancing the value that each brings to the company. The relationship between the three parties can be developed by:

- Understanding one another’s roles

- Enhancing skills/expertise

- Communicating effectively

Understanding one another’s roles

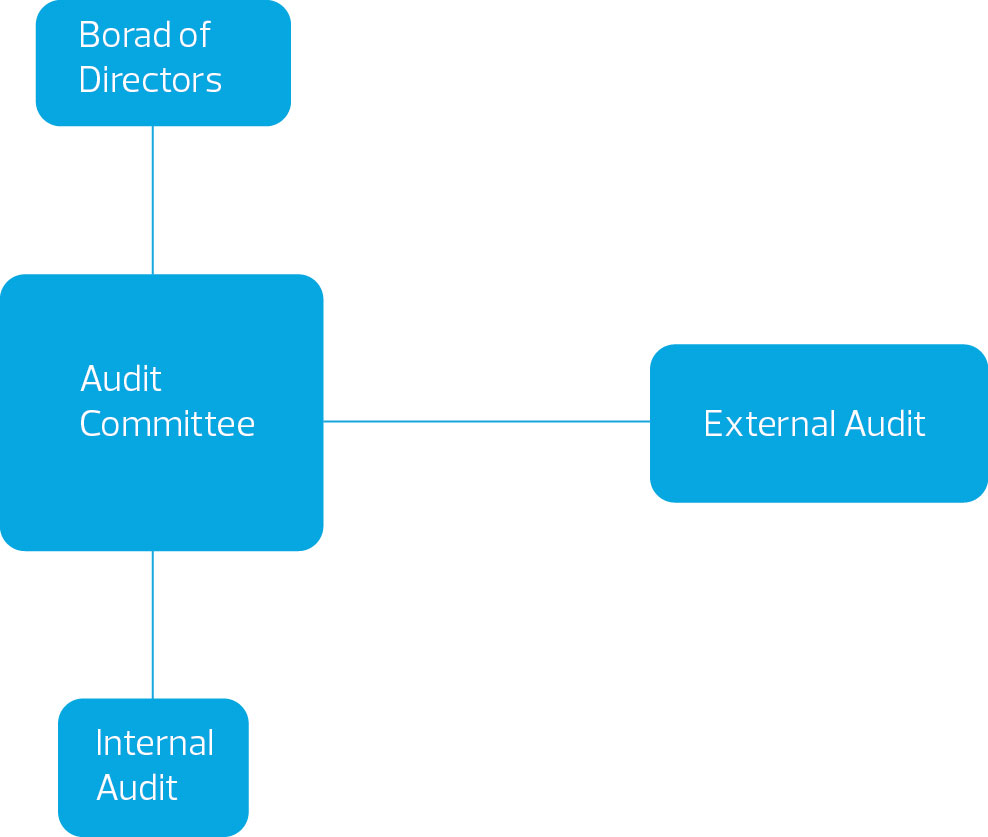

It is important that there is sufficient clarity between the roles and responsibilities of the audit committee, internal audit and external audit and that each function is aware of one another’s roles. This will assist in understanding what is expected of everyone involved and in avoiding duplication of activities. While each has their own distinct role, the audit committee, internal audit team and external auditors all feed into the overall corporate governance and performance management of the company as demonstrated in the diagram below.

Skills/expertise

Audit committees should be comprised of members who are independent and objective to the company and yet have a clear understanding of the business’s needs, objectives and priorities.

An Audit committee, therefore, should include members with a range of skills and experience that will contribute effectively to the work of the committee.

Internal auditors are required to possess the knowledge, skills and other competencies needed to perform their individual responsibilities and often internal auditors have a high level of risk assessment expertise. Internal auditors should have a deep understanding of the policies, processes and procedures of the company and act as the audit committee’s ‘eyes and ears’.

External auditors should be technically proficient and possess knowledge of the company’s industry and business environment. They should also be equipped with the necessary tools to assess areas for improvement and make useful recommendations that will add value to the company.

Communicating effectively

Effective communication is the key to any relationship be it personal or professional. In the case of audit committees, internal and external audit, a good working relationship will enhance the overall effectiveness of the work of each function and consequently the overall internal control function. Communication between the three can be enhanced through regular meetings, timely and accurate information sharing and by keeping the strategies and goals of the company in mind at all times.

Information should be shared relating to emerging issues external to the company and to regulatory guidance so that any significant developments can be addressed appropriately.

The implementation of the new 2014 Companies Act has created an opportunity for companies to apply best in practice governance practices and procedures. We believe that in practice most large indigenous companies will embrace the opportunity to have an audit committee to enhance existing financial and corporate governance structures and protect stakeholder’s interests.