The Small Company Administrative Rescue Process (SCARP) has been introduced as a mechanism to restructure micro or small companies, to protect jobs and to preserve viable businesses through a simplified restructuring process.

Who is eligible and what's the qualification criteria?

The Small Company Administrative Rescue Process is specifically designed for micro or small companies as defined by the Companies Act 2014. The Company must not be in liquidation and have a prospect of survival after the process has concluded.

The company must meet at least two out of the three criteria below:

- turnover must not exceed €12,000,000;

- balance sheet total must not exceed €6,000,000;

- number of employees must not exceed 50.

Key components of SCARP

- The Small Company Administrative Rescue Process reflects many provisions of the Examinership Legislation.

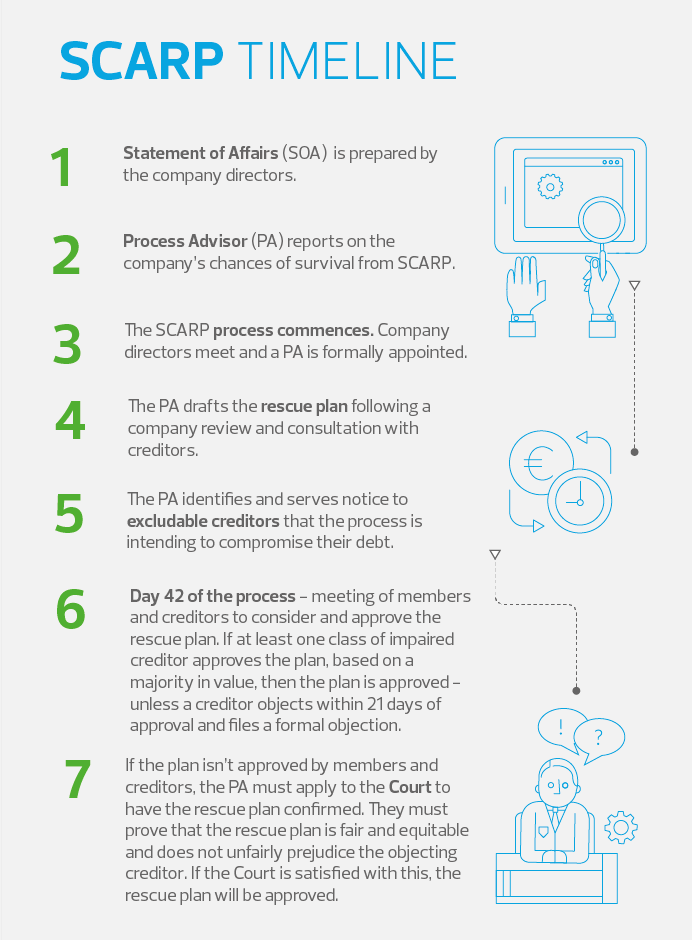

- Prior to formal commencement of the Process, the Directors of the Company will prepare a Statement of Affairs.

- An insolvency practitioner known as a “Process Advisor” is appointed by the company to engage with creditors and prepare a rescue plan.

- The Process Advisor cannot be the Auditor for the company.

- The Process Advisor will issue a report confirming the Company has a reasonable prospect of survival, following the Small Company Administrative Rescue Process.

- The process is commenced by resolution of the directors of the company rather than by application to the Court and is concluded within a shorter period than examinership.

- The Process Advisor will assess the financial position of the Company, engage with creditors and devise an appropriate rescue plan for the Company.

- The rescue plan must be prepared to satisfy the “best interest of creditors” test. The plan would provide each creditor with a better financial outcome than if the company was liquidated.

- No creditor can be unfairly prejudiced by the plan.

- The creditors of the company will be invited to vote on the rescue plan by day 42 of the Process Advisor’s appointment.

- The rescue plan is approved without the requirement of Court intervention provided the majority in value of an impaired class of creditors vote in favour of the proposal and no credito.r raises an objection to the plan within the 21-day period which follows the vote.

- Where there is an objection to the rescue plan, there is an automatic obligation on the company to seek the Court’s approval.

- The process seeks to arrive at a conclusion within 70 days. This may be subject to an extension where necessary for Court applications.

- State creditors are classified as an excludable debt.

- State creditors can be included in the rescue plan provided there are no objections by the state creditor regarding tax matters or tax audits.

- Creditors can engage with the Process Advisor upon his/her appointment and disclose any facts they consider relevant to the process.

- The Process Advisor will be subject to the same reporting requirements as a liquidator.

Our experienced and qualified Restructuring Advisory team have the expertise to act as Process Advisor should your business be eligible for SCARP. If you have any questions or require further information or assistance, please don't hesitate to contact us.