IFRS 16 – LEASES

INTRODUCTION

International Financial Reporting Standard (IFRS) 16, Leases, came into effect for periods commencing on or after 1st January 2019 with the main objective being that lease contracts should be recorded in the balance sheet of the lessees (no operating leases).

Significant changes are therefore expected in the lessee’s accounting increasing visibility of their assets and liabilities, compared to lessors where the changes expected are in the form of additional disclosure requirements in the financial statements.

Short-term leases (less than 12 months) and leases of low-value assets are exempt from the requirements of IFRS 16.

MAIN CHANGES

Leases can be used to provide access to assets without significant upfront costs. Without entities recognising these leased assets in their financial statements (along with the corresponding liability), users can neither see all the assets that the entity is benefiting from, nor easily compare their financial position to entities which have chosen to either buy the asset outright, or have entered into alternative financing arrangements.

IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to which risks and rewards incidental to ownership of the leased asset lie with the lessor or the lessee. However, IFRS 16 removes the ‘operating’ and ‘finance’ lease distinctions for lessees and replaces them with the concept of ‘right-of-use’ assets and associated financial liabilities.

|

|

Financial statement |

IAS 17 |

IFRS 16 |

|

Operating leases |

Statement of financial position |

|

|

|

|

Income Statement |

|

|

|

|

Statement of cash flows |

|

|

|

Finance leases |

Statement of financial position |

|

|

|

|

Income Statement |

|

|

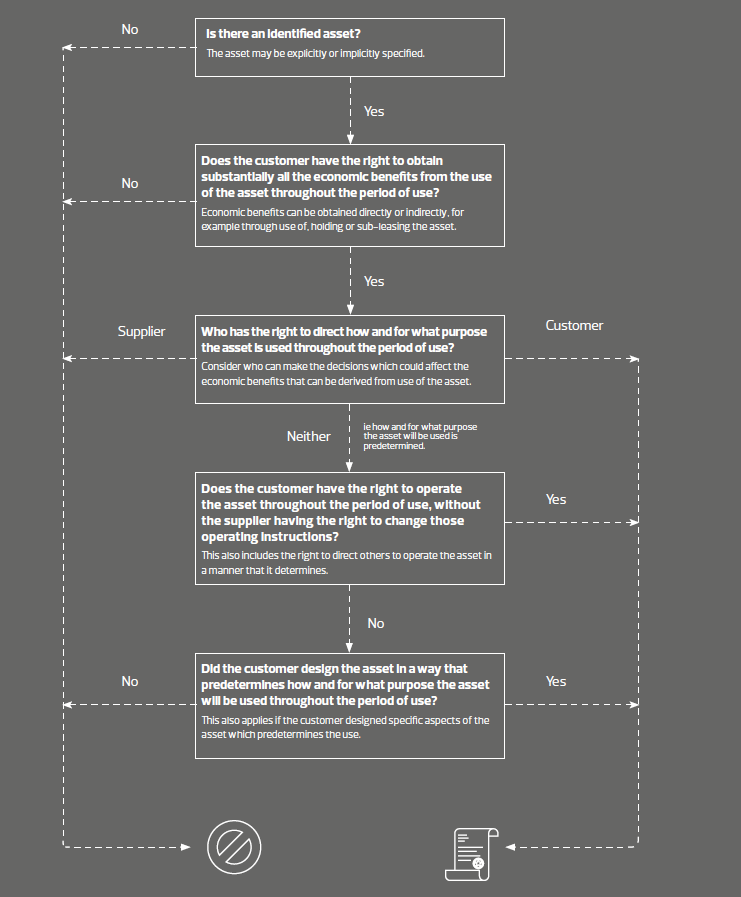

IDENTIFICATION OF A LEASE CONTRACT

IFRS 16 largely retains the definition of a lease given in IAS 17. However, the guidance setting out how to apply that definition has changed. This means that potentially more contracts will be brought into the scope of the new Standard, and some contracts which were considered to contain a lease under IAS 17 may be scoped out.

Whether a contract is, or contains a lease is now driven much more by the question of which party to the contract controls the usage of the underlying asset for the period of use. It is not sufficient for a customer to have the right to obtain substantially all the benefits from the use of an asset any more, the customer must also have the ability to direct the use of the asset.

WHEN AND WHAT SHOULD BE RECOGNISED AT COMMENCEMENT DATE

At the commencement date (the date on which a lessor makes the underlying asset available for use by a lessee), you need to recognise:

- A lease liability for the present value of future lease payments made over the lease term that are economically unavoidable (‘lease liability’); and

- A right-of-use asset at cost.

| Step 1: Calculating lease term | |

| Non-cancellable period of the lease | X |

| Period covered by an option to extend the lease (if reasonably certain) | X |

| Period covered by an option to terminate the lease (if reasonably certain not to exercise the option) | X |

| Lease term | X |

| Step 2: Calculating the present value of future lease payments | |

| Fixed lease payments (made over the lease term) (including variable payments that are in substance fixed) | X |

| Receivable lease incentives | X |

| Optional payments that are likely to be made (such as fees to take an option to extend a lease) | X |

| Variable payments that rely on an index or rate | X |

| Future lease payments | X |

| Discount to reflect the time value | X |

| Lease liability at commencement date | X |

| Step 3: Calculating the right-of-use of asset at cost | |

| Lease liability at commencement date | X |

| Payments made before commencement date | X |

| Initial estimate of any restoration costs | X |

| Any lease incentives received | (X) |

| Cost of right-of-use asset | X |

EXAMPLE OF INITIAL MEASUREMENT OF LEASE LIABILITY AND RIGHT-OF-USE OF ASSET

Lessee A enters into a 5-year lease on a building. To obtain the lease, Lessee A incurs initial costs of CU 30,000. CU 20,000 relates to a payment made to a former tenant occupying the property and the remaining CU 10,000 is paid to the estate agent for arranging the lease.

The contract sets out a minimum lease term of 5 years with the option to extend it for a further 5 years.

The payment schedule is as follows:

- First 5 years – CU 50,000 per annum in advance

- Optional 5-year period – CU 55,000 per annum in advance

At the commencement date, Lessee A concludes that it is not reasonably certain to exercise the option to extend the lease and, therefore, determines that the lease term is 5 years.

The interest rate implicit in the lease is not readily determinable, however, Lessee A’s incremental borrowing rate is 5 per cent per annum, which reflects the fixed rate that Lessee A would pay, should it borrow an amount equivalent to the value of the right-of-use asset, in the same currency, for a 5-year term, and with similar collateral.

At the commencement date, Lessee A also receives CU 5,000 of lease incentives from the Lessor.

The initial costs of CU 30,000 are added to the cost of the right-of-use asset as the costs incurred are initial direct costs, defined as “the incremental costs of obtaining a lease that would not have been incurred if the lease had not been obtained”

Step 1: Determine the lease liability at commencement date by determining the present value of the remaining minimum lease payments, discounted at an interest rate of 5%.

|

Year |

Cash flow |

Discount factor |

Present value |

|

2 |

50,000 |

0.952 |

47,600 |

|

3 |

50,000 |

0.907 |

45,350 |

|

4 |

50,000 |

0.864 |

43,200 |

|

5 |

50,000 |

0.823 |

41,150 |

|

|

|

|

177,300 |

Step 2: Determine the right-of-use asset at the commencement date.

|

Lease liability |

CU 177,300 |

|

First lease payment |

CU 50,000 |

|

Initial direct costs |

CU 30,000 |

|

Incentives received |

(CU 5,000) |

|

Right-of-use of asset |

CU 252,300 |

Lessee initially recognizes assets and liabilities in relation to the lease as follows:

|

|

DR |

CR |

|

Right-of-use of asset |

CU 252,300 |

|

|

Lease liability |

|

CU 177,300 |

|

Cash (lease payment) |

|

CU 50,000 |

|

Cash (initial direct costs) |

|

CU £ 30,000 |

|

Cash (lease incentive) |

CU 5,000 |

|

SUBSEQUENT MEASUREMENT AND DISCLOSURE

Right-OF-use asset

The right-of-use asset will be subsequently measured using either the cost or fair value model.

If an entity selects the cost model, then the right-of-use asset is recognised at cost less any accumulated depreciation and accumulated impairment losses.

If the right-of-use asset relates to a class of property, plant and equipment which the revaluation model applies, an entity may elect to apply the revaluation model to all of the right-of-use assets that relate to the particular class.

An entity that has a fair value through profit and loss accounting policy for its investment properties must measure any right-of-use asset that meets the definition of an investment property at fair value.

TRANSITION PROVISIONS

There are two transition models selected which must be applied consistently to all leases once selected.

Full transition method

Under the full transition method, IAS 8 is applied in full, meaning that the financial position at the beginning of the comparative period is restated to reflect the carrying value of the right-of-use assets and the financial liabilities as if IFRS 16 had been applied from the inception of each lease.

Cumulative Catch Up Approach

Under the cumulative catch up approach, the initial application date is determined to be the first day of the financial period in which IFRS 16 is being applied. This means that corresponding amounts are presented having applied IAS 17. Whilst this method may be considered to be easier to apply than the full transition method, the prior period financial position and results will not be comparable with the performance and position presented for the current period. For this reason, entities are required to disclose the effect of applying this approach including:

- An explanation of any difference between the operating lease commitments disclosed for the corresponding period discounted using the incremental borrowing rate and the lease liabilities recognised on initial application of IFRS 16; and

- The weighted average incremental borrowing rate that has been applied to lease liabilities recognised at the date of the initial application.

Under this approach, there is also the option of applying some additional practical expedients such as:

- Portfolio discount rate where an entity can apply a single discount rate to a portfolio of leases that have reasonably similar characteristics;

- Leases with less than 12 months remaining treated as short term operating leases as under IAS 17;

- Use of hindsight in applying the new leases standard. For example, if a lease has been extended or terminated, this known information can be used in determining the lease term; and

- Measuring the right-of-use asset at an amount equal to the lease liability as at the date of the initial application.

NEW DISCLOSURE REQUIREMENTS

The objective of the disclosure requirements in IFRS 16 is for lessees to provide information that will assist users of the financial statements to assess the effect that leases have on the financial position, performance and cash flows of the business.

- By class of underlying asset:

- Depreciation expense

- Carrying value of right-of-use assets

- Additions to right-of-use assets

- Interest expense on lease liabilities

- Other expenses relating to:

- short-term leases where the practical expedient has been applied (need not include leases with a lease term of one month or less);

- leases of low-value assets; and

- variable lease payments not included in the lease liability.

- Accounting policy for short-term leases and low value assets if the exemptions are taken

- Sub-letting income from right-of-use assets

- Total cash outflow for leases

- Gains and losses on sale and lease back transactions

- Costs that the lessee has included in the carrying amount of another asset.

Additional qualitative and quantitative disclosures will also be necessary about the entity’s leasing activities if they are considered necessary to meet the overall disclosure objective set out above. This may include for example, details of the leasing activities entered into, the variability of future cash outflows, restrictions or covenants imposed by the lessor.

HOW CAN RSM HELP

-

Assess the impact of the new standard on your key performance indicators.

-

Help you understand the impact of implementation on your financial statements and your business.

-

Develop an implementation plan to ensure smooth and cost effective transition and project manage the implementation process.

-

Establish an appropriate business process and system of internal control over accounting for leases.

-

Assess the impact of any modifications to the lease terms and how they will be accounted for.