Garbage In = Garbage Out

A valuation is the estimate of the price at which an asset would or should change hands between two well-informed parties.

The quality of the valuation output is a product of the quality of the financial information provided, or in other words, garbage in equals garbage out.

A key component of a valuation is reliance on the financial information of the business that is being valued. In a recent valuation, we were asked to prepare our opinion as at a date that was not a financial year-end and we were provided with the management accounts as at the valuation date.

As we progressed through the valuation and requested supporting documents, we noticed discrepancies in the balances. Subsequent to the provision of the management accounts to us, material adjustments had been made but not disclosed which would have resulted in a difference of $1m to our valuation opinion.

The significant differences not only raised red flags in relation to the quality of the information provided but if extra steps had not been taken by us it may have resulted in an inequitable property settlement, the need to update the valuation at further cost to the client or a delay in proceedings. As qualified business valuers, we are acutely aware of the impact that poor quality financial information can have on a valuation. This article outlines some key considerations that we feel lawyers providing instructions to business valuers within the context of a family law matter should be aware of.

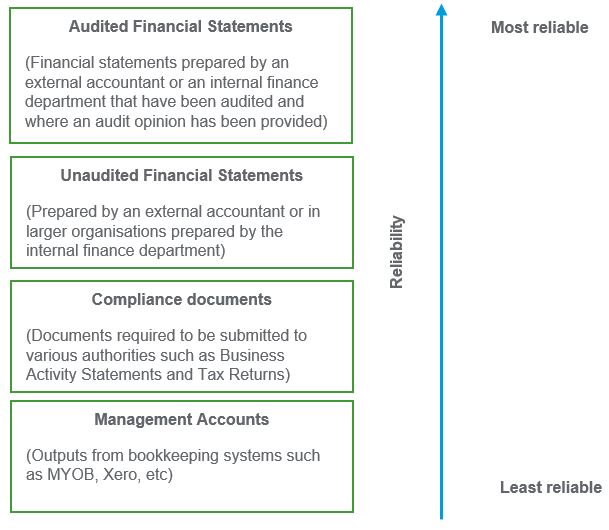

Outlined below is a summary of the types of financial information provided by the client that could be available for use in a business valuation and the relative reliability:

In most cases, the larger the business the more sophisticated their financial information is required to be for compliance purposes (for lodgement with the ATO, ASIC, and potentially the ASX) and therefore the information available for a valuation is generally more reliable in its nature.

A valuation is not an audit or a forensic review of the financial information and for most of the businesses that are of the size and scale that require a valuation for family court purposes, we anticipate being provided with unaudited financial statements for each financial year.

These provide us with some reassurance that transactions and balances have been recorded consistently, that they have materially been reviewed by an accountant (either internal or external) and therefore they are an accurate reflection of the actual financial performance and position of the Business*.

We are often asked to prepare a valuation at a point in time which is not a financial year-end, and this inevitably results in the request that we prepare our valuation based on either source documents or management accounts.

Typically, we find management accounts vary to financial statements in the following areas:

- Capital acquisitions may be expensed, rather than being shown as an asset on the balance sheet decreasing profitability and net assets;

- Stock or work in progress (WIP) balances either haven’t been updated from the prior year-end or are based on arbitrary assessments – physical stock counts may only be conducted at 30 June each year;

- No movements recorded in the provisions for annual leave, sick leave, and long service leave;

- Bank accounts may not reconcile to the actual bank balance or only reconcile due to the presence of unallocated transactions such as a suspense account or clearing account;

- No depreciation or amortisation has been recorded since the last financial year;

- Repayments of debts have not been appropriately allocated between principal and interest;

- Shareholder loan balances often used as a ‘dumping ground’ during the year for all owner related items before year-end tax calculations are completed;

- Poor attempts at manipulating profitability and net assets, often through stock/WIP movements or provisions; and

- Inconsistent application of accounting policies particularly due to accrual accounting.

Therefore, management accounts when accepted at face value may result in an inaccurate valuation opinion. However, we don’t just toss all management accounts in the garbage, when prepared appropriately they can be a great tool to guide the performance expectations for the current financial year, provide comparisons to historical and budgeted financial performance and a snapshot of the financial position of the business as at the valuation date.

As part of our engagements where we rely on management accounts we typically request documents to support key account balances such as bank statements, debtor and creditor ledgers, payroll reports, and loan agreements. Whilst our job is not to reconstruct financial statements we do ensure that if a balance differs to the underlying source data we adjust the balances accordingly in our opinion and where appropriate we adjust for particular transactions in our earnings-based valuations to ensure that the financial information reflects as accurately as possible the financial performance of the business.

So, what should you do if you are requesting a valuation at a date other than a financial year-end?

The crucial decision to ensure you obtain a satisfactory valuation opinion is to appoint an appropriately qualified valuer who you are confident has the skills and abilities to deal with the information available, and where possible we suggest that interim financial statements are prepared by an accountant (not the valuer) as at the valuation date.

*If your client has concerns about the reliability of the financial information (including concerns about hiding assets) we always suggest that these issues are resolved prior to the valuation process. This may be addressed by the preparation and external review of interim financial statements as at the valuation date or a forensic review of the source information.

For more information

If you require further information on business valuations, please contact your local RSM office.