You’ve recently graduated as a medical professional after years of hard work and endless hours hitting the books.

As tempting as it is to use your well-earned income on a feature-packed credit card and a new BMW, have you considered the power of a small investment into your superannuation?

Superannuation isn’t just a concessionally taxed structure through which you save for retirement. It is an investment vehicle that, when used to its full potential, can compound and multiply in value many times over.

We all know that motor vehicles depreciate over time as the vehicle gets older and accumulates more kilometres on the clock.

We all know that motor vehicles depreciate over time as the vehicle gets older and accumulates more kilometres on the clock.

If you purchased a BMW for $60,000, it is likely to be worth only $11,000 in 10 years’ time1.

That means that you have lost an average of $4,900 per annum or total depreciation of 81.66% on the value of the vehicle1.

People often overlook depreciation, however, when taking these numbers into account, the purchase of a vehicle should be carefully considered.

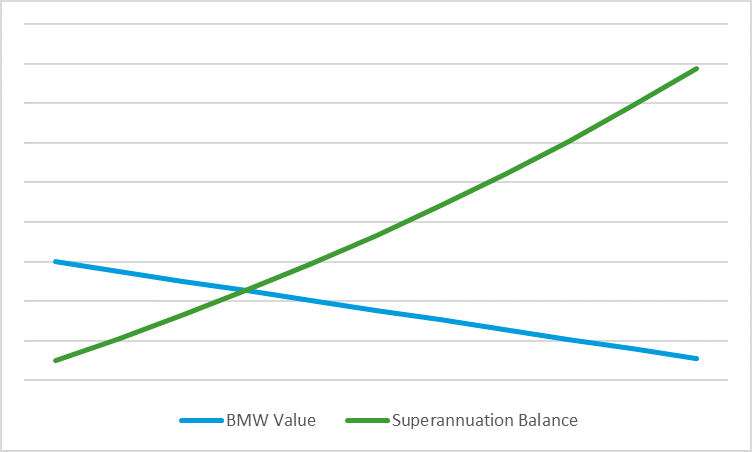

Graph A: The estimated depreciating value of a BMW compared to the potential growth value of superannuation (not including Superannuation Guarantee contributions).

Instead of purchasing the dream BMW in year one of your career, we considered the option of buying a slightly cheaper vehicle and contributing $10,000 each year into superannuation.

Instead of purchasing the dream BMW in year one of your career, we considered the option of buying a slightly cheaper vehicle and contributing $10,000 each year into superannuation.

If you start this arrangement from the age of 30, your superannuation fund could be worth over $485,000 by the time you reach age 65, without considering any employer (superannuation guarantee) contributions2. If you add employer contributions into the equation (at the standard rate of 9.50% of your income), your superannuation fund could be worth over $960,000 by the age of 65 (based on an annual income of $180,000)2.

A rate of return of 6.0% per annum has been used for this example, and the outcome will vary greatly for each person depending on your income throughout your career and the way your superannuation fund balance is invested.

Earning 6.0% per annum on your superannuation fund makes more financial sense than losing 15.60% per annum on the value of your vehicle. In fact, the value of the BMW will be just $159 after 35 years using an average depreciation rate of 15.60%1. Of course, that is assuming the car is still functional at that point in time!

There are various ways that you can contribute into superannuation including concessional and non-concessional contributions.

There are various ways that you can contribute into superannuation including concessional and non-concessional contributions.

Concessional contributions

- Concessional contributions are put into your super fund from your pre-tax income (e.g. employer or salary sacrifice contributions) and are taxed at 15% when the contribution enters the superannuation environment.

- You may be entitled to claim an income tax deduction for personal concessional contributions.

Non-concessional contributions

- Non-concessional contributions are referred to as after-tax contributions as tax has already been paid on the money used to make the contribution.

- Non-concessional contributions are not taxed when they enter the superannuation environment and you are not able to claim an income tax deduction for these contributions.

- Each type of contribution has a ‘cap’ or a maximum amount that you can contribute into your superannuation fund each year.

Next steps...

A licensed adviser may also be able to provide advice around the best way for you to invest your superannuation balance to maximise investment returns within your comfort zone.

If you start early with the assistance of quality advice from a licensed adviser, the strategy will pay dividends for years to come.

If you are considering adding to your superannuation on a regular basis, a RSM Financial Adviser can assist you in selecting the most appropriate type of contribution to obtain the best outcome for your personal financial situation.

This page has been prepared by RSM Financial Services Australia Pty Ltd ABN 22 009 176 354, AFS Licence No. 238282.

As everyone's circumstances are different and this article doesn't take into account your personal situation, it is important that you consider the above in light of your financial situation, needs and objectives, and seek financial advice before implementing a strategy.

View the Financial Services Privacy Statement and Policy, Complaints Policy and Financial Services Guide