Why does it matter?

As of 1st January 2019, it has become possible to claim a deduction on qualifying income derived from qualifying intellectual property against one’s chargeable income arising out of trade. Of course as would be expected, the new legislation has not done without specifying exactly what intellectual property would qualify under the regime.

The assets in question would be ones over which protection rights have been granted by national or international legislation. Of note is the fact that even patents that are still being processed are eligible (albeit adjustment being required in the case of rejection). Malta Enterprise has also been granted the power to establish that in the case entities not exceeding specific criteria, it would be able to establish that an asset with features similar to a patent would qualify for this benefit.

Entitlement to the Deduction

The regime specifies additional criteria which need to be satisfied in order to warrant application thereof. It is clear that the intention is to support those entities which are carrying out research, development and similar activities in relation to the qualifying intellectual property. Substance also remains a crucial element to maintain and the beneficiary will be expected to have sufficient physical presence and structure as would be appropriate to the type and extent of activity being carried out in the relevant jurisdiction.

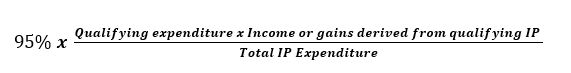

The deduction is calculated by reference to a prescribed formula.

Qualifying income will include income derived from the use, enjoyment and employment of the qualifying IP, royalties as well as other ancillary income. The legislation also prescribed the nature of qualifying expenditure which is predominantly expenditure related to the creation and development of the qualifying IP.

How can we help?

It’s important to work with a trusted advisor who understands your business and industry, and can help you achieve your objectives. Your RSM team will provide you with the necessary support and assistance in ensuring that you do not miss out on this opportunity. For more information on how you can benefit from this regime get in touch with your RSM contact or at the following contact details.

Karen Spiteri Bailey – Partner

Jana Farrugia – Senior Manager