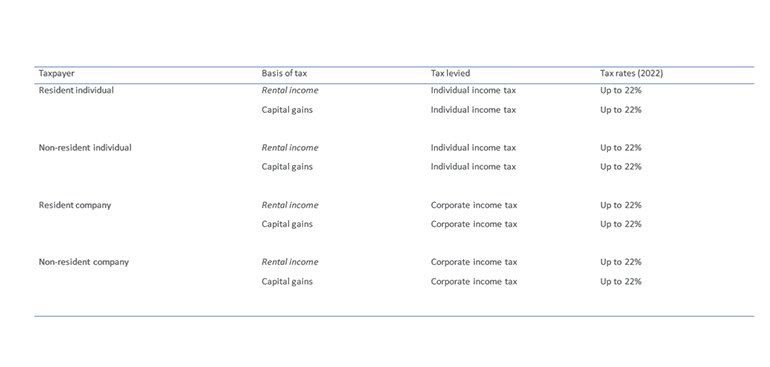

TAX TREATMENT OF INCOME AND GAINS

Individuals

lntroduction

Rental income is taxed as ordinary private or business income.

Liability to tax

Rental income received by individuals is subject to individual income tax.

Basis to tax

lncome of individuals is regarded as either employment income, business income or capital income. Rental income can either be taxed as business income from a sole proprietorship with a progressive tax rate between 33.2% and 50.6%, or as capital income at a flat tax rate of 22%.

Companies

lntroduction

Rental income is taxed as business income.

Liability to tax

Rental income earned by companies is subject to corporate income tax as business income.

Basis to tax

Business income is taxed at a flat tax rate of 22%.

Capital gains

Individuals

lntroduction

Capital gains are taxed as ordinary private income.

Liability to tax

Capital gains of individuals are subject to individual income tax.

Basis of tax

lncome of individuals is regarded as either employment income, business income or capital income. Capital gains are taxed at a flat tax rate of 22%.

Companies

lntroduction

Capital gains are taxed as business income.

Liability to tax

Capital gains earned by companies are subject to corporate income tax as business income.

Exemptions

Business income is taxed at a flat tax rate of 22%. However, an important exception applies under the participation exemption method, whereby companies owning shares or units are exempted from paying tax on profits or dividends from shares or units, subject to certain conditions.

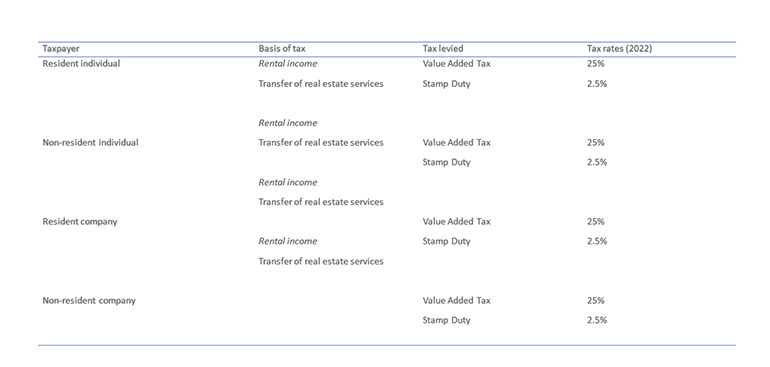

VAT & transfer taxes*

* Norway applies a 'stamp duty' on the transfer of immovable property

Value Added Tax

Individuals

lntroduction

Value added tax is a tax based on the increase in value of a product or service at each stage of the supply chain.

Liability to tax

lf an individual or a company performs commercial or professional activities in Norway, it will, as a main rule, be subject to VAT. An individual or company/business becomes liable for VAT when annual turnover from VAT liable revenue exceeds NOK 50.000.

Basis of tax

The transfer of real estate is exempt from VAT in accordance with the Norwegian VAT legislation, conversely no VAT is added to the acquisition price. Furthermore, VAT on construction costs related to a new or existing building is not deductible if the property is intended for sale.

In addition, VAT is generally not incurred when property is rented out. Any goods and services provided as part of the rent (e.g. electricity, cleaning, maintenance, etc.), will therefore be exempt from VAT.

However, an exemption is cost related to the construction of a building that will become an asset in a business liable to VAT; this gives the business right to deduct input VAT. The exemption above would also be applicable to letting of buildings for use by enterprises that are registered in accordance with the VAT legislation or a public body which is entitled to VAT compensation. In this case, the lessor can apply for voluntary registration in the VAT Register, which gives the lessor a right to deduct input VAT on purchases for his VAT liable business (e.g. construction costs and costs linked to the repair, maintenance and running of the let premises, etc.). Input VAT deducted on building projects with a VAT cost higher than NOK 100.000, and which does not constitute mere maintenance, is subject to adjustments in a 10-year period from completion, depending on changes in the use of the property.

When a property is voluntarily registered, output VAT of 25% must be calculated on the rent for tenants who use the premises in VAT liable business. This VAT is calculated using the rent together with any related costs of goods and services. The tenant will however be entitled to offset the input VAT, depending on the space actually used in their VAT registered enterprise. For a partly VAT liable business, there is a proportional right to deduct input VAT.

Companies

The same rules as for individuals apply.

Transfer Taxes

Individuals

lntroduction

Transfer tax is a tax on the passing of real estate from one person or company to another. In Norway there is stamp duty on the registration of ownership to real estate. There are no other transfer taxes.

Liability to tax

Anyone acquiring Norwegian real estate, and who wants to register their ownership, is subject to stamp duty of 2.5% on the fair market value of the property at the time the transfer takes place.

Basis of tax

The fair market value of real estate is usually equal to the purchase price in the transaction, but in some cases it may differ. The basis for tax is then the fair market value.

Exemptions

There are various exemptions available in case of (de)merger or internal reorganisation. However, various detailed conditions apply.

In case the real estate is transferred a second time within six months, the tax due on the second transaction may be reduced by the earlier transaction.

Companies

The same rules as for individuals apply.

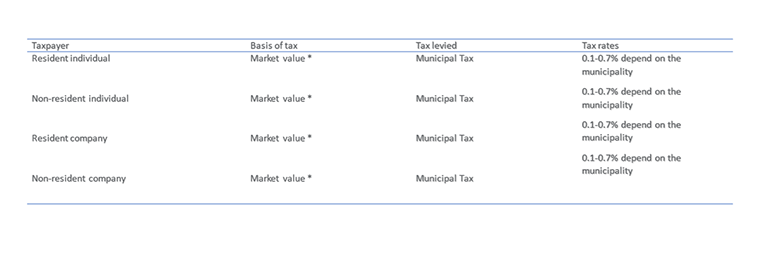

Local taxes - property tax

* There are certain rules to determine the market value for local property taxes. Every municipality determines this market value within the frames of the National Property Tax Act.

Introduction

Each municipality decides whether they will levy property tax or not, and on what kind of property. The property tax is annual, and it is deductible from business income and company income.

Liability to tax

Most municipalities in Norway levy an annual property tax on the real estate in the municipality. Property tax can be levied on either residential or commercial buildings, or on both. In municipalities with property tax, every owner or user of residential or commercial buildings is liable to local property tax.

Basis of tax

The local property tax is based on local valuation rules and is intended to find the market value. The property tax rate is between 0.1% and 0.7%, dependent on the municipality.

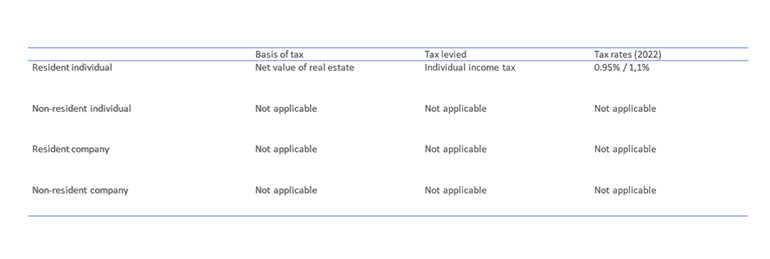

Net Wealth/worth taxes

Introduction

Wealth or worth tax is levied on either 75% or 100% of the total value of assets, including real estate. Loans are also deductible at either 75% or 100%.

Liability to tax

Only resident individuals are subject to wealth or worth tax.

Basis of tax

As a starting point, wealth tax is levied on 100% of the total value of assets for individuals, defined as residents. Thus, certain assets are subject for valuation discount for wealth tax purposes. Shares, commercial real estate and other operating assets are valued at 75% of the total value. Loans will also be reduced on certain assets, and therefore deductible at either 75% or 100% – proportionate to the distribution of total assets between the 75% and 100% valuation. For houses used by the individual as homes, there are favourable valuation rules of 25% (valuation of 50% for the exceeding value of NOK 10 million) of the fair market value. The applicable tax rate is 0.95% for net wealth up to NOK 20 million, and 1,1% for net wealth above NOK 20 million.

Suitable vehicles for Norwegian real estate

Commonly used vehicles

Limited liability company

Limited liability companies are the most common type of business entity in Norway. A limited liability company can be a private entity, known as a private limited liability company (in Norwegian: aksjeselskap/AS) or a more general type, known as a public limited liability company (in Norwegian: allmennaksjeselskap/ASA). Both forms are regulated by specific legislation; the Limited Liability Companies Act and the Public Limited Liability Companies Act, respectively. These acts are based on the same principles as the EU's limited company legislation. The main difference between the two types of business entity is that private limited liability companies may not be listed on the stock exchange.

The minimum capital requirement is NOK 30.000 for private limited liability companies and NOK 1.000.000 for public limited liability companies. Requirements governing the number of board directors and board composition vary according to company type, turnover, number of employees and whether a company has a corporate assembly.

Companies resident in Norway are taxed based on the worldwide income. Limited liability companies are taxed with a flat tax rate of 22%.

Limited partnerships

Limited partnerships (in Norwegian: Kommandittselskap/KS) have one or more partners with unlimited liability and one or more partners with limited liability. Limited partnerships are regulated by the Partnerships Act.

Limited partnerships are transparent and taxed at the owner/partner level.

Unlimited partnership

In unlimited partnerships the partners have joint and unlimited liability for an entity's liabilities (in Norwegian: ansvarlig selskap/ANS), or they may have an agreement to apportion the liability pro rata (in Norwegian: selskap med delt ansvar/DA). Unlimited partnerships are regulated by the Partnerships Act.

Unlimited partnerships are transparent and taxed at the owner/partner level.

Silent partnership

Silent partnerships (in Norwegian: indre selskap/IS) may be established as a limited or unlimited partnership. What distinguishes a silent partnership from other types of business entity is that it may not act as such in relation to third parties. Silent partnerships are regulated by the Partnerships Act.

Silent partnerships are transparent and taxed at the owner/partner level.

Sole proprietorship

Sole proprietorship (in Norwegian: enkeltpersonforetak/EPF) is a common type of business entity in Norway. This type of business entity requires that one physical person is personally responsible for the business activity and has unlimited liability for the business enterprise.

Sole proprietorship resident in Norway is taxed on the basis of worldwide income. Sole proprietorship is taxed at the owner/partner level, with a progressive tax rate between 33.2% and 50.6%.

Norwegian branch of a foreign company

A foreign company may conduct business activities in Norway through a branch, called a Norwegian branch of a foreign company (in Norwegian: norsk utenlandsk foretak/NUF). The branch is not regarded as a legal entity but must be registered and assigned an organisation number.

Companies resident abroad are only taxed on income derived from sources in Norway. A Norwegian branch of a foreign company is taxed at a flat tax rate of 22%.