This article focuses on the last 3 elements on the B-BBEE Scorecard, namely Skills Development (Statement 300), Enterprise and Supplier Development (Statement 400) and Socio Economic Development (Statement 500). These 3 elements are determined at a point in time, i.e. the Measured Entity’s financial period.

Whilst some Measured Entities with a financial year ending on 31 March 2020 or 30 April 2020, had incurred the necessary expenditure in relation to these elements of the Scorecard, most Measured Entities with financial year ends post the COVID-19 lockdown will need to consider their response to Skills Development, Enterprise and Supplier Development and Socio Economic Development in a dramatically changed social and economic landscape.

Let’s unpack the effect on each element, and consider how the Measured Entity can maximise B-BBEE points on the Scorecard with limited cash flow.

Skills Development

There are a total of 20 points for this element on the Scorecard. The Skills Development targets comprises spend targets based on the Measured Entity’s Leviable Amount (annual payroll), targets based on overall employee headcount as well as 5 bonus points based on absorption of Learnerships, Apprenticeships and Internships.

If a Measured Entity’s annual Leviable Amount is greater than R500,000 per annum, it will need to comply with the following in order to be awarded points under the Skills Development Element:

- Comply with the Skills Development Act and Skills Development Levies Act;

- Register with SARS and the applicable SETA;

- Develop a Workplace Skills Plan (WSP) and Annual Training Report (ATR)

- Implementation of a Priority Skills Programme.

COVID-19 will, in all likelihood, impact the Measured Entity’s Leviable Amount (annual payroll). If the Measured Entity elects the route of retrenchments or short pay, there will be a decrease in the annual payroll. It is important to note that according to the SARS quick reference guide, a retrenchment payment is excluded when determining the Leviable Amount.

What does this mean post COVID-19 lockdown?

Firstly, the targets based on the Leviable Amount will be reduced, meaning less overall spend on Skills Development. Secondly, targets based on overall employee headcount will also be reduced, meaning lower targets for Learnerships, Apprenticeships and Internships. If the Measured Entity is experiencing limited cash flow, it should look at training initiatives that take advantage of salary spend, i.e. the salary paid to an employee participating in the Learnerships, Internships or Apprenticeships, as opposed to the direct costs of training, bursaries and scholarships. Alternatively, the Measured Entity could select training initiatives that have a smaller initial cost but include a greater salary portion of the participating employee.

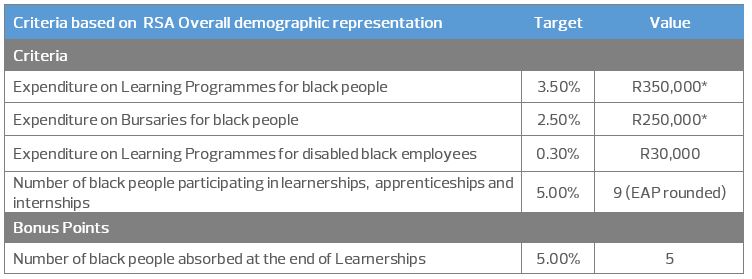

For example, if the Measured Entity X previously had a total payroll (leviable amount) of R10M and a total headcount of 100 employees, the targets would be:

*Please note, this is an overall target, the actual target may be higher as it is further broken down into EAP targets.

*Please note, this is an overall target, the actual target may be higher as it is further broken down into EAP targets.

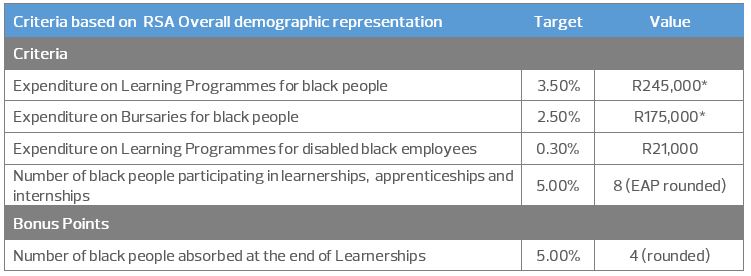

Now, if the same Measured Entity is impacted by COVID-19, and their overall headcount decreases to 65, resulting in their overall annual payroll decreasing to R7M, the targets will be:

*Please note, this is an overall target, the actual target may be higher as it is further broken down into EAP targets.

*Please note, this is an overall target, the actual target may be higher as it is further broken down into EAP targets.

From the above example, one can clearly see that a decreased headcount and overall reduction in the annual payroll amount will reduce the targets.

Clarity Regarding Absorption:

The B-BBEE Codes make allowance for the recognition of all Learnerships, Internships and Apprenticeships which include employed and unemployed. Absorption recognition applies to Black People, as defined, who, upon completion of their Learnership, Internship or Apprenticeship, secure a long-term contract of employment as defined by the Codes. In summary, the following boxes need to be ticked in order for the Measured Entity to recognise absorption points:

- A Black Person as defined;

- Who does not have a current long-term contract of employment;

- Who has completed a Learnership; Internship or Apprenticeship with the Measured Entity; and

- Who, upon completion, secures a long-term contract of employment as defined in the Codes, with either the Measured Entity or any entity within the industry.

The absorption target is based on 5% of Total Employee Headcount. If the Measured Entity’s overall headcount has decreased due to COVID-19, the target for absorption will also be significantly lower.

For B-BBEE strategic planning purposes, the Measured Entity’s B-BBEE roadmap would need to be critically assessed post COVID-19 lockdown and updated with the adjusted Leviable Amount and employee headcounts whilst taking into consideration any cash constraints. One would also need to consider the impact of absorption at a time when there will likely be a freeze on new employee hires. If the Measured Entity was reliant on the 5 bonus points for absorption which is now no longer achievable post COVID-19 lockdown this will affect the overall scorecard. It will be important to understand this consequence in relation to the overall Scorecard and make the necessary changes to the Measured Entity’s B-BBEE strategy.

Preferential Procurement

Preferential Procurement measures the extent of which a Measured Entity purchases goods or services from B-BBEE Compliant suppliers. There are a total of 27 points for this sub element of the Enterprise and Supplier Development Scorecard, with an additional 2 bonus points, making Preferential Procurement the highest weighting of all points on the Scorecard.

Preferential Procurement is the Measured Entity’s most cost-effective element on the Scorecard, as the Measured Entity does not require any cash outlay in order for it to achieve maximum points. Procurement points are calculated based on spend with B-BBEE Compliant suppliers with a certain B-BBEE status. In addition, procurement from a 51% or more Black Owned (i) Large Enterprise, turnover in excess of R50 million, (ii) Qualifying Small Enterprise, turnover between R10 million – R50 million (QSE’s), and (iii) Exempt Micro Enterprise, turnover less than R10 million (EME’s), will result in additional Preferential Procurement points on the scorecard. If the supplier is classified as a 51% or more Black Designated Group, it will result in 2 bonus points for the Measured Entity.

When it comes to verification, the Measured Entity needs to present a valid copy of the B-BBEE Certificates of its suppliers. A valid B-BBEE Certificate could either be valid within the Measured Entity’s financial period, or valid at the date of verification. As an aside, a supplier may therefore have more than one valid B-BBEE certificate during the measurement period, so the most favourable B-BBEE certificate should be used in the B-BBEE verification.

With the current pandemic, there is the risk that the Measured Entity’s current suppliers will drop a B-BBEE level or be non-compliant overall. Now, more than ever, the Measured Entity should critically analyse its supply chain to determine which suppliers are compliant and which suppliers could be substituted with suppliers that are at least 51% Black owned, with the aim of maximising the points under Preferential Procurement.

Enterprise Development, Supplier Development and Socio Economic Development

These elements are based on a Net Profit after Tax (NPAT). Due to the pandemic, many companies are moving into survival mode. B-BBEE is unlikely to be a priority at this stage, while companies are scrambling to keep the doors open. However, for purposes of B-BBEE if the Measured Entity is unprofitable as a result of COVID-19 lockdown this will, unfortunately, not excuse the Measured Entity from compliance under the B-BBEE legislation. The Amended Codes of Good Practice specifically state that if the Measured Entity’s NPAT is below a quarter of the industry norm, it will be subject to the average NPAT over the past five years. If this is still lower than the quarter of the industry norm, then the industry norm will be applied in order to determine the NPAT target.

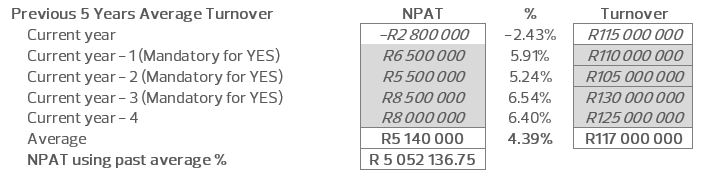

As COVID-19 lockdown will inevitably affect the overall profitability of the Measured Entity, the Measured Entity will be subject to either the 5 year average or the industry norm. This fact must be borne in mind by the Measured Entity when revisiting its B-BBEE roadmap.For example, if the Measured Entity makes a loss in its financial period, the Measured Entity would need to look at the average NPAT of the last 5 years:

The Measured Entity would need to take the average NPAT for last five years, being 4.39%, over the current turnover of R115million, in order to establish the NPAT for purposes of ED, SD and SED targets. Based on the example, the average NPAT would be R5,052,136.75 for purposes of the ED, SD and SED targets.

The Measured Entity would need to take the average NPAT for last five years, being 4.39%, over the current turnover of R115million, in order to establish the NPAT for purposes of ED, SD and SED targets. Based on the example, the average NPAT would be R5,052,136.75 for purposes of the ED, SD and SED targets.

The next example is based on industry norms. If the Measured Entity makes a loss this year, and its average is less than a quarter of the industry norm, the Measured Entity would need to apply the industry norm. Let’s assume the Measured Entity falls under the Community, Social and Personal Services Industry. The current industry norm is 6.52%, a quarter of which is 1.63%. The Measured Entity would use the 1.63% of the current turnover, which results in an NPAT of R1,874,282 for the ED, SD and SED targets.

Enterprise Development

Under the Amended Codes of Good Practice, the target for ED is 1% of NPAT for 5 points on the Scorecard. ED is any contribution (monetary or non-monetary) that is made to an enterprise (not a supplier) being an EME or a QSE that is 51% or more Black Owned with the objective of contributing to the development, sustainability and financial and operational independence of the enterprise beneficiary. These programs should be strategic for the Measured Entity and should ideally be geared towards the graduation of an Enterprise Development beneficiary to a Supplier Development beneficiary, or the creation of jobs as a result of the program, which will earn the Measured Entity bonus points for B-BBEE.

Supplier Development

Under the Amended Codes of Good Practice, the target for SD is 2% of NPAT for 10 points on the scorecard. SD is any contribution (monetary or non-monetary) that is made to a supplier being an EME or a QSE that is 51% or more Black Owned, again with the objective of contributing to the development, sustainability and financial and operational independence of the supplier beneficiary. These beneficiaries should be in the supply chain of the Measured Entity.

For both ED and SD contributions, the Measured Entity should look at initiatives that minimise impact on cash flow, for example offering rental space at no cost, offering resource capacity, providing goods at a discounted rate, providing a loan on favourable terms, etc.

The contributions made by the Measured Entity is subject to a Benefit Factor Matrix, meaning that not all contributions will be recognised at 100% for purposes of B-BBEE – some contributions may be recognised at 70% or lower.

Socio Economic Development

Under the Amended Codes of Good Practice, the target for SED is 1% of NPAT for 5 points on the scorecard. SED is any contribution (monetary or non-monetary) that benefits communities, natural persons or groups of natural people where at least 75% of the beneficiaries are Black people as defined.

The Measured Entity may need to reassess its transformation strategies and imperatives to see how it can positively impact the post COVID-19 landscape, to align with the broader economic and social needs of South Africa.

YES

YES stands for Youth Employment Service. This initiative was introduced by Government with the aim of reducing the unemployment rates, specifically the high rates of unemployment for youth between the ages of 18 and 35 years. The initiative allows Measured Entities that register with and meet the YES targets, to move up to two levels on their current Scorecard. One of the requirements for being awarded this benefit, is the absorption (based on the targets for the Measured Entity) of a certain number of youth. The absorption is based on the completion of 12 consecutive months on the programme. A practice guide has been released indicating that should the 12 months still be unfolding at the date of Verification, the Measured Entity would need to provide evidence to indicate that it is committed to absorbing the required percentage of youth. If the Measured Entity has just completed a Verification and made this commitment, then post COVID-19 lockdown, the commitment would need to be honoured otherwise, the current Scorecard would be at risk.

With the current pandemic, it is very likely that the YES youth are to be affected as a result of the economic fallout from the COVID-19 lockdown. The Measured Entity may elect as part of its cash tightening initiatives and in order to preserve jobs, to reduce or stop the monthly stipend under the YES program. In the event that the Measured Entity retrenches the YES youth within the 12 month period, the Measured Entity would receive no recognition for the program.

YES is very aware of this risk to the sustainability of the program, and hosted a webinar on the 6th of April to discuss the impact on the YES Youth. YES have engaged with the DTI around the options and relief during the COVID-19 lockdown, and beyond. Any change to the program will necessitate a change to the legislation, and this may or may not occur.

In deciding whether to terminate the YES youth within a 12 month period, the Measured Entity must be very clear of the B-BBEE consequences of doing so and the overall effect on the B-BBEE Scorecard.

Way Forward

In our view, B-BBEE will continue to be relevant in South Africa post the COVID-19 lockdown and the aftermath. We do not foresee any relaxation in the B-BBEE legislation regarding compliance. In fact, as discussed above, the Measured Entity should use this period to critically assess its B-BBEE compliance taking into account the changed economic and social landscape, and to make the necessary strategic changes before its financial year end. B-BBEE will continue to ensure a competitive advantage in the market place, now even more so.

As always, RSM South Africa is able and willing to guide you through the various issues relating to B-BBEE, and to help you develop or fine tune your B-BBEE strategy and roadmap for a changed world.

Liz Pinnock | Head: Group Legal

Zahn Abreu | B-BBEE Manager