The release of the 2021 Draft Taxation Laws Amendment Bill (Draft TLAB) and the 2021 Draft Tax Administration Laws Amendment Bill (Draft TALAB) at the end of July will result in corporate taxpayers crunching hard at their numbers.

These draft bills deal with various tax proposals but the proposal to restrict the set-off of the balance of assessed losses in determining taxable income would probably be the most eye-catching for corporate taxpayers.

In its current form, Section 20 of the Income Tax Act No.58 of 1962 allows taxpayers to set off the balance of assessed losses carried forward from the preceding years of assessment against their current year income with any portion of the unutilised assessed loss being carried forward to future years of assessment. The result is that taxpayers are only liable for tax once the assessed loss balance has been depleted.

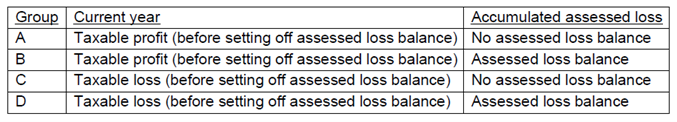

The proposed amendment would see the balance of assessed losses carried forward being restricted to 80% of taxable income. This would imply that only companies in a taxable income position before the set off of any assessed losses, may be potentially impacted, while companies generating a loss in the current year would not be impacted.

One of the reasons provided by treasury for the amendment is to “smooth the tax burden for companies whose primary business is cyclical in nature and not in line with a standard tax year, and for start-up companies that are not profitable in the early years of trading” while also providing some of the fiscal space required to enable treasury to lower the corporate tax rate.

The table below was provided in the Draft Explanatory Memorandum on the Taxation Laws Amendment Bill 2021 and confirms that Groups A, C and D will not be affected by the proposed amendment, while Group B may potentially be affected. While the example refers to a Group in the first column, the reference is specific to a company.

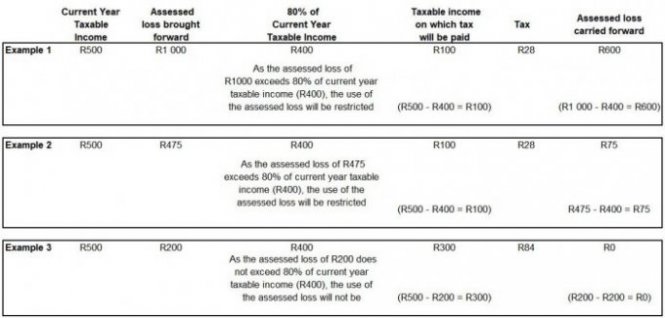

A few examples have been provided below to better illustrate the effect of the amendment.

A few examples have been provided below to better illustrate the effect of the amendment.

The proposed amendment will come into operation on 1 April 2022 and apply in respect of years of assessment commencing on or after that date. Companies with a year ended 31 March 2023 will potentially be the first companies to be affected by the proposed amendment.

While these specific amendments have not been gazetted, taxpayers would need to be weary and perhaps begin quantifying their potential tax exposures.

Ozeyr Ahmed

Regional Divisional Director: Corporate Tax, Johannesburg