Employee bonuses provides compensation beyond annual salary to employees as an incentive or reward for reaching certain predetermined individual or team goals. The purpose of an employee bonus is to provide recognition for employees who have gone above and beyond normal work obligations.

13th Cheque vs performance bonus

Often 13th cheques and bonuses are used interchangeably however these concepts are different. A 13th cheque is a bonus that the employee can expect every year with absolute certainty if it forms part of the employee’s employment contract. On the other hand, a performance bonus is generally attached to individual or team performance and the overall performance of the business and is often tied back to some form of Key Performance Indicators (KPIs) set out by management at the beginning of the financial year. Where the employment contract is silent on the payment of bonus; then the payment of a bonus is at the discretion of the employer.

Should an employer make provision for bonuses?

In terms of IAS 19, the employer is required to recognise a liability when an employee has provided service in exchange for employee benefits to be paid in the future, while an expense will be recognised when the entity has consumed the economic benefits arising from the service provided by an employee in exchange for employee benefits.

Provision is a liability of uncertain timing or amount. Therefore, the following conditions must be met for the employer to make provision for bonuses:

- The entity must have a present obligation to pay bonuses

- It is probable that an outflow of resources embodying economic benefits will result from the settlement of the obligation

- A reliable estimate can be made of the amount of bonus payable

An obligation to pay a bonus may arise either from an employees’ contract (through its explicit or implicit terms), or entity history or established pattern of past practice or policies or specific current statement that has indicated that the company is paying and will continue to pay bonuses to employees. In so doing, the entity has created a valid expectation to employees that it will discharge the responsibility to continue to pay bonuses in the current year.

Bonuses are often settled in cash or cash equivalent, share-based awards or other assets distribution therefore it is probable that an outflow of resources embodying economic benefits will result from the settlement of the obligation

A reliable estimate amount of bonuses payable can often be made. Some bonuses are easier to calculate than others. Performance-based bonuses are normally calculated based on performance measurements driven by Key Performance Indicators (KPI).A Key Performance Indicator is something that can be counted and compared; and can provide evidence of the degree to which an objective is being attained over a specified time. A 13th cheque amount is normally based on a month salary.

If the above conditions are not met, no provision for bonuses should be raised.

Accounting for provision for Bonuses in the Financial Records

Provision for bonuses is classified as short-term employee benefit in terms of IAS19. Short term employee benefits are employee benefits that are expected to be settled wholly within twelve months after the end of the annual reporting period in which employees rendered the related service.

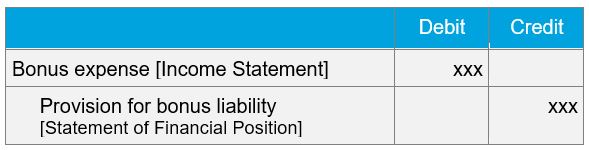

Undiscounted amount of bonuses is recognised by raising an expense; with a corresponding amount in current liabilities (accrued expense); therefore, normal accrual accounting principles will apply. An expense should be raised unless another standard requires or permits the inclusion of the bonus in the cost of the asset such as IAS 2 Inventories or IAS 16 Property, Plant and Equipment.

An example of bonus provision journal is provided below:

Bonus: Income Tax Implications

The issue to consider is whether bonus provision raised at year end may be deducted for tax purpose or treated as temporary difference and therefore added back in the calculation of taxable income. Bonuses are deductible in terms of section 11(a) of the Income Tax Act, No 58 of 1962, read with section 23(g). For an expenditure or loss to be allowed for deduction against income in terms of section 11(a), an amount must have been 'actually incurred' by the taxpayer during the year of assessment. Where the legal obligation at the end of the year is uncertain, or where bonus payment is conditional in any way on the occurrence of a future uncertain event, the liability will not be regarded as having been 'actually incurred' during the year and should be added back on the tax computation.

In terms of section 7B of the Income Tax Act, No 58 of 1962, an employer will only be allowed a deduction for variable remuneration when it actually pays the remuneration to the employee, thereby aligning the timing of the employer’s tax deduction with PAYE withholding.

Therefore, the bonus provision added back in the tax computation will result in a temporary difference, which could result in a significant higher taxable income for the year and provisional taxes to be paid.

Bonuses in the hands of the employee is a taxable remuneration, as such the PAYE must be deducted and paid over to SARS on or before the 7th of the month following the month on which the bonus was paid to the employee.

Pendo Manala

Manager: Payroll & Outsourced Accounting, Johannesburg