As the digital revolution progresses, terms such as Big data, Data Analytics and Automation have become increasingly popular amongst auditors. The need to effectively audit large amounts of data in a cost-effective manner without compromising audit quality has given rise to opportunities for auditors to explore various options, one of which is the value of data analytics for an external audit.

The Oxford dictionary defines an “analytic” as the systematic computational analysis of data or statistics.

At a basic level, data analytics is sorting and examining the raw data available to be able to interpret and ultimately conclude on this data. While this is not a new concept, there are growing trends towards integrating data analytics as part of the audit methodology, to not only gather audit evidence but to also satisfy the necessary assertions.

The IAASB defines data analytics for audit as the science and art of discovering and analysing patterns, deviations, and inconsistencies, and extracting other useful information in the data underlying or related to the subject matter of an audit through analysis, modelling and visualisation for the purpose of planning and performing the audit.

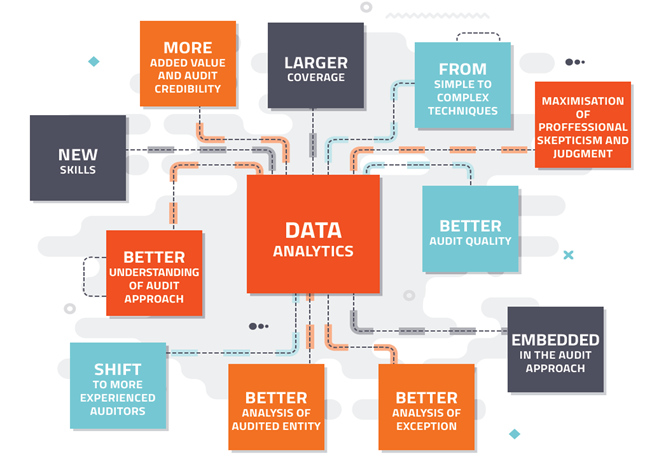

For auditors, the main purpose of using data analytics is to improve audit quality as well as add value to their client’s operations. It allows them to extract and thoroughly analyse large volumes of data, to better understand the client as well as identify both business and audit risks. Below are some of the main benefits that can be expected when data analytics is applied to an audit.

Source : DATA ANALYTICS : THE FUTURE OF AUDIT (Institut des Réviseurs d’Entreprises)

- A cornerstone of audit data analytics is independent data access and extraction. Data provided by the client must be tested for completeness and accuracy before reliance can be placed upon such data. Direct access to the client’s database ensures that completeness and accuracy are constantly verified in support of audit reliance. While the security and confidentiality of data is always of concern, audit engagement clauses and secure IT environments ensure the data is protected at all times.

- The increase in understanding from analytical procedures aids the identification of risks associated with an engagement, in line with a risk-based audit approach. This allows testing to be better focused on these areas. This is further enhanced by allocating more of the auditor’s time in testing an area of risk instead of verifying routine transactions.

- The use of data analytics facilitates the option of testing the entire population, thus improving coverage of audit procedures, and reducing or eliminating sampling risk and obtaining a higher level of assurance. This is especially beneficial in areas where high volumes of transactions occur with relatively low transactional value or where repetitive transactions are noted. Predictive analytics are also an effective way of testing an entire population and obtaining a higher assurance value.

- Data analytics software makes it easy to interrogate and extract data from multiple sources so that auditors can run tailored analyses efficiently and effectively. As companies often make use of more than one system for processing and recording transactions, data analytics allows one to access the original source of each transaction instead of the summarised transactions recorded in the accounting system. This increases the assurance factor as it allows the auditors to understand the flow of data within the organisation and identifies any weakness which potentially result in a material misstatement in the accounting records.

- By accessing a client’s systems, more insightful and complex analytics can be performed. Audit data analytics use data fields not typically included in reports generated from the system. Examples of such fields include time of postings, capturer, post and approve user IDs, non-summarised transactional data, transaction references, and other such fields.

- Procedures performed by data analytics can be automated and saved for future use. Analytics performed can be both tailored for a specific area/industry/client or can be part of the general audit procedures performed for every audit. Efficiency can therefore be realised in future audits in which automated procedures are stored and run.

- Extracting the data directly from a database ensures data integrity is maintained and can be cleansed and harmonised to make sure the auditors can manipulate the data as required. It is also common to create visual displays of the data in which outliers and exceptions can be more easily identified as compared to a numerical presentation of data.

The results of analytics performed can also be presented to the management of an entity which may not be involved in the daily operations or its finance function. This provides the opportunity for management to discuss and also be aware of any exceptions or weaknesses identified within the entity. The extraction of data by the audit team also eases the pressure on accounting staff to provide data dumps and reports to the auditors.

In conclusion, while there are still some challenges that need to be overcome in order to seamlessly integrate data analytics into an external audit, numerous advantages are already being realised to an extent where data analytics has become an integral part of the audit process. With the rapid advancements in technology, the “new normal” circumstances from COVID-19 regulations and continuous emphasis on robust and quality driven audits, data analytics will become a crucial factor in servicing clients using the latest technology and innovation.

Salim Mohamed

Data Analyst, RSM South Africa