Public policy measures put in place to contain the spread of Covid-19 are resulting in significant operational and financial disruption for companies. Staff quarantine, supply chain failures and sudden declining demand from customers are causing multiple issues for companies in all sectors. Therefore, it is important that companies are proactive in assessing their capability to withstand the disruption following Covid-19 and that companies act decisively to mitigate actual or potential issues. RSM is here to assist!

Reasons why companies may be having issues

The impact of Covid-19 is felt throughout all segments in the market, both operationally as well as financially:

| Operational | Financial |

|

|

RSM can help you with relevant questions

-

What is the liquidity need and for how long?

-

How to deal with supply chain disruptions and working capital impact?

-

Operational continuity and strategic challenges (planning).

-

Are there debt and capital solutions available?

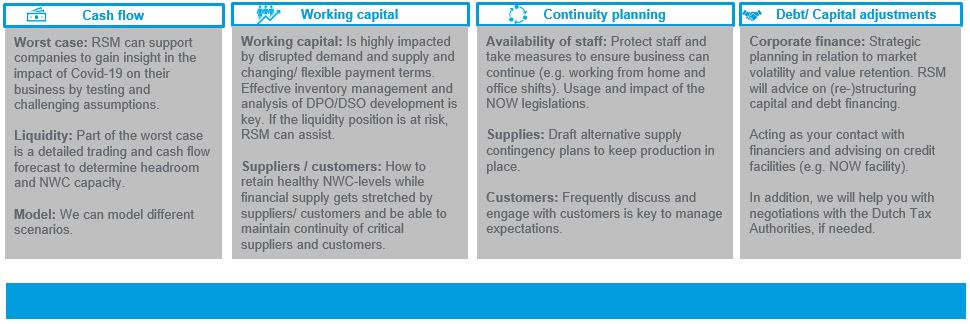

Be prepared by assessing the impact on the following focus areas, where RSM can support you:

What could you do?

-

Please contact RSM after which we will schedule a physical (or by phone) meeting to discuss the challenges you are facing in more detail.

-

We will analyse your specific problems in detail, of course in close collaboration with your internal financial officer.

-

Discuss possible solutions and provide insight in different (desired) possible financial scenarios for the near future.

-

Need to draft and organise structural solutions for company’s liquidity need / funding to secure financial business continuity as much as possible (i.e. going concern).

-

Discuss other wishes and measures to be taken.

If you have any questions about the corona measures and your financial position, please contact one of our RSM colleagues. We have set up a crisis team that can provide you with the right answer as quickly as possible. If more related information becomes available or if there is a change in the measures implemented, we will obviously inform you accordingly.