How much of your wealth is tied up in your business?

When you have most of your financial ‘eggs’ in one basket, it is a good idea to watch that basket! Successful business owners check the value of their business every year, as part of their wealth creation and succession plan.

Periodic indicative valuations of the business allow for a way to measure the impact of:

- consolidating strengths;

- fixing weaknesses;

- opportunities taken;

- and the minimizing of threats executed.

This allows for realistic expectations between a perceived current business value and the target business value commonly known as the business value gap. The game is to reduce the gap!

If you have never had a business valuation done or have no idea what your business is worth, it’s a common occurrence that many business owners talk to us about.

It’s also why we decided to put together this simple, easy to understand guide.

We know from our experience that valuing businesses is specialist area which requires industry knowledge, benchmarking and understanding the true risk and value drivers within a business.

We aim to provide some better understanding on what, how and when of business valuation.Plus, we’ll give you some tips and simple ways to make your business more valuable as well as let you know how RSM can best help you.

We hope you find the guide helpful and insightful.

What is a Business Valuation?

A business valuation is a process whereby a set of methods are used to determinethe economic value (quantitative and qualitative) of a whole business or company unit.

This ascertains a value at which company shares (equity) or business enterprise (stock, plant & equipment, intangibles) can be bought or sold.

When we refer to business valuation, we are typically referring to the valuation of either of the following two categories of business interest:

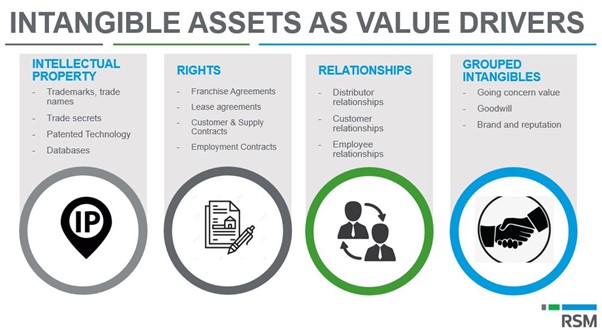

- Business Enterprise: business enterprise assets only (usually stock, plant & equipment, intangible assets such as goodwill).

- Company Shares (Share Value): business enterprise assets plus net assets expressed as a $ per share.

How do you value a business?

We lift the hood and look at what the risk and return within the business looks like to make an assessment.

Typically, as a starting point we get a good understanding by asking key questions, reviewing documentation and obtaining financial statements of a relevant period e.g., the last three years.

Once we understand the risk and value drivers within the business, and it’s relationship the current industry andeconomic climate, we can ascertain which approach and methodology is best suited.

There are different valuation approaches and methodologies for consideration:

- Asset Based – Current value of all assets less all liabilities

- Earnings Based – Traditionally the most frequently chosen to value SME’s

- Market Based – Industry comparable data

Earnings based valuation method is the most popular method to use. In this, we use:

- WANEBIT – Weighted Average Notional Earnings Before Interest and Tax

- Capitalisation Rates - Business Cap Rate/Profit Multiple – A patented and scientific business value assessment algorithm which caps the value of the business based on its aftertax cash flow and risk profile.

Good growth, stability and return on investment (ROI) will mean stronger value, however if there are glaring cracks internally and externally, the valuation will reflect this. Most business buyers aren’t looking for a risky purchase. They want something reliable and robust.

What is included in a Business Valuation Report?

A comprehensive review of qualitative risk and value drivers that affect business value including:

- Industry trends

- Key person reliance

- Customers, staff and systems

- Growth opportunities and more

We standardize your business profit so it can be compared with similar businesses. Typical profit adjustments include abnormal and extra-ordinary items and non-commercial owner salaries and benefits.

We ensure that our valuation processes, systems, and reports are benchmarked against and compliant with international accounting standards and regulatory requirements.

Our continual tailored support ensures that we help you grow your business and valuation.

When should you get a Business Valuation?

You should always get a business valuation if you’re thinking of selling the business now or in the future, prior to accepting any offers.

Getting an annual valuation will assist in strategic planning and tracking your targeted business value. It also closes any perceived owners perceptions of the business and market value gap.

- Valuations should be done prior to restructuring for tax and estate planning.

- Valuations should be used as part of succession and exit planning.

Understanding Goodwill

Goodwill is an intangible asset arising as a result of name, reputation, customer loyalty, location, products, supply contracts, employees, business performance and similar factors not separately identified.

- The presence of goodwill is a function of market demand. This is influenced by a wide range of factors.

- To have commercial value goodwill must be transferable.

- Last asset to appear in a business and the first to disappear when performance declines.

- Most calculated based on a multiple of earnings.

- Represents the value to an investor or prospective buyer of those earnings and reliability going forward.

How can I make my business more valuable?

Adding value will depend on how much time you have. Depending on your sale timeline you may want to fix every issue identified, or you may want to identify the key issues you want to address before putting your business up for sale.

To extract maximum value from your business, it needs to be firing on all cylinders and in its best shape.

- Have transparent and up to date financial records.

- Illustrate Strong Earnings, balance sheet and cash flow.

- Understand if there is a value gap between your perceived value of the business and the industry, then address why and how to correct.

- Put all sales through the business, have strong controls around debtor and creditor management.

- Well documented policies, procedures around systems and processes to ensure quality control of product or service.

- An up-to-date strategic business plan.

- Steps and structure allowing the business to survive without the owner(s).

- Tying up loose ends e.g., Disputes & legal issues, HR issues, maintaining plant & equipment maintenance programs, updating lease agreements.

- Identify and protect your Intellectual property (IP).

- Understand how your business differentiates itself from the competition/market.

How we can help

Our Business Valuation Service will show you the true value of your business and can be easily updated to highlight changes over time.

The key outcome is an accurate, cost-effective valuation assessment of your business.

- Simplified approach

- Comprehensive report

- Bespoke valuation using qualitative and quantitative analysis.

We use industry valuation benchmarks to pinpoint areas where you can improve your business value.

You can also use it not only when selling your business but for succession planning and asset protection.

If you want to grow the value of your business, we provide ongoing support which are tailored to your goals and your budget. We work closely with your whole business, not just the numbers. Our specialist advisory services include:

- Benchmarking

- Business Improvement Plan

- Chief Financial Officer (CFO) Program

- Board of Advice Program

Get in touch with one of our Business Advisory Partners to discuss the best approach tailored to your needs.

You can also send us your enquiry here.