Budget 2018: The New Zealand Labour Government via its Finance Minister the Honourable Grant Robertson has delivered its first coalition budget since the 2017 election. There is a significant spend, particularly in the areas of health & education however this won’t see massive improvement overnight!

The Spend

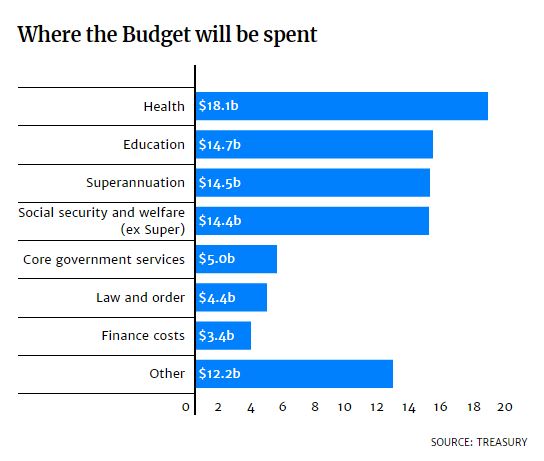

An increase of $3.2 billion over four years was announced for Health with $2.3 billion provided for District Health Boards (DHBs). The Government considers this will enable our hospitals and health services to provide quality care at all times and will mean more money for services such as mental health and to take the pressure of overworked staff. This will presumably allow DHBs to attract more experienced and quality workers. There is an extra $750 million in additional capital spending allocated in Budget 2018 (last year $150 million was allocated). An additional $100 million in capital will be available if necessary in 2018/19 to strengthen DHB balance sheets. There will also be an extension to free doctors’ visits for under 14 year olds (currently free for children under 13) and lower fees for those who hold a community services card.

The health services in New Zealand are under huge pressure both financially and from a staffing perspective. Hon. Grant Robertson’s budget speech talks of this investment being the biggest commitment to rebuilding health infrastructure in a decade.

Education will see around $1 billion a year in each of the next four years for a school building package plus funding for a further 1,500 teachers with boosts to teacher aids and those with learning difficulties.

Other budget announcements include:

- $234m for 6,400 new state homes over four years;

- $1 billion for a "Pacific reset" over four years. This will see a boost in New Zealand’s foreign service including diplomatic corps increased by another 50 positions;

- $100m for America's Cup funding;

- Immigration New Zealand will get $140 million over the next five years;

- Justice to get $1.2 billion, funding 920 police officers and 240 support staff in 2018;

- Budget 2018 delivers $618m over four years to Green Party policies, pleasing co-leader James Shaw;

- More refugees to enter New Zealand with extra funding allocated to house them in Auckland;

- Department of Conservation gets its first boost for 16 years, with $181.6m promised for conservation.

The opposition have been scathing which comes as no surprises. Opposition Leader Honourable Simon Bridges has questioned Labour’s labelling of the 2018 Budget as one to rebuild the country and said it was National’s nine years in power that has set the new Government up for a strong starting position. Hon. Bridges questions whether this will be a budget of broken promises given the large spend, increase borrowings and increased tax take.

The Economy

The economic outlook projected by Treasury is solid – growth picking up from 2.8% this year to around 3.3% in the next two years and unemployment projected at 4.4%. Treasury predictions announced in the Budget are that in 4 years the Government will have $23 billion more to spend each year that what it has today. This is significant and an increase of 31%. This is a lot to do with the economy that the Government has inherited so the key will be how well the new Government will do in its next 4 year journey.

Budget 2018: The Tax Funding

It is not just a healthy economy that allows the increase spend announced by Labour. The country’s tax take has a huge part to play in allowing this, however Budget 2018 will not be remembered for its tax initiatives. On saying this however, a Tax Working Group was established on the Labour Government being elected into power which is reviewing the structure and fairness of the tax system as a whole. So perhaps it is no surprise that this Budget contained “nothing new” from a tax perspective!

What did the Budget contain however from a tax perspective?

- $23.5 million over the next four years to improve Inland Revenue’s ability to ensure outstanding company tax returns are filed.

- $3 million for Inland Revenue to identify legislative opportunities over the next four years to improve tax compliance in specific industries through the use of third party reporting and withholding taxes.

- $4.3 million over four years to implement and administer the recently announced research and development (R&D) tax credit.

- Changes to bloodstock tax rules for the New Zealand racing industry were also announced.

The Government is committed to increasing investment in R & D from 1.3% of GDP to 2% of GDP within ten years. It is choosing to do this via a tax incentive rather than an increase in grants. This will allow businesses to claim a tax credit of 12.5 cents on eligible investment in R &D.

It was announced that as a result of measures proposed by the Government around the tax take, and legislative changes recently introduced, that revenue from taxes would increase by $183m over 4 years. The “Amazon tax” proposals however are considered to be on the conservative side and forecasters suggest the tax take could well exceed this.

As mentioned above, a Tax Working Group (TWG) has been established to consider the “future of tax” in New Zealand. It is no secret that the TWG are debating the taxation of capital income, i.e. the introduction of a comprehensive capital gains tax (CGT). New Zealand is one of the few OECD countries that does not have a comprehensive CGT. A “quasi CGT” in the form of the bright-line test was introduced from 1 October 2015 however this may well be the start of things to come.

The TWG will make recommendations at the end of their review which will result in the Government enacting legislation to bring those recommendations to fruition. The TWG and the Government needs to ensure that there is in fact an issue to solve in New Zealand and not simply introduce a CGT to fix a perceived problem. The Government is already taking steps to curb tax preferences towards property investment, including:

- Extending the existing bright-line test for residential property investment, so that if a property is acquired and sold within five years and is not the taxpayers' main residence, any gain made is subject to tax. This is intended to bring property speculators within the tax net more than may have previously been occurring. Prior to 29 March 2018, the bright-line test was a two-year period

- Ring-fencing rental property tax losses so that they are unable to be offset against other taxable income (i.e. to reduce net tax paid). This is currently in a discussion phase and no legislation has been introduced as yet. The ring-fencing will only apply to residential land (so commercial leasing activities are excluded). In addition, losses can be offset where taxpayers hold a portfolio of properties. Losses on one can be offset to the extent of profits made on another. The Government is considering whether to adopt these rules on a phased-in basis.

In September 2018, the TWG will release an interim report. The overall direction of our tax system is set to become clearer with its release, as they move towards a final set of recommendations in early 2019. Watch this space!

As mentioned the Government tax coffers will also be bolstered by what has been referred to as a proposed “Amazon” tax. This relates to the collection of Goods and Services Tax (GST) on low-value goods that are ordered online. From 1 October 2019, offshore suppliers would be required to register, collect, and return New Zealand GST on goods valued at or below $400 supplied to New Zealand consumers. The rules would apply when the goods are outside New Zealand that the time of supply and are delivered to a New Zealand address. Offshore suppliers would be required to register when their total supplies of goods and services to New Zealand exceed $60,000 in a 12-month period. In certain circumstances, marketplaces and re-deliverers may also be required to register. Submissions on these proposals are being sought currently. The 2018 Budget figures are reliant on this tax being introduced to assist in funding the projected spend. Note this is in addition to the “Netflix” tax already introduced with regard to GST on cross-border remote services.

Overall the Budget is reasonably solid in terms of financial indicators. But that was always going to be the case for the 2018 Budget. The challenges lie in 2019 or 2020 as the impact of public sector pay rounds will have flowed through by then.