Successful companies treat cash flow as an insurance policy, a buffer. They have 3 to 10 times the ratio of cash to assets compared to their competition.

These successful companies take a conservative approach to debt. They shave risk wherever possible. When they hit a difficult time, they really pull ahead of those who are less disciplined.

What do the experts say about cash flow?

Jim Collins, author of Good to Great and former CEO of GE is an advocate of getting the right people on the bus before you work on your strategy.

Jim warned that the era of stability we have enjoyed for 60 years is now over:

- It has been replaced with chaotic disruptive normality.We are returning to normal. Normal is chaos, disruption, uncertainty and change. That’s actually the human condition.

- The turbulence is likely to gather pace with technology and globalisation acting as accelerators to speed up the boom and bust cycles.It sounds ugly but with the turbulence comes opportunity.

- The new world order is a fertile place for those striving to be the best. The mediocre should be scared.The exceptional should be positive. Being great was an option, now it is a necessity.

How can you improve your cash flow situation?

Understanding working capital and cash flow cycle

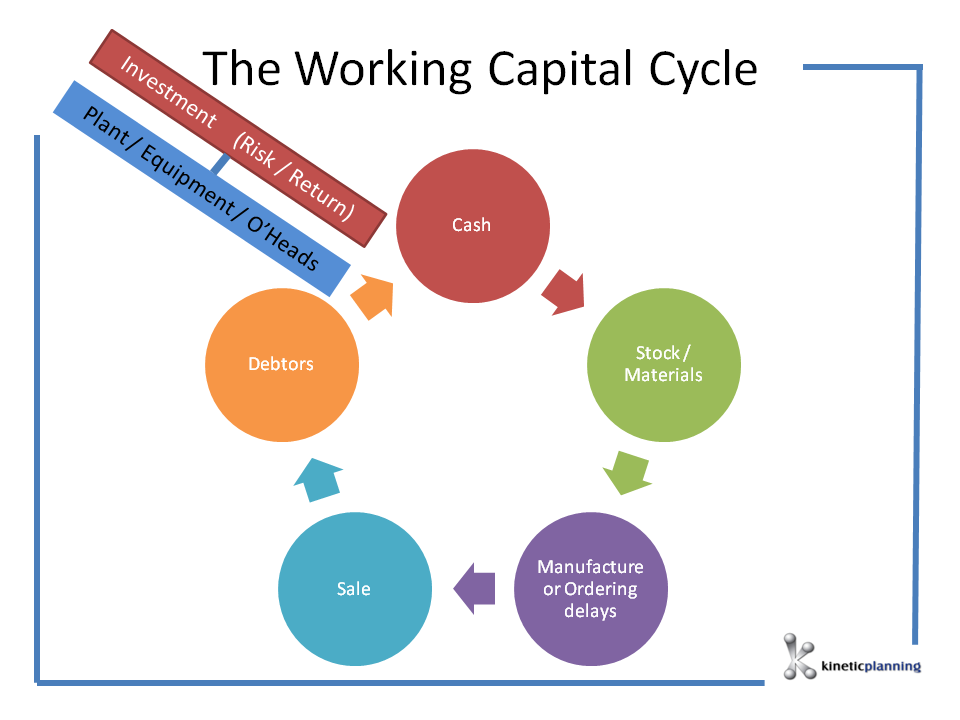

* Image supplied by KineticPlanning

Your working capital cycle is how long it takes from start to finish in a business transaction and receive the cash in your hand. In this diagram, if each stage of the cycle takes 30 days, you will be funding your sales through either cash or finance for 120 days. That is four months or even more in some cases. That is a long time for a small business to survive in today’s fast paced world of business.

If you take that four month period and add in variables such as debtors who take longer than 30 days to pay, the amount of stock you are holding and product delays, you can see how your working capital has a significant impact on your businesses cash flow.

Ways to reduce your cash flow cycle

Greatness does not happen in one moment or one breakthrough. It is all about building momentum over a long period and planning strategies to help your business thrive.

Plan, plan, plan and regularly work on your business

A few things you can start considering to improve your cash flow situation are:

- Setting up your terms of trade to encourage quick debtor collection

- Owning up to slow moving stock and turning it into cash

- Putting continuous pressure on debt collection

- Offer a small prompt payment discount

- Having you suppliers fund consignment stock

- Using a just in time process for manufacturing

- Planning your input requirements way ahead

- Looking at how you fund your imports

- Collecting information to find ways to reduce the working capital cycle

- Looking at alternative funding methods including factoring

Do you want to be a successful company?

Do you remember the successful companies we mentioned at the start of this article? The ones who have 3 to 10 times the ratio of cash to assets?

With our help, you can be that company

Over the last few years we have prepared growth options reports for many of our clients. These reports look at the “big numbers” in a business and help identify areas within the business where change can/should be made. It will not provide answers, but highlights areas requiring some attention.

Once a report is prepared we are able to provide you with a profit and cash flow budget (with integrated balance sheets) and work with you to form an action plan to implement the changes.

So why wait? Contact us today to identify strategies to improve your cash flow and build yourself a self sustainable business!

To read about a real life example of the growth options report success, click here