One of the financial reporting changes that now impacts a large proportion of charities is a mandatory requirement to disclose information regarding remuneration of key management personnel.

We are aware that this new disclosure requirement may initially engender sensitivities in some organisations. Here we look at what disclosure is required and why.

What’s required to be disclosed?

Charities are now required by law to comply with the relevant financial reporting standards issued by the External Reporting Board (XRB). For those with annual operating expenditure in excess of $2m per annum, these requirements are found in the Tier 1 or Tier 2 Public Benefit Entity (PBE) Standards.

Within both of these tiers, PBE IPSAS 20 Related Party Disclosures, contains requirements to disclose:

- the aggregate remuneration of key management personnel as well as the number of individuals determined on a full-time equivalent basis receiving remuneration within each category, split between the major category of key management personnel.

- any other remuneration or compensation paid to key management personnel or close members of the family of key management personnel (including their spouse, children and dependents of that person or their spouse) even if provided to the charity on a normal arms-length supplier relationship

- details of any loans to key management personnel or close members of the family of key management personnel are also required to be disclosed.

A further recent clarification to the standards is that if a PBE obtains key management personnel services from another entity (e.g. from a management services entity) then the amounts paid or payable are also required to be disclosed.

Who are Key Management Personnel?

Key management personnel (KMP) are defined as:

1. all directors or members of the governing body, regardless of whether they are paid for their services

2. other persons having the authority and responsibility for planning, directing and controlling the activities of the entity.

This latter group will include the senior management team of an entity, which usually includes the Chief Executive Officer or General Manager as well as the head of finance and other senior operational leaders. Sometimes it may also include key advisors of the CEO if they have access to privileged information and may be able to exercise control or significant influence over an entity. However, this will require judgement on a case by case basis.

What’s the sensitivity?

The sensitivities to this disclosure appears to come from smaller charities who, while they have over $2m in annual operating expenditure may only have a relatively small workforce and thus a very small management team.

It is also common in charities that board members will be providing all their input as volunteers and hence there will only be a time involvement required for them as part of KMP disclosure rather than also a $ disclosure.

Hence some charities, and especially some management personnel, may feel concerned that management’s individual remuneration levels may be obvious to readers of the publicly available financial statements - i.e. if there are only a couple of KMP other than the governing body, then readers may be able to work out approximately how much each individual is paid.

We have already heard concerns from KMP about this being a breach of their privacy and confidentiality of their employment contracts. In addition, the concern has been raised that this disclosure may cause unnecessary angst and animosity amongst other non-KMP staff in a charity.

It’s all about transparency

Key Management Personnel remuneration disclosure is a transparency issue.

The primary rationale behind the reporting requirement as we understand it is that Public Benefit Entities are to a large degree likely to be public funded, and hence as a PBE’s stakeholders (which by definition includes the general public) don’t have the ability to demand key info. As a result, this accountability to the wider public is mandated in standards.

The rationale is that persons with this level of authority have the ability to influence the nature and amount of benefits they receive. Given this, t it is considered appropriate that disclosure of key management personnel remuneration is provided.

Public disclosure of charities’ financial statements, including all information required to be disclosed under accounting standards, is considered necessary as a consequence of the benefits provided by charitable status.

Disclosure of the remuneration of key management personnel is now a requirement for many organisations required to publish or file financial statements – including public sector organisations, listed companies and even large subsidiaries of overseas corporates – so charities are not alone in this requirement.

It must be remembered that auditors will need to audit the KMP disclosures as well, and hence will be applying the requirements of the standard when assessing what charities are intending to disclose.

But what about privacy and confidentiality?

The standard setters also very closely considered privacy principles as they are required to when drafting (as these accounting standards are, in effect, legislative instruments).

Section 23 Financial Reporting Act 2013, contains the following paragraph:

23 Disclosure required to comply with standards does not breach privacy principles

(1) The disclosure of personal information is not a breach of principle 10 or 11 of the Privacy Act 1993 if the disclosure is required for compliance with a standard or an authoritative notice.

Thus the technical answer is that there is no exemption from the disclosure requirements due to privacy concerns.

How do we disclose?

As well as the aggregate remuneration of KMP you must disclose the number of individuals by each category of KMP, determined on a full-time equivalent (FTE) basis. As board and committee members’ roles are generally not full-time you should calculate the FTE amount based on the frequency and length of meetings and the estimated time for members to prepare for those meetings.

Remuneration should include all pay and benefits, such as cars, insurance payments, subsidised housing, bonuses. If the cost of a benefit is not determinable, an estimate should be made.

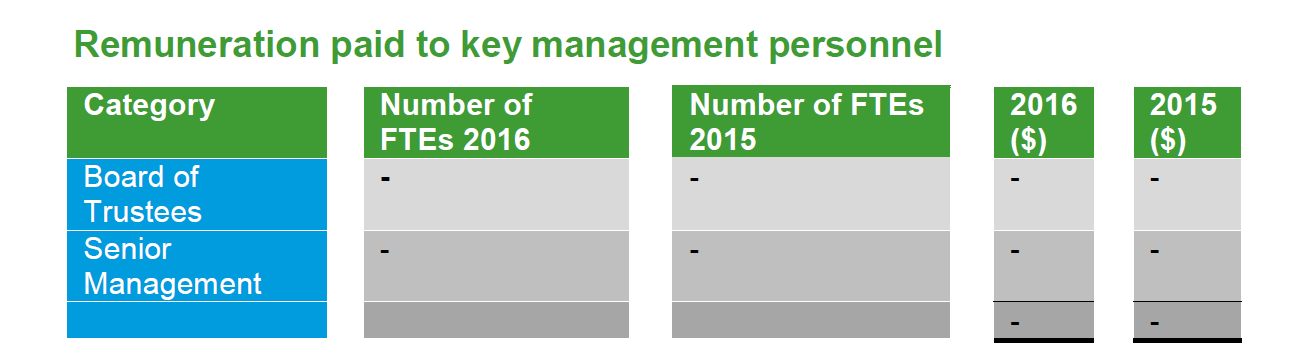

The disclosure could be provided in total for each category aggregate and below is an example of such disclosure for a smaller organisation:

Key management personnel are considered to be the Board of Trustees, together with General Manager of Operations and the Financial Manager. The aggregate remuneration of key management personnel and the number of individuals, determined on a full-time equivalent basis is as follows:

No remuneration is paid to members of the Board of Trustees, and no remuneration or loan advance is paid to any close family members of key management personnel.

Summary

We appreciate this is a change for many charities and that this new disclosure may be uncomfortable for some at first. However similar disclosure requirements have existed in the Public Sector as well as larger corporates in NZ and have done so for some time.

Receiving the income taxation exemption and public credibility benefits of being a registered charity is a privilege as well as a choice.

Ultimately if an entity is not comfortable disclosing key management personnel remuneration information due to privacy concerns, they may need to consider if a registered charity, and the transparency that charitable status requires, is the best vehicle for their activities.

You could say that this new disclosure is part of the price of this privilege and that the compliance is part of the “tickets to the game.”