New Zealand is now two years into our new accounting framework for Public Benefit Entities being applicable. So how has it gone? What has the experience been to date? What can we learn from the adoption so far?

1 April 2015 was a revolutionary date in New Zealand as that was when our new PBE Accounting Standards took effect. For periods beginning on or after 1 April 2015 all entities that were required by law to follow them (being registered charities and a few others at this stage) had to adopt these new accounting standards.

But First; Some Fundamentals

Q: What’s the point of financial statements?

A: These are primarily a financial communication tool. The aim is so that those involved with the entity and other interested stakeholders can ascertain the financial position of the entity at a point in time, as well as its financial performance for a period (usually 12 months). This information assists the users in making decisions about the entity.

Q: Why do we need accounting standards?

A: In order for financial information to be useful it needs to be prepared on a basis that ensures it is consistent, comparable, and generally understandable. This need becomes even greater when the users or stakeholders are remote from the entity preparing the information.

Q: Do we have to do this?

A: If the law says you have to follow the standards then you do. This is now the case for all registered charities in New Zealand. Hence, as much as you may wish to complain about compliance this is now “tickets to the game” of being a recognised charitable entity with all the benefits of the public trust and confidence that comes with that, as well as the exemption from paying income tax.

Q. Do these new financial statements make sense for the sector?

A: Yes. The new accounting standards now required to be adopted by public benefit entities have been developed by the External Reporting Board, our Government appointed standard setter. For the larger Tiers these are based on an international standard suite prescribed by a board that specialises in the setting of accounting standards that do not focus on for-profit entities. That is, they recognise and appreciate the different features of entities that aren’t set up purely to make a profit for shareholders. These standards have been adjusted where necessary to ensure that they are in compliance with New Zealand specific legislation. They have also been tailored to respond appropriately to the types of transactions experienced in the public-sector and not-for-profit environment.

Hence if you are involved in a Public Benefit Entity this new financial framework provides you with a platform from which you can tell your story. However, whether your story actually makes sense is equally dependent on the accurate application of the new accounting standards relative to the specific circumstances of your entity, as well as your story-telling capabilities. Or put another way; if you just follow the accounting standards slavishly without being specific to your particular organisation you are likely to end up with some bland information that doesn’t really tell your story.

How are you doing?

Considering the effort that you have put into your first set of financial statements under the new accounting standards you may be quite content with the result. But how do you know how your financial statements stack up to those that are good, or those that need some help? In this article, we look to provide some context from some of what we have seen.

The Good

-

General awareness and compliance with requirements

There has been a strong uptake of the standards by Tier 1 entities.No great surprises there.These are large entities with more than $30m in operating expenditure annually.As you would expect for entities dealing with that amount of funds flowing through their annual operations they are generally well served in terms of their accounting capability and resource, either internally or externally, or both.At present, there are also only around 70 of these entities in New Zealand, albeit that number may quite likely increase once all entities correctly follow the standards regarding consolidation of controlled entities.

We have seen some mixed reactions in the Tier 2 and Tier 3 space, but with a general willingness to comply with the requirements. As one moves to smaller entities the level of experienced and qualified accounting resource tends to diminish and hence one expects more challenges with coping with change.

As a general observation, many entities changing from Old GAAP (generally accepted accounting practice) or special purpose reporting to Tier 3 have found the move not that challenging.This is due to the straight-forward nature of the Tier 3 PBE Simple Format Reporting – Accrual standard.It was designed to provide good consistent, comparable, and hopefully common sense, accounting but with a policy over-ride that cost should not outweigh the benefit.As a result, the entire Tier 3 standard and all appendices is under 60 pages in total.

In contrast, many entities required to adopt the Tier 2 PBE Accounting Standards Reduced Disclosure Regime (RDR) have had quite a step up in requirements from what they were previously used to.This has meant for many this transition experience has been quite challenging.The main reason for this is that the standards for the Tier 1 & 2 PBEs are based on a comprehensive international standard set designed to cover many complex variations that are found in larger entities.Adopting this international standard set as a base allows us in New Zealand to be globally consistent for our large entities and adopt international best practice, rather than having to reinvent the wheel.

To provide some context to the possible extra complexity for the larger charities, the standards appear to be more than 1,000 pages when you consider all 40+ PBE standards.However, it is also not as bad as it sounds as many of those standards will not be applicable to many PBEs.That is, if they don’t have the transaction type then the standard can be ignored in its entirety.

Whether the change has been difficult or easy, the good news from all of this is that for many the transition is largely a one-off pain.Next year will just be a refinement of the same accounting treatment and hopefully quickly be consigned to “business as usual”.Hence, now that we are essentially over the “first-time adoption hump”, we expect to see some tweaking and refining of the disclosures going forward, rather than the radical change that was the initial transition.

The overhaul of the financial reporting framework has provided an opportunity for entities to have a good look at the structure of their funding arrangements, the structure of their operations including the group in which they operate, and the appropriateness of their judgements and estimates.

-

Group structures and capital maintenance

We have generally seen good identification of group structures. For many entities, this is the first time that they have consolidated for financial reporting purposes entities that they control. For other entities, this was an eye-opening experience as they might never have considered that they control certain entities that they are now required to consolidate. Likewise, this new concept of control for financial reporting purposes caused some consternation from some entities who did not consider themselves to be under the control of anyone else.A few of these controlled entities were consolidated due to the fact that these controlled entities were originated as “autopilots” – an entity whose policies have been irreversibly predetermined and are unable to be modified.

For some entities, consolidation meant that their financial statements looked impressive. Perhaps the reserves or cash in bank became a material figure. However, the reality was that most of those reserves were set aside for predetermined uses according to a funding contract.

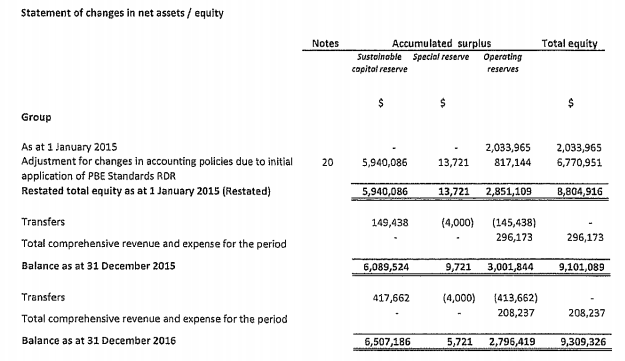

In order to clearly present financial statements which show the true state of affairs to potential funders, some entities have utilised their statement of changes in net asset/reserves in such a way as to present an accurate picture of how and where the entity will benefit from further funding. The accounting standards allow movement within reserves, and the following from The Auckland Philharmonia Trust is a good example of this situation:

-

Key management personnel information

Despite the sensitivity of some of the key management personnel information, there has been reasonably good compliance with this accounting requirement. In some instances, charities find themselves in a perceived pickle, as they have only one or two key management personnel members. This means confidentiality could be seen to be somewhat compromised. The reason for the general acceptance of this requirement and an important fact to remember, is that when operating in the charitable/not-for-profit space there is a sense of selflessness as the main objective is benefitting the public. It is for this reason that transparency is so much more important in this sector.

This privacy principle issue was also carefully considered by the standard setters in their drafting of the requirements.It was cleared with the relevant authorities to ensure that the disclosure of personal information for Key Management Personnel purposes is not a breach of the Privacy Act 1993.

The Bad

-

Group structures

Group structures have possibly caused the most challenge with the transition to the new reporting framework.Some entities appear to refuse to believe that this applies to them, or that they can’t just do what they used to before they were required by law to follow mandatory accounting standards.There have been entities apparently ‘opinion shopping’, looking for someone to give them a “technical answer” that suits their former world view, rather than accept the common interpretation of the relevant accounting standards.We respectfully suggest that this issue is not over yet and it may take a couple of years before there is consistent application of the controlled entity requirements.

Also notwithstanding our praise above of the good identification of group structures, oftentimes that identification does not translate to great disclosure. The applicable standard states that a list of significant controlled entities as well as a list of controlled entities where the controlling entity holds 50% or less is required to be disclosed. This could be disclosed in the basis of consolidation note, or as part of the related party relationships disclosure.

-

Poor explanation of basis of preparation

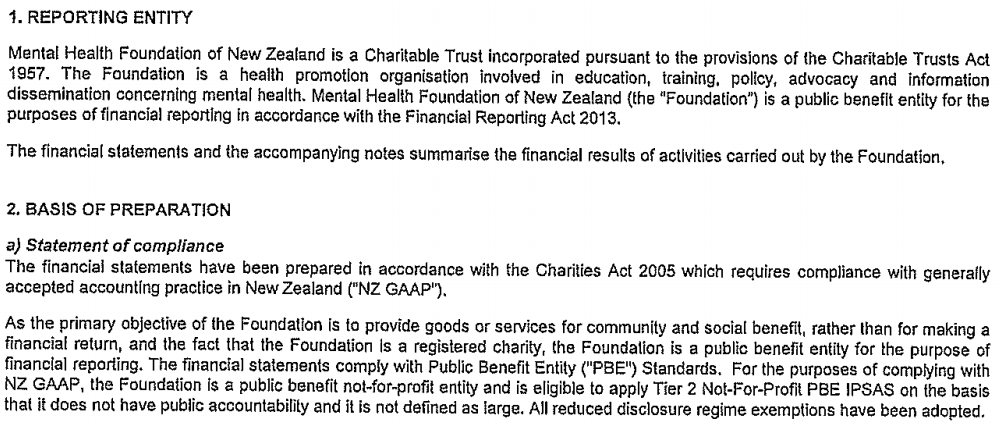

It is quite common that entities miss the basics of what needs to be disclosed in the basis of preparation and information on the reporting entity. We’ve not shown an example here as by definition of the problem there is no point!However in contrast, below is a good example from Mental Health Foundation of New Zealand of disclosures as required by the accounting standards on presentation, followed by the requirements:

Requirements as per PBE IPSAS 1 Presentation of Financial Statements:

- The statutory base under which the financial statements are prepared;

- The fact that, for the purposes of financial reporting, it is a public benefit entity;

- That it has reported in accordance with Tier 1 PBE Standards, or elected to report in accordance with Tier 2 PBE Standards and applied disclosure concessions;

- If reporting under Tier 2 concessions the entity shall disclose the criteria that establish the entity as eligible to report in accordance with Tier 2 PBE Standards;

- An explicit and unreserved statement of compliance with PBE Standards.

Opting up to Tier 2

Many Tier 3 not-for-profit entities choose either to opt up to Tier 2 in its entirety, or to opt up to a certain standard in Tier 2 such as the financial instruments standard to fair value property, plant and equipment.

For entities whose expenses are approaching the Tier 2 threshold, opting up to Tier 2 on transition can be a wise decision as it could save valuable time down the road. However, some small Tier 3 entities have chosen to opt up to Tier 2, but since they are quite small their financial statements look incomplete as they are so simple. For these smaller entities, we respectfully suggest it is wiser to stick to the Tier which best reflects your expenditure as the costs of applying the Tier 2 standard can far outweigh the benefits.

When opting up to a certain standard in Tier 2, keep in mind that you will have to apply the standard in its entirety, and for all transactions of that type. Thus, you cannot opt up to PBE IPSAS 29 Financial Instruments: Recognition and Measurement to fair value your investments, and ignore the disclosure requirements for financial instruments within PBE IPSAS 30 Financial Instruments: Disclosure. You will also have to fair value all investments of that type in accordance with the Tier 2 standard.

We are also aware of some entities that have chosen to opt up from Tier 3 to Tier 2 specifically to avoid having to prepare a statement of service performance (SSP).While this standard is not yet required for Tier 2 entities, it is coming and hence this seems a somewhat strange decision to take.In our view, the additional work effort from correctly applying Tier 2 standards over Tier 3 would likely far outweigh the effort of providing a SSP for a Tier 3 entity.This is also just putting off the inevitable and hence entities that have opted up will then have to choose in future when SSPs are mandatory for Tiers 1 & 2 whether they remain at the higher more complex level of compliance of Tier 2 or switch back down to Tier 3 representing another change.

The Ugly

-

Boilerplate accounting policies

An area where we see many boilerplate policies is the financial instruments note. Far from stating the facts specific to the entity, many entities are bogged down by a misunderstanding of the different categories of financial assets. From what we have seen they seem to borrow disclosures from other more complex entities or a set of illustrative financial statements designed to cover every possible eventuality.This results in financial instrument policies spanning two or three pages and probably being less intelligible to the reader as a result. Let’s save a tree here folks!

The standard on disclosures for financial instruments specifically lists the policies that are required to be disclosed. Any more than this should be for no other reason but an enhancement of the user’s understanding.

-

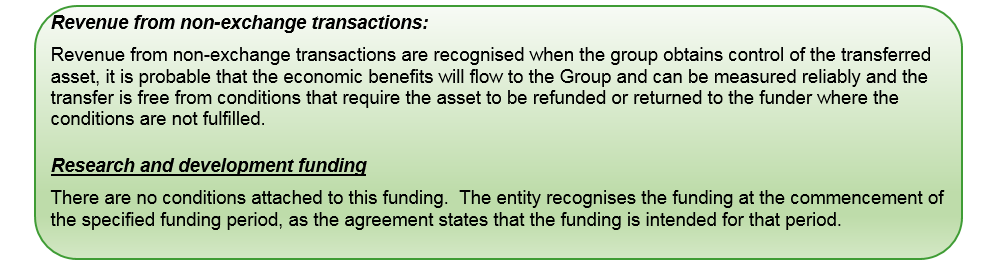

Revenue policies

The revenue policies must be clearly defined in order for a user to understand the point at which revenue is recognised. In the same breath, these policies also need to comply with the accounting standard applicable to that type of revenue. The following is an example of a policy that not only contradicts itself, but is also not in line with the revenue recognition requirements of the applicable standard:

The first paragraph is correct, however in the second paragraph it appears as though the accounting principles from the first have been ignored. The second paragraph should state that revenue has been recognised on receipt of the funding in the absence of conditions placed on the funds.

-

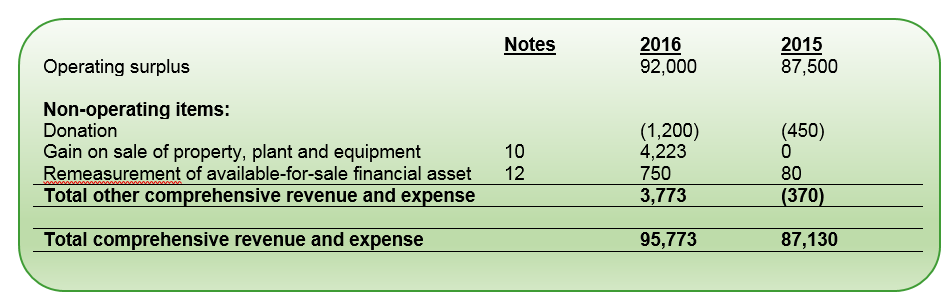

Other comprehensive revenue and expense

We’ve noted some confusion over which items are disclosed under the “other comprehensive revenue and expense” section of the statement of comprehensive revenue and expense. Below is an example of a charity making this mistake:

It appears as though the charity was trying to use the other comprehensive revenue and expense section for non-operational items. Only the remeasurement of available-for-sale financial asset belongs in this section, and the other items should be moved to surplus and deficit.

Other comprehensive revenue and expense is a term defined in the accounting standards as items of revenue and expense (including reclassification adjustments) that are not recognised in surplus or deficit as required or permitted by other PBE Standards. This means that the items that are found in other comprehensive revenue and expense are required to be presented as such and are not permitted to be presented as part of the surplus or deficit.

Some of these items are:

- Revaluation gains on property, plant and equipment;

- Gains and losses on available-for-sale financial assets (that are not impairment losses);

- Foreign currency translations on foreign operations;

- Remeasurements on defined benefit pension plans

This list is not exhaustive.

-

Fair value of property, plant and equipment

Some Tier 2 entities were previously applying special purpose financial reporting, and were using the revaluation model for their property, plant and equipment. The valuations they had relied upon in the past had been based on values such as insurance or rateable value, as they considered it was too expensive to involve a professional valuer.

They received some bad news when they were advised that this value is not appropriate any longer in accordance with the Tier 2 PBE Standards.

Some entities are aware of the ongoing costs involved in keeping the revaluation model for their property, plant and equipment and have hence chosen to revert to the cost model on transition. This is because the standard states that a revaluation is required with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at reporting date. The fair value is also usually the asset’s market value determined by independent appraisal. For some entities based in areas where property prices were steadily on the rise, this exercise could prove costly. Adopting the cost model is also often strategically more sensible for entities that don’t or are not allowed to sell their PP&E, or have no need to leverage their balance sheet and hence are not as concerned about the most up to date fair value.

The costs involved in using the revaluation model are not relevant to a Tier 3 entity opting up to Tier 2, as the Tier 3 standard allows the Tier 3 entity to use rateable or government valuation when opting up to Tier 2 in order to revalue property, plant and equipment.

This has been the biggest single change in financial reporting in this sector ever.Hence, it should come as no great surprise that not everyone has got there perfectly first time.Some are still fighting the change.However, this is the new environment for registered charities in New Zealand and their financial reporting.As such there is only one long term choice for them to make.

It is great to see how many PBEs have got quickly on board and made a reasonable attempt or better of their transition financial statements. Overall clearer, more consistent and more comparable financial reporting will be the result which will ultimately benefit all in the PBE sector. And even better news, is that they have done the hard work and next year will be a refining process rather than another revolution like this initial period.

Onwards and upwards!