It can be daunting to consider exiting a business that you’ve invested into, where you’ve spent significant time, effort, money and emotion to get it to where it is. From sole traders through to large closely held private companies, forming an exit strategy in advance enables better control for success of the owner’s future and the future of the business.

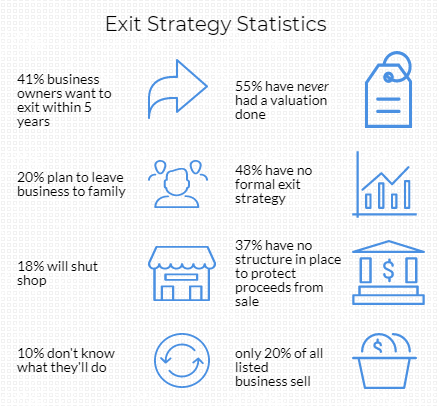

In our earlier article “When & How to Start Succession Planning”, it was clear that planning for succession earlier rather than later in the life of a business, would have significant positive effects for all involved in the process. In our experience, over 48 per cent of business owners who want to sell, have no exit strategy. An exit strategy should mean that owners make the best decisions to help achieve their exit goals - on a day-to-day basis and at a strategic level. It’s important to understand the benefits that forward-planning can provide an owner.

To begin the exit strategy process, owners should firstly consider their answers to the following questions.

Why am I considering an exit?

Is it to wind down and spend more time on the boat, traveling, with family and friends? Are you facing health issues or burnout? Are you nearing retirement? Have you had a change of interest or an unexpected offer? Or is it about how successful, or unsuccessful your business is? Do you want to ‘take the money’ and run or do you need to mitigate your losses? Whatever the reason, this isn’t a decision to be taken lightly or rapidly. Investing the necessary time to determine a well-planned exit will help maximise desired outcomes. If you don’t have the luxury of time, use key advisors as a sounding board.

Do I know what I want?

An exit strategy is about delivering on a desired outcome. Know what you want! Determine that up front and all the steps required to achieve this outcome become more evident. An ideal strategy will consider objectives for price, timing, deal breakers, readiness for sale, current value of business versus potential value, a likely buyers’ pool, and, it should also include more than one option for exiting.

A 2018 study by UBS Global Wealth Management on exit strategy findings, found that over half of the respondents wanted to sell but almost as many had no formal exit strategy. Of those who were planning to leave the business to their family, a massive 82% of family members were not interested in taking on the business.

A 2018 study by UBS Global Wealth Management on exit strategy findings, found that over half of the respondents wanted to sell but almost as many had no formal exit strategy. Of those who were planning to leave the business to their family, a massive 82% of family members were not interested in taking on the business.

So, what’s the best strategy?

There are several options when considering an exit and the best advice is to always consider more than just one option. Let’s take a look at the most popular possibilities and some pros & cons for each.

Sell to a targeted market

Pros:

- People already operating in that market generally have a better understanding of the market, competitive factors and potential synergies

- The more profitable your business and the lower the risk, the greater the attractiveness to buyers within that market

- The combined factors are likely to generate increased competition and a quicker sale

Cons:

- By targeting the same-sector market, you may miss a buyer with deeper pockets looking to pay a premium to acquire market entry.

- External buyers sometimes see greater value by being able to leverage technologies or systems that work elsewhere into a synergistic market. As such they may be willing to pay a premium for the opportunity over market-specific, prospective purchasers.

Selling to a Foreign Investor(s):

Pros:

- Having greater geographic pool of potential international buyers can mean that your business may fetch more than what domestic buyers are prepared to pay

- International players often look to expand into untapped markets

Cons:

- Language, cultural, regulatory environment and currency barriers can cause confusion or additional difficulties in the negotiation process causing extra time and money to be spent.

Selling to a Competitor:

Pros:

- A direct competitor can be a great option for a buyer that understands the nature of the industry and therefore, the business.

- The competitor might be looking to grow and/or gain a monopoly in the market.

- This could raise the perceived value of the business as well as save time and money trying to find a 3rd party buyer.

- Direct approaches to a key competitor can also often mean that the business does not publicly appear to be for sale which in turn can minimize business performance disruption.

Cons:

- Always proceed with caution during the due diligence period to ensure you don’t give away anything the competitor could use against the business and to their advantage, if the deal does not go through.

Selling to a Private Equity Firm/Fund Manager:

Pros:

- The business could be perfectly positioned for a majority take out by a private equity firm/fund manager due to synergies or growth prospects requiring investment.

- Private Equity firms are inherently more comfortable with risk and therefore more likely to accept the deal on the table within their risk appetite as opposed to private buyers who can get scared off quite quickly as they have more to lose.

- They generally take a major stake in the company but not necessarily buy 100% of it and then try to leverage to get a return on their investment through a variety of means within a specified period. Win – Win approach

Con:

- You’ll lose majority control but still remain in the business and have to adjust to your investors’ requirements.

Selling to Immigrants:

Pros:

- New Zealand is an attractive place to work and live and your business could appeal to migrants wanting to invest in a business to help facilitate their settling into New Zealand.

- Understanding if your business has appeal to overseas migrants could increase its value and broaden the potential buyer market.

Con

- Beware that entrepreneurial or investor visas could hold up proceedings and drag out this process but could be well worth it if the price is right.

Keeping it in the Family:

Pros:

- Keeping the legacy within the family and seeing both the business and different generations of the family prosper as a result.

- Greater control for both yourself and children succeeding you regarding the varying aspects of transition from start to finish.

Cons:

- Can present many issues around fairness and equity amongst siblings and parents if not structured correctly.

- Family member(s) taking over may lack necessary skills and experience and therefore present risk of serious consequences such as wealth erosion and broken family relationships as a result.

- Agreeing on a specified value, obtaining funding and timeline of transition can be difficult to marry up if there is no plan in place. Also the risk of it not working at all and other options having to be pursued as a last minute will erode the sale value.

- Inability to divorce family dynamics from an objective approach to business can be problematic.

- There can be the reality of the original owners having to be able to actually let go over time.

Management/employee Buyout:

Pros:

- Keen and able management or other employees are often best placed to take an ownership stake as they see from the inside the value in growing the business in the foreseeable future.

- Greater control in the sale process for the business owner as knows whom he/she is dealing with.

- Great flexibility possible as can be done in a staged sell down approach making sure both parties transition in and out maximizing their respective investments over a period of time that is beneficial to both.

- Legacy of the business is in familiar hands and operating as usual going forwards with less likely changes anticipated.

Cons:

- Value of the business may be perceived as lower compared to an external party due to management not attaching value to certain aspects of the business which an external party may do, e.g. intellectual property & synergies.

- The management or employee(s) may struggle to obtain funds to buy the owner out as and when required.

- Management or employee(s) are unable to make transition in the skill set required from working in the business to that of a director and business owner.

IPO:

Pros:

- Can be a worthwhile strategy for medium and large businesses due to significant funding levels that can be attracted for the business, as well as potential for wealth realisation for existing owner.

Cons:

- It is likely to be a more costly and drawn out process with significantly higher compliance and reporting standards to adhere to.

- Not common for small businesses and can be perceived as daunting therefore not often even considered and pursued.

Our next article in the series will take a look at how to extract the maximum value from your business upon sale.